Retirement Income

Investment Menu

A target date fund (TDF) is arguably the most important investment on a retirement plan menu. It allows all investors regardless of their level of sophistication to have a diversified investment that’s appropriate for their age and career timeline. Furthermore, a TDF takes a complex investment challenge and presents it in a simple solution that plan participants can more easily understand.

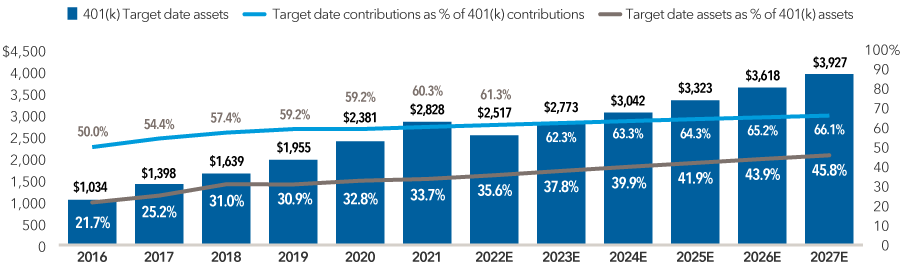

As a result, TDFs have become the dominant investment trend in 401(k) and other defined contribution plans. However, they may still be underutilized by participants. According to Sway Research and Callan, TDFs comprised only 32% of total 401(k) assets, as of September 2022.

Target date assets comprise the majority of 401(k) contributions and a growing percentage of all 401(k) assets

401(k) target date assets and contributions, 2016–2027 ($ billions, 2022–2027 estimated)

Sources: Department of Labor, Investment Company Institute, Plan Sponsor Council of America, Vanguard “How America Saves” and Cerulli Associates, The Cerulli Report, U.S. Defined Contribution 2022.

Analyst note: Previous asset totals were restated. A long-term market appreciation assumption of 4.10% was used to estimate and project 401(k) target date assets.

Why target date funds?

TDFs became hugely popular following the passage of the Pension Protection Act of 2006 (PPA), which defined the safe harbor for a default option — qualified default investment alternatives (QDIA) — and included TDFs. This allowed plan sponsors to select a more appropriate default for their plan than the traditional low-risk solutions like money market and stable value funds. Currently, TDFs are offered in 82% of plans and TDF assets are estimated to reach nearly $4 trillion by 2027.

This presents an opportunity for financial professionals to help plan sponsors and their participants better understand and make use of TDFs. Many plan sponsors might not have a solid understanding of the valuable role they play in preparing their employees for retirement. You can start the conversation by discussing how TDFs can be beneficial to plan sponsors and their participants alike, especially when coupled with automatic enrollment and auto escalation.

Benefits for plan sponsors:

- Convenience — TDFs offer a single, age-appropriate portfolio that adjusts to participants’ risk profile over time while helping ensure that they are appropriately diversified.

- Fiduciary protection — TDFs are one of the investment types that meet the Department of Labor’s (DOL’s) requirements, when applicable, for a QDIA, which can reduce a plan sponsor’s investment-related fiduciary liability.

- Potential for better outcomes — A professionally managed portfolio may help participants achieve better results than if they had chosen their own investments.

Benefits for participants:

- Simplicity — Participants don’t have to choose a variety of different investments. Instead, participants can choose the fund for the year that is closest to the year they plan to retire.

- Diversification — TDFs give participants exposure to a mix of cash, stocks and bonds and may include international exposure.

- Automatic rebalancing — The investment mix changes from a more growth-oriented strategy to a more income-oriented focus as the fund gets closer to its target date, allowing participants to automatically have their investment strategy adjusted as they get older.

Benefits for financial professionals and consultants:

- Plan success measurement — Consistent and disciplined investment strategy by participants could lead to better participant and plan outcomes, which are key success measurements for most plans.

- Focus on other important issues — Simplifying the investment process for participants allows for more focus on other issues.

- Client satisfaction — Proactively bringing ideas to your clients and prospects can build loyalty and trust that help build your practice.

Improving TDF adoption through an investment re-enrollment

Despite the rapid growth and availability of TDFs, not all participants have benefited. Many participants have been invested in TDFs as plan sponsors have automatically enrolled new hires — but employees who joined the plan before automatic enrollment was adopted may still be in the same options they chose when they enrolled, or even in a default option from before the PPA. To help this group, you can encourage plan sponsors to do an “investment re-enrollment,” asking all employees to confirm their investment selections. Those who don't opt out of the re-enrollment can then be defaulted into age-appropriate TDFs.

Re-enrolling participants into a TDF is a powerful tool that may level the playing field for all participants, although it can be misunderstood by some plan sponsors. You can help educate them by addressing some of their chief concerns and misperceptions:

- Perception: It’s an administrative burden — With the help of a solid plan provider and financial professional, investment re-enrollment can be very straightforward for both plan sponsors and participants.

- Perception: Participants may react negatively — Participants may appreciate the help and be grateful that they don’t have to make stressful investment decisions on their own. Furthermore, participants can always choose to opt out before any changes occur.

- Perception: Investment re-enrollment increases fiduciary risk — TDFs meet the DOL’s requirements, when applicable, for a QDIA, which can reduce a plan sponsor’s investment-related fiduciary liability, and an investment re-enrollment creates a “paper trail” for all participants, including those that were defaulted prior to the PPA.

While an investment re-enrollment is primarily beneficial for plan participants, there are compelling benefits for plan sponsors, consultants and financial professionals as well. An investment re-enrollment that places employees into an age-appropriate investment like a TDF can help boost plan sponsors’ confidence that all their participants are on the road to a better retirement outcome.

Five factors to evaluate target date funds

The evaluation process for TDFs is different than for core menu options. Here is a quick primer on the unique factors to consider when evaluating TDFs:

- Participant needs and demographics — The key participant investment need is to manage both longevity risk and market risk, which requires target date funds to strike the appropriate balance between appreciation and conservation at each point in a participant’s career. Recognizing this need and pairing it with any distinct characteristics of the plan sponsor’s employee base may lead to better retirement outcomes.

- Glide path construction — The glide path of each TDF series should evolve over time within major asset classes, leverage strategies to mitigate risk and provide thorough diversification through traditional asset classes and subclasses.

- Value versus cost — Consider the value of a target date series relative to its costs by comparing expenses with returns over long periods of time.

- Quality of underlying funds — A TDF series is only as good as its underlying funds. Plan sponsors should evaluate the strength of the target date fund’s underlying funds as well.

- Consistency and repeatability — Evaluate the TDF series to ensure that the investment manager’s philosophy, approach and process remain consistent and are reflected by the series’ investment results over meaningful time periods.

TDF evaluation made easy

While the QDIA regulations created certain fiduciary protections for the use of TDFs, plan sponsors are still obligated to prudently select and monitor them. The diverse nature of TDFs makes them difficult to compare across different managers’ series, but there are tools that can help.

Financial professionals can evaluate funds with Target Date ProView. Reach out to your Capital Group representative for assistance running these reports.

Our latest insights

-

-

Retirement Income

-

Target Date

-

Practice Management

-

Participant Engagement

RELATED INSIGHTS

-

Practice Management

-

Investment Menu

-

Practice Management

Never miss an insight

The Capital Ideas newsletter delivers weekly investment insights straight to your inbox.

John Doyle

John Doyle