Planning & Productivity

11 MIN ARTICLE

The end of the year is a good time for financial advisors to take stock and think about business goals in the coming year. Would you like to focus on improving efficiency so you can spend more time on activities that increase revenue? Or maybe it’s time to put energy into adding new services and capabilities to your practice? What about using marketing to expand your brand and reach new groups of potential clients?

No matter your desired outcome, allocating time to business planning and goal setting can lead to enhanced growth. After all, as Benjamin Franklin is believed to have said: “Failing to plan is planning to fail.”

According to Capital Group’s Pathways to Growth: 2022 Advisor Benchmark Study, the highest growth advisors were 42% more likely to set goals in areas like efficiency, productivity, client satisfaction and growth in assets under management. “Advisors in today’s top teams are thinking like CEOs,” says Paul Cieslik, an advisor practice management consultant at Capital Group. “These advisors don’t just run a practice — they run businesses.”

Whether your goal is growth through efficiency, client acquisition, deeper engagement with existing clients or all three, here are some specific strategies that you can use to help achieve them:

- Boost your practice’s productivity and growth

- Use marketing to reach new prospects

- Offer specialized services that help strengthen client relationships

1. Goal: Boost your practice’s productivity and growth

Who wouldn’t welcome more time to help conquer that never-ending to-do list? Until astrophysicists figure out how to expand the day beyond 24 hours, there are techniques you can adapt to help you boost your productivity and get more done each day.

Create more standard operating procedures

Standard operating procedures (SOPs) are designed to provide clear directions for essential tasks. They can help you share institutional knowledge, establish best practices and keep operations consistent with the rest of your team. For example, prospecting SOPs can help you streamline the process of following up on new client prospects that you meet. Even a simple checklist gives everyone a codified procedure to communicate with prospects from first meeting through setting up and hosting a successful client meeting, as well as when and how to follow up.

Source: Capital Group research

You could also use SOPs to develop a robust playbook for specific client scenarios, such as helping clients to both envision their ideal retirement and plan for their financial, social, health and legacy needs for that time in their lives.

So, whether you’re looking to streamline everyday practice functions or provide deeper guidance to help clients reach their goals more efficiently, SOPs can be a useful tool to help free up time to focus on giving clients better, more personalized service.

Find ways to deepen your most valuable client relationships

Interacting with clients and working with them to achieve their financial goals is likely what most motivates you in your work as an advisor. So it makes sense that you want to dedicate the bulk of your time and energy on personally meeting all of your clients’ needs.

But as your business grows, that up-to-the-minute personal touch for each client becomes difficult to accomplish. It might make sense to use segmentation to focus on increasing engagement with your most valuable clients.

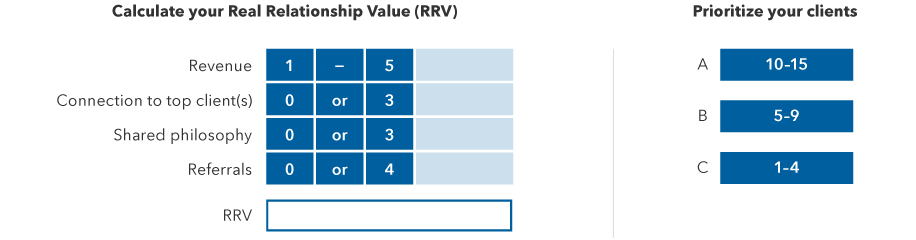

The real relationship value (RRV) formula can help you identify those clients. More than just the cost of service or revenue that a client brings in, RRV can be a way to capture a deeper view of each client relationship, taking into account considerations such as centers of influence and potential for referrals, as well as intangibles as likeability or shared investment philosophy.

You can also personalize those characteristics to suit you and your practice. For example, a desire to foster and grow your slate of female or underserved clients might be more important to you. Calculate client RRV based on the factors you choose on a scale of 1 to 5. For example:

Source: Capital Group research

Compare the client totals, segment them into groups, and think about how much time you spend with each. This can help you figure out areas where you might want to continue with personalized contact and areas where you believe you can tailor your services and meet those client needs in a scalable way.

Read more on how to boost productivity

Advisory productivity: A key to unlock business growth

From clients to coffee: SOPs help you serve both better

5 ways to improve productivity in your business

Better practice management and productivity, with Ray Evans

2. Goal: Use marketing to reach prospects

You’ve probably successfully relied on word-of-mouth to build up your roster of clients. But solely counting on recommendations from others can make you vulnerable to slowdowns — even the most robust practices can hit a mid-career slump about 16 years into their practice, according to Capital Group’s Advisor Benchmark Study.

The study, however, also found that 25% of the highest growth practices have high expertise in marketing. Given that, you might consider deploying marketing strategies to open new lines of communication, which can foster referrals and introduce yourself to new clients.

Boost your brand

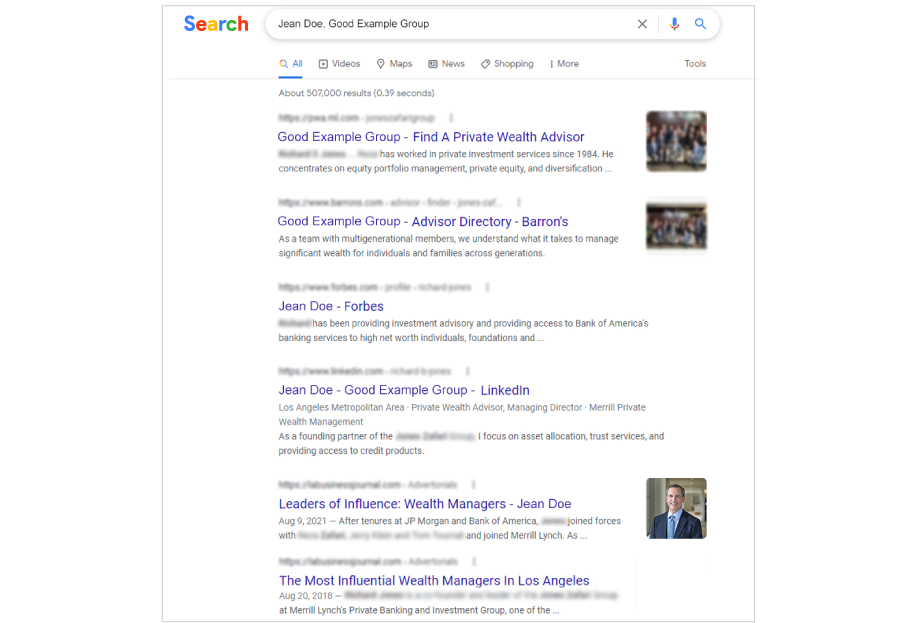

How do you stand out in a Google search of advisors in your area? A powerful brand can help you build loyalty and an emotional connection with clients and prospects in an increasingly competitive financial services industry.

If you’re unsure how to create your brand, or want to refine an existing one, consider our three-step framework designed to help you create a brand that best expresses the value your services provide in a way that’s clear to your clients. The first worksheet in this framework helps you to define your “why,” (i.e., who you are, what you do and why you do it).

Source: Capital Group research

Next, differentiate your value. Ask new clients what drew them to you; ask longtime clients why they stay. Use that intelligence to understand the value you and your work bring. Lastly, demonstrate your effectiveness — especially on the web. When prospects search for your firm, do the results reflect the words, phrases or associations that your brand aims to show?

Add digital media to your marketing toolkit

In a noisy 24/7 media environment, strategic use of digital media can help you stand out. A relevant website that leverages search engine optimization (SEO) and search engine marketing (SEM) is important to help clients and prospects find you. Strategic use of social media allows them to get to know you and see what you care about personally and professionally. Finally, content marketing can highlight your expertise.

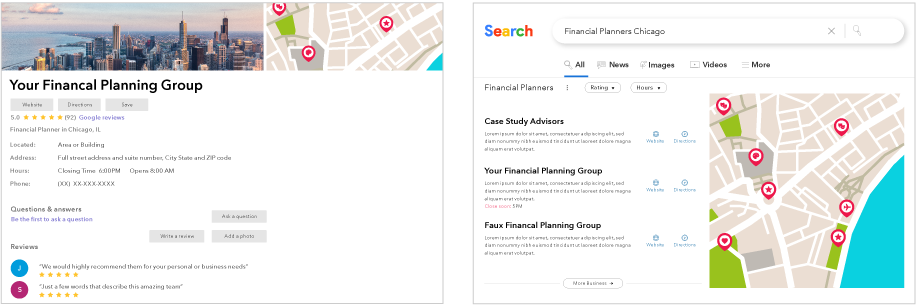

Search for your firm on the web. Do the results reflect all that you offer? If not, or if you want to further refine those results, start by registering your business on two widely used search engines, Google and Bing, at https://wwww.google.com/business/ or https://bingplaces.com/.

Source: Capital Group research

Next, maximizing SEO and SEM could help put your firm on the map. Search on Google for financial advisors and notice the related searches it recommends. See which competitors rank highly in your area and notice the keywords they use. Compile the most relevant and frequently searched keywords or phrases that prospects might use to find you and use them strategically throughout your site.

Source: Capital Group research

Read more on how marketing can strengthen client relationships and reach prospects

3 brand-building essentials for your business

6 social media myths preventing your practice from growing

5 digital marketing strategies for financial advisors

3. Goal: Offer specialized services that help strengthen client relationships

Our latest Advisor Benchmark Study also found that the highest growth practices provided a wider-than-average menu of service offerings. Before you start from scratch, however, look into whether your practice has already carved out a niche you aren’t fully aware of. For example, assessing your client list using the RRV formula discussed above might reveal that your ideal client profile is someone who leads multigenerational families, or maybe you have a robust business preparing clients for retirement.

If you don’t see an obvious niche, think about what gives you the most satisfaction when working with your clients. Is there more there you can do to add to those services and seek out like-minded clients?

Nurture next-gen relationships (and don’t neglect women!)

The average advisor and her client are both getting older, signifying that practices are heading toward exit ramps rather than driving toward new heights. You can infuse new life into your practice and boost growth simply by asking current clients to invite their partner and heirs into the planning conversations you are already having with them.

One technique that can strengthen current client relationships while also building them with family members is to host a family wealth briefing. Nearly three-quarters of wealth transfers are unsuccessful,1 because many families have poor communication and are ill-prepared for the transition. As a trusted advisor, you are well positioned to broker these conversations and help them avoid some of those wealth-transfer pitfalls.

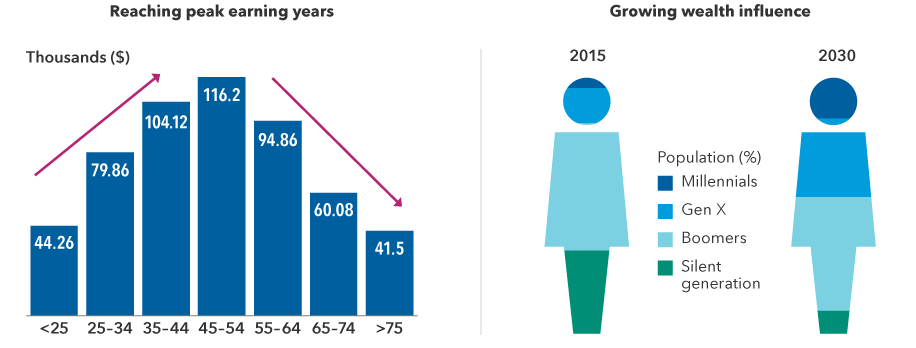

Source: Consumer Expenditure Survey, U.S. Bureau of Labor Statistics, 2020, Deloitte Center for Financial Services, as of 2015.

The time is now to forge strong next-gen relationships. Millennials, especially, are about to enter their peak earning years — and Gen X is already there — making each of those generations likely receptive to good financial advice. Don’t wait until they fully receive the trillions in inheritance coming due to them because they will probably have formed other advisory relationships.

The time is now to forge strong next-gen relationships. Millennials, especially, are already in their peak earning years and are likely receptive to good financial advice. Don’t wait until they fully receive the trillions in inheritance coming due to them, because they will probably have formed other advisory relationships.

Another typically weak point in advisor-client relationships is with women, both as partners of current clients as well as heads of their own families. But these ties can be strengthened. Ask clients to include partners in annual meetings and seek out her opinion on family financial, retirement and other related goals.

A good way to show your value to female clients and prospects is to remember that financial health is more than investment management, but using money to help with life management, such as eldercare or childcare, which disproportionately fall on women. That’s according to Heather Ettinger, founder and CEO of Luma Wealth Advisors and Fairport Wealth, which focuses on working with women.

And don’t make assumptions about women based on their marital status or if they are childless, she cautions. “If an advisor sees ‘not married, no kids,’ they could be missing a six-figure-plus number over time,” she says. “About 32% of PANKs [professional aunts, no kids] were actually supporting children in the next generation.”

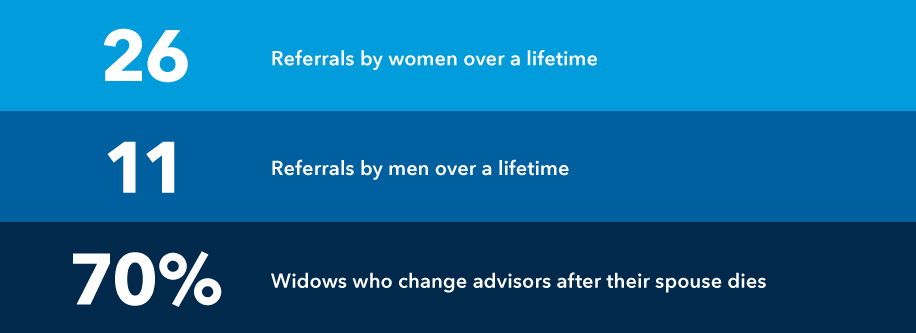

Source: Investment News, “Female clients more likely than men to make referrals,” April 2012; and Family Wealth Advisors, “What do breadwinner women want” report, 2015

Cultivating relationships with women is good business. They make 26 referrals over a lifetime compared to 11 by the typical male client. But if there isn’t a connection, they are quick to cut ties, too. Seventy percent of widows change advisors after their spouse dies. 2

Become a retirement specialist

Aligning your services to key client milestones like retirement can be a successful strategy to build client loyalty. For example, help clients (and their partners) explore their visions for retirement. Where do they want to live? How would they like to spend their time? Expand the discussion beyond investments and a final retirement “number,” and help clients create a holistic plan that addresses the life they seek to have for those years.

If you have large employers in your location or many of your clients work for a specific company, it could make sense to forge closer relationships with human resources and benefits professionals there. Capital Group’s Advisor Benchmark Study also shows that the highest growth practices have a higher percentage of assets under management in retirement plan assets, and that those assets are linked to greater referrals.

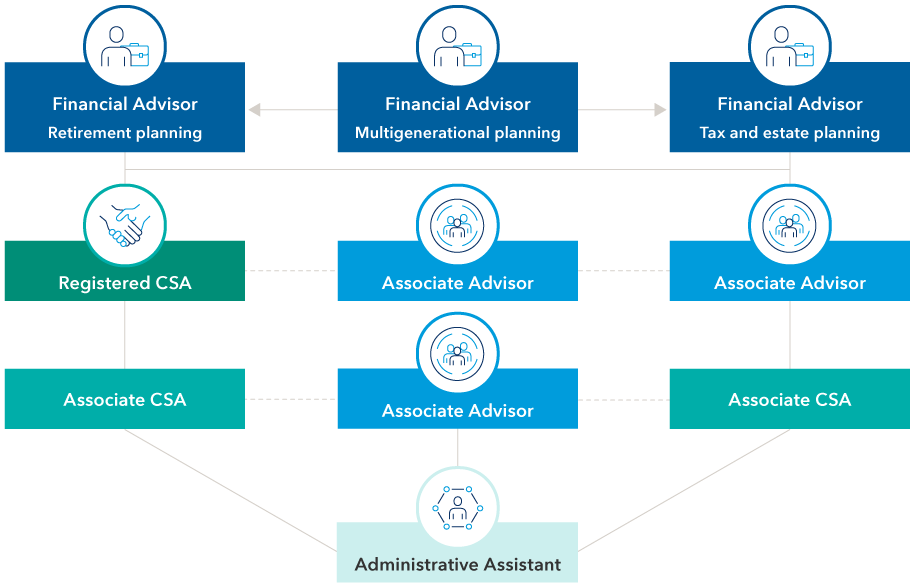

Explore team structures best suited to the services you provide

Lastly, take a look at how your team is structured. A horizontally aligned team can provide your practice optimal support to offer specialized services. A set of primary advisors deliver specialized services, and associate advisors and client service staff with complementary skills work with them on more tactical needs. Administrative staff would layer underneath those specialist groups to provide support.

While you can’t likely revamp your firm’s structure overnight, making changes along the way to create a more horizontally focused team could enable you to better deliver specialized services to clients.

Source: Capital Group

Read more on how to build capabilities to offer clients specialized services

Build a multigenerational growth strategy

Webinar on demand: Bring the power of multigenerational growth to your practice

Forget pink. Building a practice that serves women better, with Heather Ettinger

How to help women prepare for their financial futures

Connecting the retirement business to wealth management, with Jonathan Freeman and Brian McCarver

Reinvent your retirement playbook

Winning Main Street clients by mastering the employee handbook, with Rhonda and Scott Ferguson

Effective team structures for financial advisors

1 Source: "Prepare your heirs: Why it's so important for families to work together as a team," The Williams Group, 2019.

2Hemington Wealth Management, “Women of wealth: What do breadwinner women want?

Related content

-

Marketing & Client Acquisition

-

Team Management