ETF

Within active ETFs, thematic funds focused on specific economic trends garner a lot of excitement and attention. Yet active ETFs are much more than thematic funds or concentrated strategies for smaller satellite allocations.

After the recent run-up and volatility in many thematic ETFs, we believe the development of active ETFs is entering a new phase. Specifically, investors are getting more active core ETFs to choose from. This article examines why investors’ experience in thematic ETFs may look worse when dollar-weighted returns are considered and why well-designed active core ETFs may be the next big evolution in active ETFs.

- Investors have been inundated with thematic ETFs in recent years, but the temptation to chase returns may be high.

- Thematic ETFs are designed to profit from long-term economic trends, but many end up closing or launching at the peak of the trend’s popularity.

- Active core ETFs may be the next big opportunity for investors and advisors.

Within active ETFs, thematic funds focused on specific economic trends garner a lot of excitement and attention. Yet active ETFs are much more than thematic funds or concentrated strategies for smaller satellite allocations.

This article examines the research on how investors use thematic ETFs and why active core may be the next area of growth for active ETFs.

Thematic ETFs and chasing returns

As their name suggests, thematic ETFs focus on themes such as electronic vehicles, artificial intelligence and digital assets. Thematic ETFs often lend themselves to an active rather than passive approach because the industries they invest in are dynamic and often volatile.

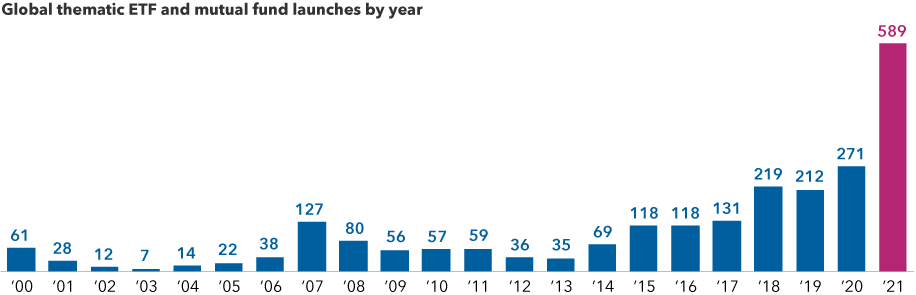

Investors have been inundated with thematic ETFs and funds in recent years. Nearly 600 thematic funds and ETFs launched globally in 2021, more than doubling the previous year’s record.1

Thematic fund launches jumped to a record high in 2021

Source: Morningstar, as of December 31, 2021. Includes thematic ETFs and mutual funds.

Much of the latest generation of thematic ETFs launched during the longest bull market in history,2 and some benefited from tilts to technology and consumer discretionary stocks that experienced large gains. The recent market volatility driven by inflation and geopolitical concerns, however, has called into question the process and investor conviction in thematic ETFs.

“Investors have been inundated with thematic ETFs and funds in recent years.”

History suggests that one common mistake investors make with thematic ETFs is chasing returns.3 It’s a familiar pattern, from the dot-com bubble to the more recent run-up and implosion in so-called meme stocks.

In fact, academic research based on data between 2013 and 2019 found that thematic ETFs tend to launch when a particular theme is at its most popular or peak, often resulting in disappointing returns for investors who pile in.3

Thematic ETFs and the investor behavior gap

In theory, thematic funds could be viewed as longer term investments to let the economic theme play out and mature. In fact, during the past 15 years more than 75% of thematic funds globally have shuttered.1

“Thematic ETFs that invested in high-valuation, growth-focused companies have fallen hard in volatile markets.”

The latest generation of investors entered the market during the pandemic, and some used the growing array of thematic ETFs to invest in their favorite themes. To be clear, some of these thematic ETFs had stellar returns in 2020. Among the 111 U.S. thematic ETFs that launched prior to May 2019 and survived through April 2022, 50 gained more than 50% in 2020, while another 17 had annual returns in excess of 100%.4 Yet returns since the end of 2020 have come down from those lofty levels amid a tough market for growth stocks. For example, the two largest U.S. thematic ETFs have both lost more than 30% over the past year.5

Things look even worse when dollar-weighted returns are factored in based thematic ETF flows that measure how much of the returns investors actually captured. For the same set of 111 U.S. thematic ETFs, dollar-weighted returns were 11.4 percentage points less than their total return, on average.4 This negative returns gap suggests investors piled into thematic ETFs near the top.

Why core may be the next big opportunity for active ETFs

Initially, many successful active ETFs invested in bonds because fixed income portfolio managers were less concerned about transparency, holdings disclosure and potential front-running than their equity counterparts.

More recently, thematic ETFs hit a peak in popularity during the pandemic as investors bet on “work-from-home” and other investment themes. Now, a third phase may be kicking off as active managers develop active core ETFs that lend themselves to longer term investing.

“We believe active ETFs are still relatively early in their evolution,” said Anthony Wingate, an ETF sales specialist at Capital Group.

Capital Group believes that investors want more from the core of portfolios, but until recently haven’t had many active core ETFs to choose from. Active ETFs are still predominantly satellite strategies, but with more established managers entering the ETF stage, core strategies are catching up in number.

Capital Group recently launched its first active core ETFs because we think they can help investors pursue better long-term outcomes using our time-tested active management with the features of the ETF structure. It’s important to give investors and their advisors more choice — whether it’s a mutual fund, ETF or separately managed account — to access our fundamental, bottom-up investment process.

Indeed, in the past two years, more asset managers have launched active ETFs to give advisors more access to their investment strategies.6 In 2021, U.S. managers listed 298 active ETFs, up from 175 the previous year, while active ETF launches are on track to outpace passive ETFs in 2022.6 Active ETFs account for only about 5% of overall ETF assets, suggesting the category can grow much more.6

“We at Capital Group think well-designed active core ETFs are the next big evolution in active ETFs.”

For Capital Group, launching active core ETFs has been a thoughtful process. For more than a decade, we had been researching the ETF structure and discussing the opportunity to bring our active management to the vehicle. The tipping point was 2019 regulatory changes requiring ETF transparency and disclosure.7 ETFs that aren’t fully transparent have restrictions on their investments, for example.8

“The new rules ensured we could offer our signature active management approach — the Capital System™, which has been in place for nine decades of investing — in the fully transparent ETF structure that investors expect,” says Zahid Nakhooda, Capital Group ETF sales specialist.

Although thematic funds have gotten a lot of attention recently in active ETFs, Capital Group thinks well-designed active core ETFs are the next big evolution in active ETFs.

1 Morningstar. “Morningstar Global Thematic Funds Landscape 2022,” March 2022.

2 The Financial Times. “US stocks’ record bull run brought to abrupt end by coronavirus,” March 12, 2020.

3 “Competition for Attention in the ETF Space,” Itzhak Ben-David, Francesco Franzoni, Byungwook Kim and Rabih Moussawi, December 30, 2021.

4 Morningstar. “Chasing Thematic ETFs’ Returns Has Set Investors Up to Fail,” Bryan Armour, June 7, 2022.

5 ETF.com, as of July 27, 2022.

6 WealthManagement.com. “Early Innings for Active ETFs,” June 6, 2022.

7 U.S. Securities and Exchange Commission. “SEC Adopts New Rule to Modernize Regulation of Exchange-Traded Funds,” September 26, 2019.

8 The Financial Times (Ignites). “SEC maintains intense scrutiny of non-transparent ETFs,” April 1, 2021.

To read the full article, become an RIA Insider. You'll also gain complimentary access to news, insights, tools and more.

Already an Insider?