Portfolio Construction

Portfolio Construction

Helping clients accumulate wealth is usually the fun, straightforward part for financial advisors. Guiding clients through the process of drawing down those assets during retirement, on the other hand, can be more of a challenge.

“A distribution portfolio is a much more complex problem relative to the accumulation phase,” says Casey Dregits, senior portfolio consultant and investment advisory specialist at Capital Group. “Portfolios have different objectives and face different risks once you enter the drawdown phase. The outsized importance of sequencing of returns can’t be overlooked.”

With most of the baby-boom generation firmly into their retirement years, managing distribution portfolios is something that all advisors need to master. We examine common mistakes advisors make in transitioning portfolios to the distribution phase and provide suggestions for building portfolios that are designed to sustainably meet retirees’ spending needs in today’s environment.

- Low interest rates and longer life expectancy have made designing portfolios for retirement income especially challenging.

- Retirement income portfolios should support sustainable withdrawals, limit sequence-of-returns risk and manage exogenous risks.

- Equities can play a critical role in supporting income and addressing inflation risk in distribution portfolios.

Helping clients accumulate wealth is usually the fun, straightforward part for financial advisors. Guiding clients through the process of drawing down those assets during retirement, on the other hand, can be more of a challenge.

“A distribution portfolio is a much more complex problem relative to the accumulation phase,” says Casey Dregits, senior portfolio consultant and investment advisory specialist at Capital Group. “Portfolios have different objectives and face different risks once you enter the drawdown phase. The outsized importance of sequencing of returns can’t be overlooked.”

With most of the baby-boom generation firmly into their retirement years, managing distribution portfolios is something that all advisors need to master. We examine common mistakes advisors make in transitioning portfolios to the distribution phase and provide suggestions for building portfolios that are designed to sustainably meet retirees’ spending needs in today’s environment.

Shortfalls in constructing distribution portfolios

Because distribution portfolios have different objectives, they need to be constructed differently. But Capital Group’s research indicates that few advisors are constructing portfolios specifically with income in mind. “Less than 5% of the nearly 1,700 portfolios we analyzed in the first seven months of 2021 had a specific retirement income objective when it came to portfolio construction,” Dregits said.

If advisors aren’t building portfolios with distribution in mind, they may be ignoring risks that are specific and critical to retirees, such as sequence-of-returns risk — or the risk that a market drawdown impairs capital early in retirement, reducing the portfolio’s longevity. Capital Group’s research indicates that when advisors think about income, their first inclination may be to look to fixed income and increase allocations to instruments like high-yield bonds. “Because high-yield bonds behave like equities under market stress, however, this itself adds to sequence-of-returns risk in ways that may not be fully visible to advisors,” Dregits said.

“Portfolios have different objectives and face different risks once you enter the drawdown phase. The outsized importance of sequencing of returns can’t be overlooked.”

The new retirement paradigm

The current economic and market environment makes designing portfolios for retirement income especially difficult. Advisors need to navigate four key challenges facing retirement portfolios today.

1. Longevity risk

Today, U.S. retirees can expect to live longer than their predecessors. While this may be welcome news, it poses a portfolio challenge — longevity risk. For a couple aged 65, there is a 50% chance that at least one of the individuals will live past 92, and a 25% chance they will live beyond 96.1 Retirement portfolios need to be designed to reflect this.

2. Inflation

Even if the recent uptick in inflation proves to be transitory, inflation is something that portfolios need to account for. Overall prices, as measured by the core Consumer Price Index (CPI), have doubled in the past 30 years. Meanwhile, health care costs, which disproportionately affect retirees, have tripled over the same time frame.2

3. Low yields

Low yields are a familiar story for fixed income investors; the 10-year U.S. Treasury yield stood at 1.3% as of September 1, 2021.3 And on the equity side, high valuations mean low dividend yields; the dividend yield on the S&P 500 Index is currently around 1.3%.4 At current inflation rates, this means real yields across core bond and equity markets are negative.

4. Equity valuations

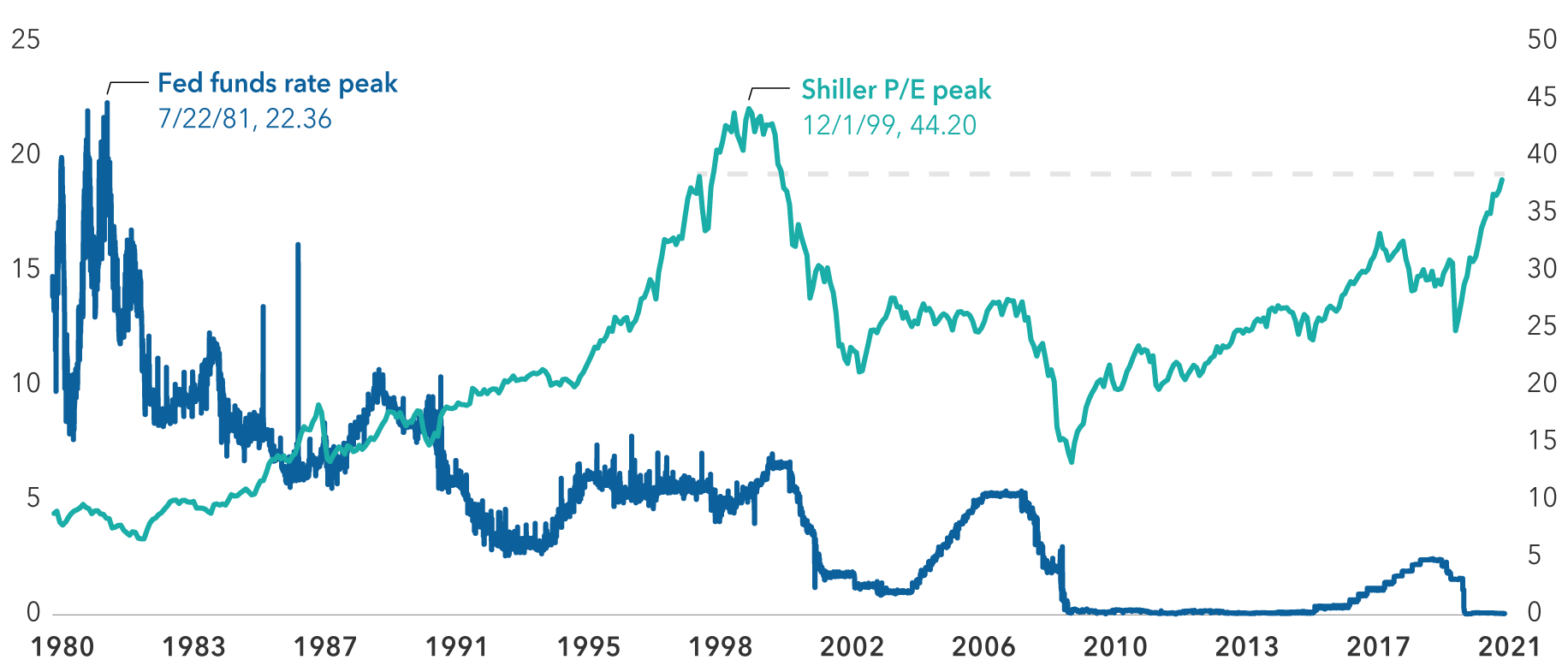

Based on most measures, equity valuations are currently above their 25-year averages. The Shiller P/E ratio (also known as the cyclically adjusted P/E ratio or CAPE ratio) assesses likely future rates of return on equities over the next 10–20 years, based on valuations. As shown in the graph below, the Shiller P/E ratio peaked in 1999. Over the next 10 years, the S&P 500 Index produced an annual average return of –2%, including dividend reinvestment. Today, the Shiller P/E ratio is nearing its 1999 peak, suggesting that investors may need to prepare for a decade of muted equity returns.

Effective federal funds rate vs. Shiller P/E ratio, January 1, 1980, through July 1, 2021

Source: Federal Reserve Bank of St. Louis

Building retirement-ready distribution portfolios

Capital Group’s investment teams have deep experience building portfolios designed to meet retirement income objectives. Here are some key principles we adhere to when constructing distribution portfolios.

Avoid the “yield at any cost” trap

The goal of a retirement income portfolio shouldn't be to generate the highest yield possible regardless of volatility. Rather, sustainable portfolios should account for the complex nature of the distribution phase, which entails navigating multiple risks. These include longevity risk (supporting withdrawals for 30+ years in many cases), sequence-of-returns risk (limiting capital-impairing drawdowns early in retirement), and managing exogenous risks such as inflation. Given the multivariate nature of risks facing retirement portfolios, advisors should take a holistic approach to diversifying income across bond sectors and look to equities to help augment yield.

Build a flexible fixed income strategy

Capital Group’s review of advisors’ portfolios found that advisors use core-plus bond funds more than any other fixed income category. Core-plus bond funds often include a material allocation to high-yield bonds, which tend to be highly correlated to equities, and typically take broad top-down views on interest rates — all of which increases risk. Capital Group suggests dynamically managing credit, duration and inflation. For example, active duration and curve positioning can add a differentiated return stream and help provide on-the-run inflation protection.

A fixed income strategy also should consider the disparity in bond sector performance from year to year. The average annual difference between returns of the highest and lowest sector across the high-yield, investment-grade corporate, emerging market, and securitized debt sectors was stark at about 14%.5 This emphasizes the benefit of diversification and flexibility in fixed income.

“Less than 5% of the nearly 1,700 portfolios we analyzed during the first seven months of 2021 had a specific retirement income objective when it came to portfolio construction.”

Maintain exposure to equities

Capital Group’s research indicates that another common approach among financial advisors when constructing a retirement portfolio is to simply scale back equity allocations, often to as low as 20% or 30% of the total portfolio. But when facing a 30-year time horizon and low bond yields, equities can be critical to supporting income and addressing risks like longevity and inflation.

“Our distribution portfolio models focus equity exposure on high-quality dividend payers,” Dregits said. “This type of equity exposure can provide yield and limit downside risk and volatility relative to growth-oriented equity exposure. In our target date series funds, even at the 30-year mark post-retirement, equity allocations are still around 50% of the portfolio,” Dregits said.

Actively manage distribution risks

Managing multiple goals and risks as they evolve over a 30-year horizon requires a dynamic approach, so a distribution portfolio shouldn’t be based on a static model. For example, sequence-of-returns concerns are paramount in the early phase of distribution, but they moderate over time. Fixed income exposures need to be managed across the credit cycle and shifts in sector performance. In addition, a dividend-focused equity strategy may benefit from active stock selection.

Resources to help your clients navigate retirement

At Capital Group, we understand the challenges involved in designing portfolios for retirement income. We have 90 years of experience focused on helping investors meet their objectives, and our team regularly provides one-on-one support for advisors' investment efforts, including customized consultations on advisors’ portfolios.

You can tap into these resources to apply to your approach to designing distribution portfolios today. Download our brochure to learn more about Capital Group’s approach to retirement income, or request a personal consultation from one of our portfolio specialists to begin addressing your clients’ specific investment needs today.

1 Sources: Center for Retirement Research at Boston College, 2016; Actuaries Longevity Illustrator, July 29, 2021.

2 Source: Federal Reserve Bank of St. Louis, January 1, 1980–June 1, 2021.

3 Source: U.S. Department of the Treasury, Daily Treasury Yield Curve Rates.

4 Standard & Poor’s, August 31, 2021.

5 Source: Capital Group. Calculated using the best-to-worst returns spread each year from 2007–2020 for high-yield, investment-grade corporates, emerging market debt, and securitized. High yield: Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index. Investment-grade corporate: Bloomberg U.S. Investment-Grade Corporate Index; Emerging market: JPMorgan EMBI Global Diversified Index. Securitized: 80% Bloomberg CMBS Ex AAA Index/20% Bloomberg ABS Ex AAA Index.

To read the full article, become an RIA Insider. You'll also gain complimentary access to news, insights, tools and more.

Already an Insider?

Casey Dregits

Casey Dregits