Retirement Income

Fiduciary Responsibility

Retirement plan fees have long been an important touchpoint in annual 401(k) plan reviews, particularly with the numerous excessive-fee lawsuits in recent years. Now with heightened market volatility and inflationary pressures, 401(k) fees have taken on even more scrutiny as sponsors seek to make every dollar they spend count as much as possible.

As reviews approach, are you using all the tools in your toolbox to manage what could be challenging conversations? One idea you may not have considered is to demonstrate the potential tax advantages to employers that come from how plan expenses are paid.

Many 401(k)s are reflexively set up to pass on some plan costs to participants. And some plan sponsors may be unaware that other options exist. But paying some or all plan expenses out of company funds can have benefits for both employers and employees.

Tax savings for employers

Some out-of-pocket plan fees are tax-deductible expenses, such as recordkeeping, fiduciary services, plan administration and possibly financial professional compensation. Startup plans may also qualify for a tax credit. The SECURE Act significantly increased the tax credit from a maximum of $500 a year to $250 for each non-highly compensated employee who is eligible to participate in the plan, up to $5,000 a year.

Potential for improved retirement outcomes

By transferring some costs to business owners, participants will have lower fees, allowing them to save more for retirement. Furthermore, in small plans, the business owner often has the largest account balance. As a result, their accounts pay a big chunk of fees from plan assets. Business owners can avoid this issue — and keep more of their retirement savings growing through the power of compounding — by paying 401(k) administration fees from company assets.

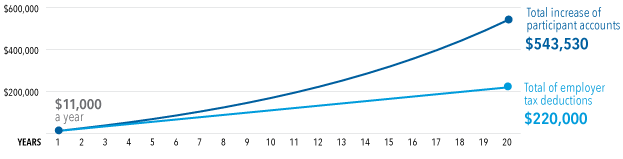

In the hypothetical example below, the employer pays $11,000 of annual plan costs out of company assets instead of them being deducted from participant account balances. Over 20 years, the employer tax deductions amount to $220,000. Because participants didn’t have to pay plan costs, that money remained in their accounts and, with growth, added up to an extra $543,530 after 20 years. This additional accumulation may make a meaningful difference in the quality of retirement for participants.

Tax savings for employer, increased assets for employees

Assumes $1 million in plan assets, 30 participants, $11,000 in annual plan costs and an 8% annual investment growth rate over 20 years

This hypothetical example was developed by third-party retirement plan consultant Patrick Shelton, GBA and managing member of Benefits Plans Plus, LLC. The example assumes annual recordkeeping costs of $4,000, annual advisor costs of $5,000 and annual TPA costs of $2,000. To estimate the increase of participant balances, one-fourth of $11,000 ($2,750) is invested quarterly with an annual growth rate of 8% compounded quarterly over 20 years. Sponsors can elect whether or not to pay plan expenses each year, depending on business conditions. For illustrative purposes only and not intended to portray actual investment results.

Reduced litigation risk

Finally, as the flurry of excessive fee litigation indicates, paying excessive fees is a major source of fiduciary liability. But paying plan costs with company assets can help sponsors reduce the potential for excessive-fee claims.

A win-win for sponsors and participants

As fees remain under scrutiny, are the plan’s expenses too much for it to absorb? Try externalizing them and using company assets to pay for some of them. As a plan’s financial professional, you also have options. Some plan professionals maintain asset-based fees while others change a flat-dollar fee, outside of the plan. There are many choices available to consider. Check with your specific firm for information on billing and plan compensation guidelines.

If you are considering putting this idea into action, we can help. You can download our single sheet to share with clients. You may also reach out to your Capital Group/American Funds Retirement Plan Counselor.

Our latest insights

-

-

Retirement Income

-

Target Date

-

Practice Management

-

Participant Engagement

RELATED INSIGHTS

-

Practice Management

-

-

Plan Design

Never miss an insight

The Capital Ideas newsletter delivers weekly investment insights straight to your inbox.

Renee Grimm

Renee Grimm