Portfolio Construction

ETF

Financial advisors incorporating exchange-traded funds (ETFs) into client portfolios need to understand how buying and selling them is different from mutual funds. For example, investors typically trade ETF shares on a secondary market like a stock exchange rather than interacting directly with the asset manager.

This article will help advisors understand the nuances of ETF liquidity and the resources they can leverage to help them get the best trading execution for their clients.

- ETF liquidity is important to advisors because they want to be able to transact on behalf of clients quickly and easily at a price that accurately reflects what the fund holds.

- When evaluating the liquidity of an ETF, advisors should look beyond average daily trading volume to also consider the liquidity of the ETF’s underlying securities.

- ETF providers like Capital Group have ETF capital markets teams that can give guidance on ETF trading best practices to help optimize execution quality for large client orders.

Financial advisors incorporating ETFs into client portfolios need to understand how buying and selling them is different from mutual funds. For example, investors typically trade ETF shares on a secondary market like a stock exchange rather than interacting directly with the asset manager.

This article will help advisors understand the nuances of ETF liquidity and the resources they can leverage to help them get the best trading execution for their clients.

Why ETF liquidity matters

Advisors care about ETF liquidity for a simple, yet important, reason: They want to make sure they get the best prices for clients on ETF trades. Specifically, this means they want the ETF market price to be as close as possible to the indicative net asset value (iNAV) of the basket of securities the ETF holds.

Most fully transparent ETFs release an iNAV that is updated throughout the trading day and can be thought of as a real-time estimate of the value of the securities the ETF holds. Therefore, advisors can compare the ETF’s share price to the iNAV to see how close the price is trading to fair value. One caveat is that iNAV may not be as accurate for ETFs that hold international securities when the underlying market is closed due to time zone differences.

Do ETFs trade like individual stocks? Yes and no.

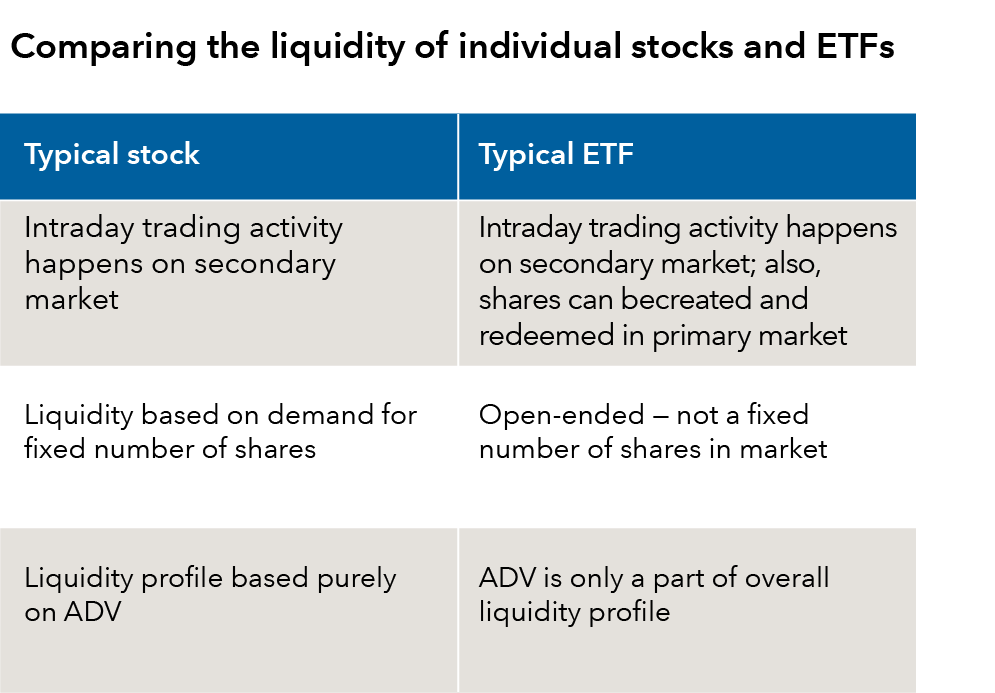

It’s often said that ETFs trade on an exchange like an individual stock. Yet, this is an oversimplification when it comes to liquidity, or how quickly and easily a security can be bought and sold in the secondary market.

When evaluating the liquidity of an individual stock, investors typically hone in on the average daily volume (ADV).

With ETFs, however, ADV doesn’t tell the whole story. Investors also need to factor in the liquidity of the underlying securities that the ETF holds. All else equal, ETFs that invest in widely traded U.S. large-cap stocks are more liquid than ETFs that trade in less liquid parts of the market such as emerging market debt and micro-cap stocks.

When evaluating the liquidity of an individual stock, investors only need to consult ADV because there are a finite number of shares available or outstanding. ETFs, on the other hand, are open-ended, meaning shares can be created and redeemed in what is called the primary market in response to demand in the marketplace.

With ETFs, average daily trading volume doesn’t tell the whole story. Investors also need to factor in the liquidity of the underlying securities that the ETF holds.

ETF creation and redemption: How it works

Now that we know that ETF shares can be created and redeemed, how does it work and how does the process potentially boost the liquidity of an ETF?

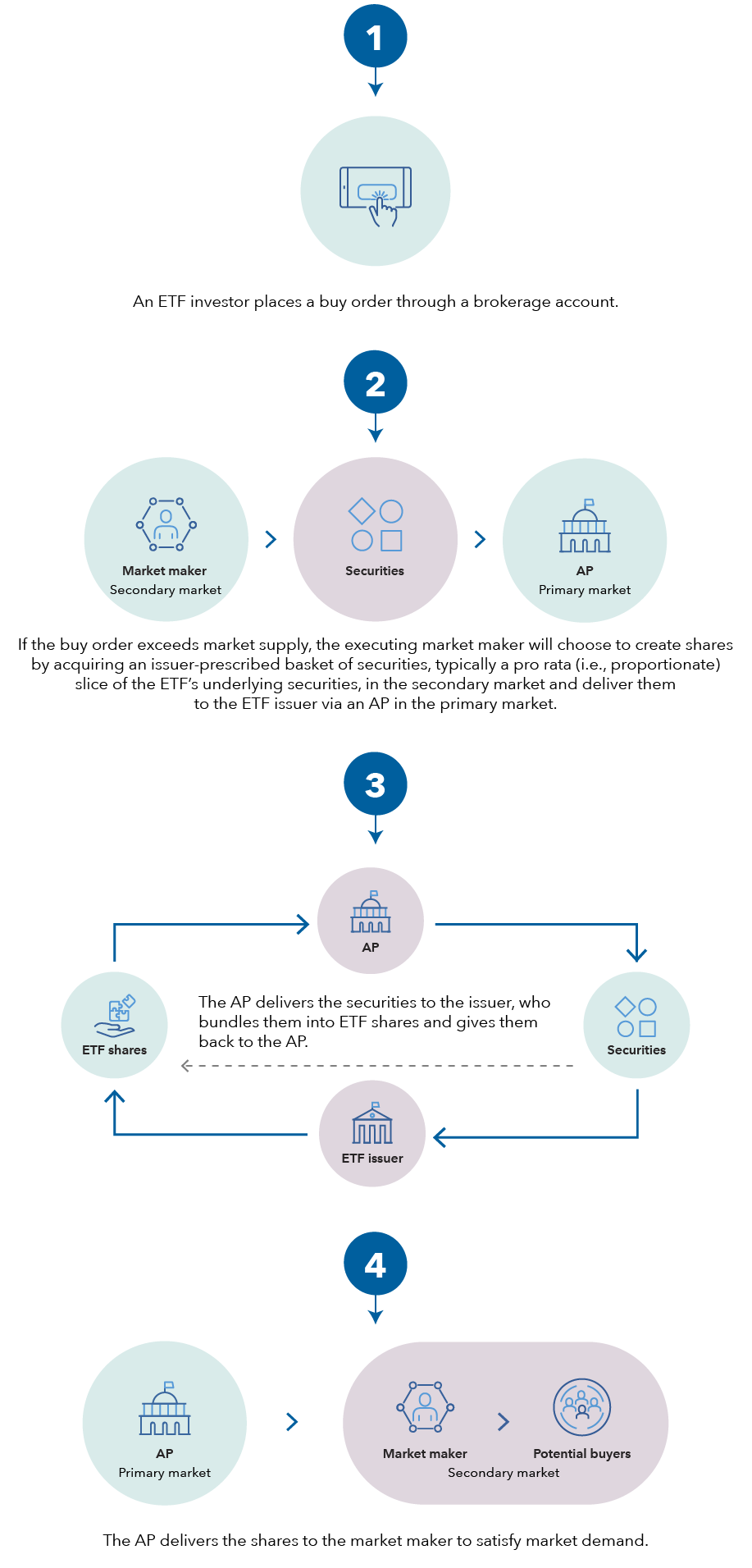

Unlike a mutual fund, the investor or advisor doesn’t interact directly with the ETF issuer. When buying an ETF, investors place a trade in their brokerage account, and the transaction is typically executed by market makers in a “secondary market” like a stock exchange.

Let’s assume that the demand for an ETF exceeds the current number of shares outstanding. In that case, market makers via authorized participants (APs) can go to ETF issuers like Capital Group to create more ETF shares to meet the demand. Even if the ETF has a relatively low ADV, more ETF shares can easily be created if the underlying basket is liquid. Conversely, if selling in an ETF exceeds demand in the secondary market, the APs can redeem the shares back to the ETF issuer. This reinforces why it is important to look beyond ADV and also consider the liquidity of the asset class or sector the ETF invests in.

The creation process

Allows the number of ETF shares to increase, as needed, depending on market demand

Source: Capital Group. For illustrative purposes only.

There are many reasons why implied liquidity is a more accurate way to estimate an ETF’s liquidity than ADV alone. We think of implied liquidity as an estimate of the total amount of an ETF’s shares that could be created or redeemed on any given day without materially impacting the least liquid security in the ETF’s basket. Particularly in highly liquid markets like U.S. large-cap stocks, implied liquidity may be significantly higher than the ETF’s ADV.

How ETF capital markets teams can help on large trades

At Capital Group, we have an ETF Capital Markets team that works directly with our Portfolio Strategy Management team to help maximize the liquidity of our ETFs’ basket composition.

The ETF Capital Markets team is focused on best-in-class execution and works with market makers, exchanges and other partners in the ETF ecosystem. The team also works with the advisor community to answer questions and help advisors trade ETFs with confidence.

Advisors looking to execute large block trades of Capital Group ETFs should connect with their Capital Group representative, who can help facilitate a conversation with the ETF Capital Markets team.

Learn more about Capital Group’s lineup of actively managed ETFs.

Key terms glossary

Average daily volume (ADV) provides a measure of an ETF’s secondary market activity (but is not the most accurate indicator of the fund’s liquidity).

An authorized participant (AP) is a broker-dealer that has a contracted opportunity with the ETF issuer to create and redeem shares in the primary market to meet market demand.

A basket is a collection of securities that share certain themes or criteria, such as being in the same sector, industry or investment strategy.

The Capital Group Capital Markets team is responsible for pursuing best execution for ETF investors by monitoring the trading environment and working with ETF market participants (authorized participants and market makers) to promote efficient trading.

The Capital Group Portfolio Strategy Management team is responsible for optimizing vehicle portfolios to provide a similar investment risk and return profile as the initial investment portfolio while accounting for vehicle-specific needs. In the case of ETF portfolios, this includes liquidity, cash management and tax efficiency.

The ETF creation and redemption process allows the ETF issuer to work with an AP to create and redeem the ETF’s underlying fund holdings in the primary market to meet investor demand to buy or sell ETF shares in the secondary market. This allows the number of ETF shares to increase or decrease as needed, depending on market demand.

An ETF issuer is a firm that creates, manages and operates an ETF, establishing its strategy and working with regulators and exchanges to obtain permission to offer the fund.

ETF market price is the price at which shares of an ETF can be bought or sold on a secondary exchange, like a stock market.

Implied liquidity is the total amount of shares that you’re able to create and redeem on any given day without having to materially affect the least liquid security in that ETF’s basket.

Intraday liquidity results from ETFs trading like a stock in that they can be bought and sold anytime during the trading day at market price, which may be at a premium or discount to the net asset value (NAV), which can be helpful for investors who want more control over investment timing.

Market makers are firms that help set the market price for the ETF in the secondary market and execute client demand.

Net asset value (NAV) of an ETF is the value of the ETF’s assets, minus its liabilities, then divided by the number of outstanding shares of the ETF.

Open-ended securities are funds, such as ETFs, that do not typically have a limit on the number of shares that can be bought and sold at any time.

A primary market is the section of the capital market where new securities are issued. It’s also where APs work with ETF issuers to adjust the supply of ETF shares in the market, either creating new shares or redeeming excess shares.

A secondary market is where most retail investors buy and sell securities. The most common examples are stock exchanges like the NYSE and NASDAQ, but trading in this market can occur across several exchanges and market maker trades.

To read the full article, become an RIA Insider. You'll also gain complimentary access to news, insights, tools and more.

Already an Insider?

For financial professionals only. Not for use with the public.

Donald Kernizan

Donald Kernizan