Portfolio Construction

ETF

Exchange-traded funds (ETFs) had another solid year based on 2022 inflows – especially when considering the volatile market environment of rising inflation, tighter monetary conditions and geopolitical uncertainty. Under the surface, actively managed and dividend-focused ETFs were among the most popular ETF segments, while thematic and environmental, social and governance (ESG) ETF strategies saw declining interest.

This article examines five impactful trends in ETFs last year and offers a glimpse into what could be expected in 2023 and beyond.

- ETFs had their second-best year ever for inflows in 2022 despite difficult market conditions and outflows from mutual funds.

- Actively managed ETFs continued to gain momentum in terms of investor and advisor interest, rising assets and more investor choices.

- Thematic and ESG-focused ETFs experienced negative flows in 2022, while dividend-focused ETFs attracted significant inflows as investors gravitated to income.

ETFs had another solid year in 2022 – especially when considering the volatile market environment of rising inflation, tighter monetary conditions and geopolitical uncertainty. Under the surface, actively managed and dividend-focused ETFs were among the most popular ETF segments, while thematic and ESG ETF strategies saw declining interest.

This article examines five impactful trends in ETFs last year and offers a glimpse into what could be expected in 2023 and beyond.

ETFs gathered assets even in a tough market

If the industry learned anything about ETFs in 2022, it’s that they can still see net inflows even in difficult markets when many traditional mutual funds are experiencing outflows. In the U.S., ETFs gathered almost $600 billion last year, while mutual funds posted net outflows of nearly $1 trillion.¹ If markets manage to recover in 2023, it could provide a tailwind for more ETF flows this year.

For ETFs, last year’s inflows were their second-best year ever after ETFs gathered about $900 billion in 2021.² Last year’s inflows were even more impressive when considering the markets’ challenging year — the S&P 500 Index posted a total loss of 18%, while the S&P U.S. Aggregate Bond Index lost about 12%.³

“The persistent inflows and ongoing ETF launches suggest the business may still be in the earlier stages of development, particularly in the case of actively managed ETFs.”

In terms of total assets, U.S.-listed ETF assets fell about 10% in 2022 to $6.5 trillion as inflows softened the impact of declining equity and fixed income markets.¹

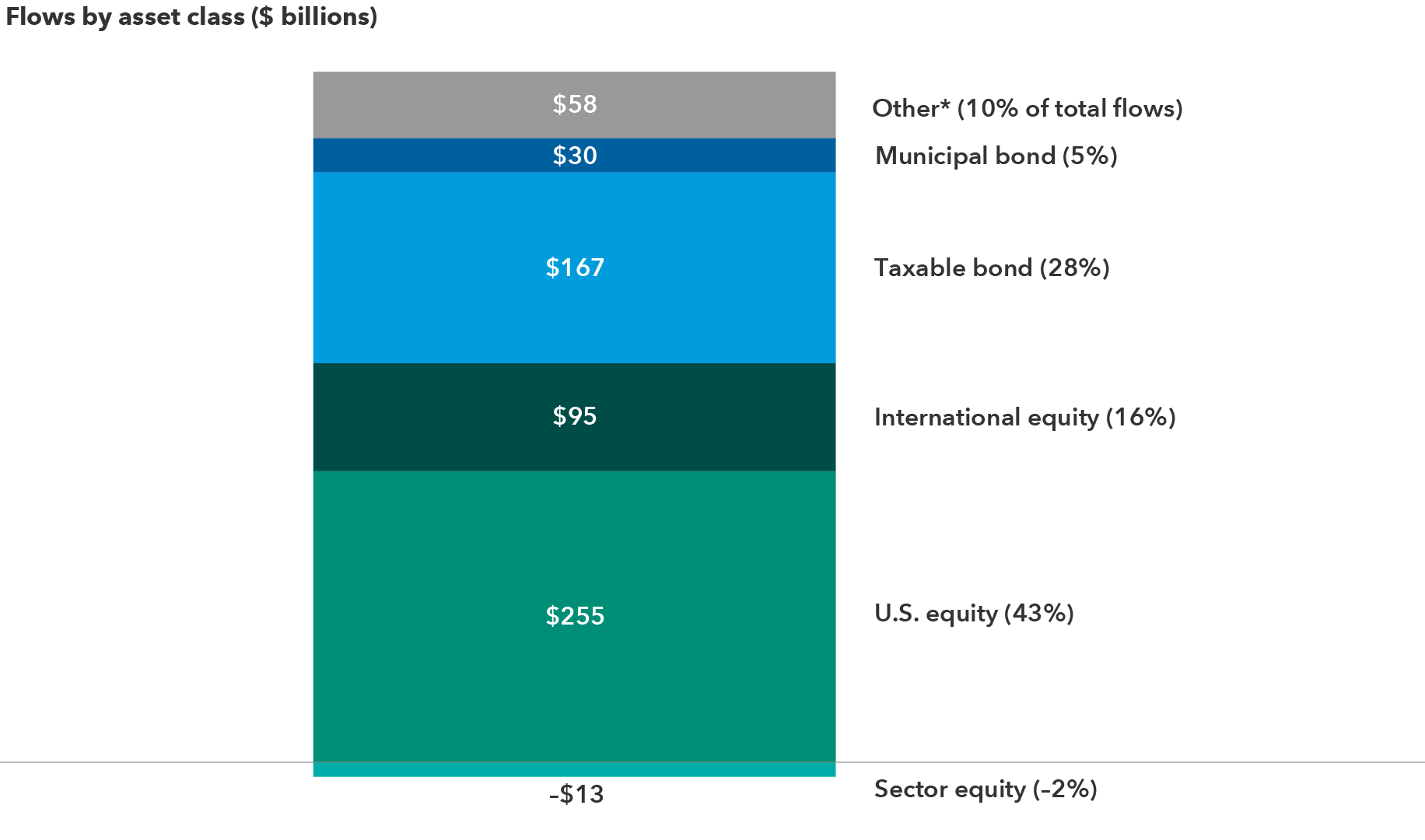

2022 ETF flows: Equities led the pack, but bond ETF flows continue to rise

Source: Morningstar, as of December 31, 2022.

* “Other” includes commodities, alternatives, allocation, nontraditional equity and miscellaneous.

Market headwinds didn’t prevent new ETF launches in 2022: 460 new ETFs listed last year, just shy of the previous year’s record.¹ Meanwhile, 170 different issuers listed new ETFs in 2022, and 163 ETFs gathered at least $1 billion of inflows for the year.¹

Active ETFs continue to come on strong

The persistent inflows and ongoing ETF launches suggest the business may still be in the earlier stages of development, particularly in the case of actively managed ETFs. For example, more than 65% of new launches in 2022 were actively managed ETFs for the second straight year.¹

Overall, active ETFs accounted for 15% of total ETF inflows despite representing just 5% of total ETF assets in the U.S.¹ Active ETFs pulled in nearly $90 billion in 2022, in line with the previous year’s record.¹ Active ETF assets even managed to climb by 16% last year despite market declines as continued product launches and strong inflows helped set the pace.¹ In particular, Capital Group’s research indicates that the fastest growing advisors have been using actively managed ETFs in client portfolios.

Mutual fund to ETF conversions should also continue to drive active ETF growth. There were 20 mutual fund to ETF conversions from 14 issuers last year, compared with 16 conversions from four issuers in 2021.¹ Some asset managers are seemingly getting more comfortable with the conversion process and opting for the tax efficiency and other features of the ETF structure.

Three more notable trends: Thematic, ESG and dividend-focused ETFs

Thematic and ESG ETFs garnered a lot of attention in 2022, but their flows didn’t measure up to the hype.

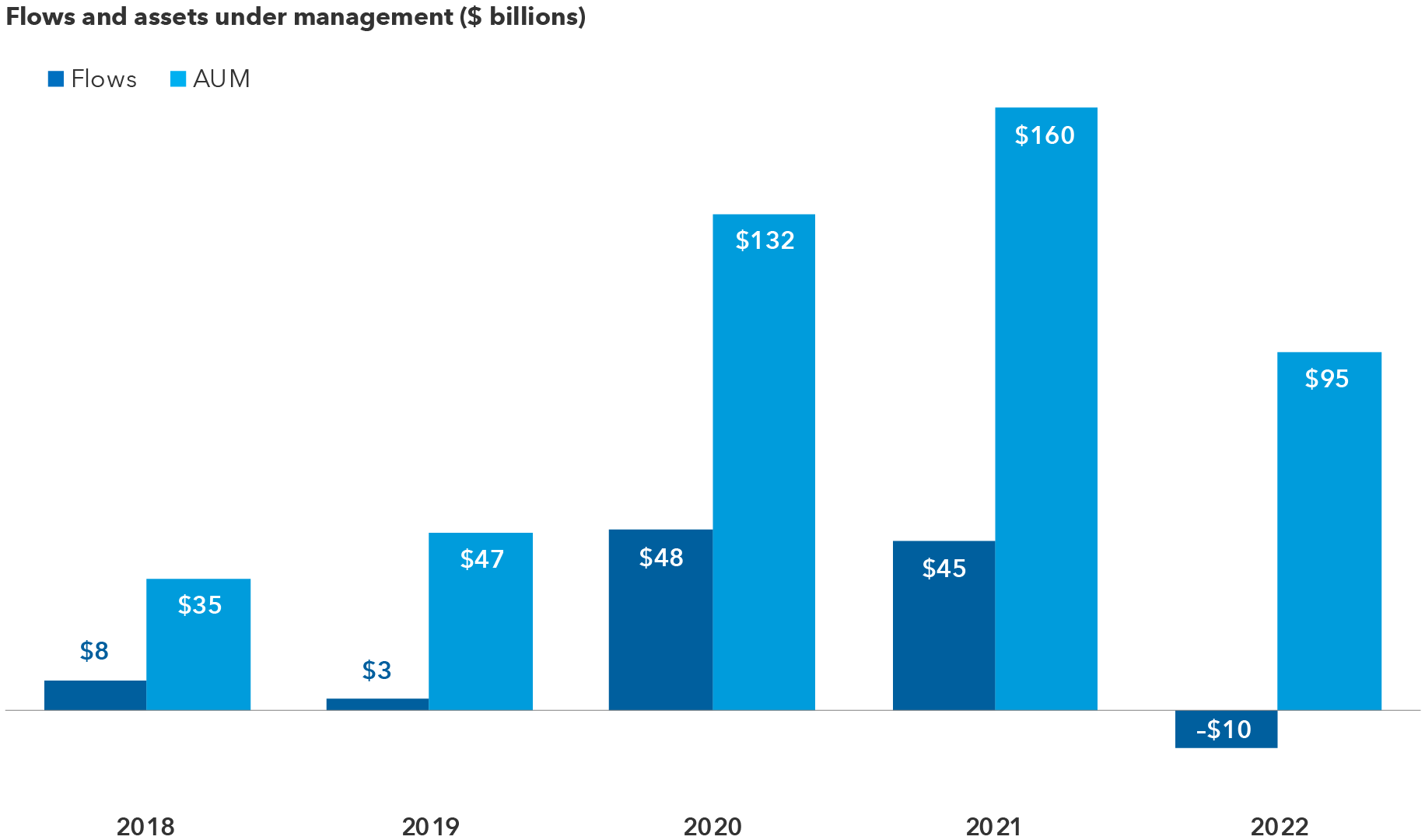

Thematic funds saw a notable turnaround as flows swung negative in 2022 after gathering nearly $45 billion in 2020 and almost $48 billion 2021.¹ Thematic ETFs focused on specific economic trends, such as electronic vehicles and artificial intelligence, fell out of favor last year in a particularly tough environment for growth-oriented stocks. Market volatility turned many advisors’ attention to core-oriented funds, rather than niche exposures where they often used thematic ETFs. In fact, thematic ETF assets dropped over 40% in 2022 to represent about 1.5% of overall ETF assets.¹

Reversal of fortunes for thematic ETFs in 2022

Source: Morningstar, as of December 31, 2022.

ESG continued to be a popular topic in 2022, but demand cooled. In fact, ESG ETFs attracted only $4 billion last year after taking in over $30 billion in each of the previous two years.¹ Asset managers still introduced over 50 new ESG ETFs in 2022 after launching nearly 70 in 2021.¹ Even though ESG strategies get a lot of attention, ESG ETFs still represent only about 1.5% of total ETF assets.¹

Some investors favored dividend stocks in 2022 as a way to generate yield and also help mitigate the impact of market volatility, since the income they produce may provide some cushion against market declines.4 Dividend-focused ETFs saw $70 billion of inflows in 2022 — a record for the biggest ETF inflow to a single factor in a calendar year.¹ Other single-factor strategies include value, growth and low volatility.

“Some investors favored dividend stocks in 2022 as a way to generate yield and also help mitigate the impact of market volatility.”

Capital Group active ETFs update

Capital Group introduced its suite of active ETFs in 2022 — launching five equity and one fixed income fund in February and three additional fixed income funds in October. In less than a year, Capital Group’s ETFs captured 7% of inflows to active ETFs.¹

Capital Group believes the trend of well-known active managers making their strategies available in the transparent, tax-efficient and relatively low-cost ETF structure will continue. That means investors and advisors will have more choice when accessing active strategies, whether in mutual funds, SMAs or ETFs.

Learn more about our full suite of active ETFs.

1 Source: Morningstar, as of December 31, 2022.

2 “A Brutal Year in the Markets Doesn’t Rattle ETF Investors.” Morningstar.com, January 3, 2023.

3 Source: S&P Dow Jones Indices, as of December 31, 2022.

4 “Analysis: Volatile U.S. markets boost appeal of dividend stocks.” Reuters, July 12, 2022.

To read the full article, become an RIA Insider. You'll also gain complimentary access to news, insights, tools and more.

Already an Insider?

There may have been periods when the results lagged the index(es). The indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

Each S&P Index ("Index") shown is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2023 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

©2023 Morningstar, Inc. All Rights Reserved. Some of the information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar, its content providers nor Capital Group are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. Information is calculated by Morningstar. Due to differing calculation methods, the figures shown here may differ from those calculated by Capital Group.

For financial professionals only. Not for use with the public.

Scott Davis

Scott Davis