Practice Management

- Clients will likely ask you about politics. Be prepared to keep the discussion constructive.

- Simply changing the subject is often not an option. Clients expect a thoughtful response.

- Redirecting the conversation toward long-term planning can build your connection with clients.

“Don’t talk about religion and politics.” That’s an adage you’ve probably heard. But political discussions are difficult for RIAs to avoid — clients often ask and expect an answer.

The key to talking politics is having an approach. After all, it’s fair for clients to wonder how changes in Washington, D.C., or state government might potentially affect their portfolios. Some may expect you to help them understand if any adjustments are needed — so it’s best to be prepared.

“You have to address it (politics),” says Mike Joslin, CEO of Bellevue, Wash.-based Joslin Capital Advisors. Joslin says clients, including high net worth clients, routinely ask him about political matters. It’s important for RIAs to convey they are informed on the issues, but not take a side. “To not address something that is so obvious is to ignore the elephant in the room, and I think that makes it even a more awkward moment.”

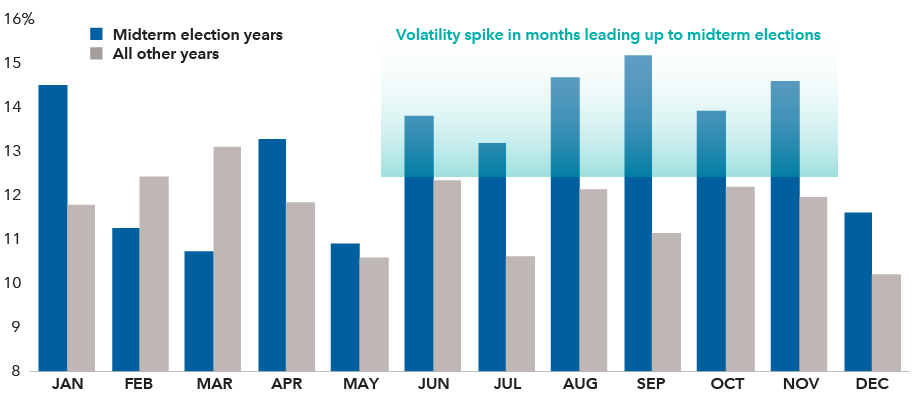

Clients are especially interested around the November elections, reminding advisors of the importance of being prepared for questions. Capital Group research confirms market volatility tends to increase in midterm election years, such as in 2018.

Volatility rises in midterm election years

S&P 500 Index annualized monthly volatility since 1970

Sources: Capital Group, RIMES, Standard & Poor’s. As of 8/31/18. Volatility is calculated using the standard deviation of daily returns for each individual month. The median volatility for each month is then displayed in the chart on an annualized basis. Standard deviation is a measure of how returns over time have varied from the mean. A lower number signifies lower volatility.

But while some clients might bring up politics, several leading RIAs have developed ways to respond so they can strengthen relationships with clients. Here are a few suggestions:

- Don’t bring up politics — wait and see if your clients do it first. Bob Smith, Market Leader and Partner of the Cleveland office of HPM Partners, is active civically and clients are aware of that. He has been appointed to several civic positions by elected officials, including the Ohio Public Employees Retirement System, and serves as the current chair of the Detroit Police and Fire Retirement System Investment Committee.

But Smith doesn’t bring up politics before being asked. He tells a story that highlights this. A client had called a young advisor at the firm at 5 p.m. for a “15-minute” conversation. After the client arrived at the office, Smith and his associate answered the client’s questions. Just when the meeting was ending, the young advisor asked the client a political question. “Two hours later, we finally left,” Smith recalls.

Now, the advice is to not go there unless clients take you there.

“If clients want to ask that question, that’s theirs and we will answer it based on our perspective and how politics, government and public officials affect public markets,” he says.

- Be prepared with a response. Joslin’s clients tend to ask about politics frequently. That’s especially true with newer clients, who are still learning that the firm’s long-term approach is rarely affected by short-term news.

So when the clients start asking about an election or other event, Joslin gets ahead of it.

Joslin writes and emails articles on major political events when clients start asking about them. This includes elections and Brexit.

For example, many clients expressed concern with the United Kingdom’s decision to leave the European Union. Many of the firm’s clients have significant weightings to international stocks. Joslin had a newsletter with four key points in clients’ email boxes just days after the vote. “The Brexit (email) was probably the one that got the most kudos because we got it out just days after that happened,” he says. “That was worrying clients.”

Be ready with a response

Front page of Joslin Capital’s letter on Brexit

Source: Joslin Capital Advisors

Capital Group routinely provides data and talking points about topics your clients might ask about, including midterm elections.

- Focus on opportunities presented by long-term policy. Avoid talking about red or blue. Focus on real financial policy shifts that can create opportunities for clients, says Miles Stackpool, business development analyst at Boulevard Family Wealth.

The Beverly Hills-based wealth management firm specializes in multigenerational wealth management for ultra high net worth clients and sees questions about politics as an opening to show what really matters.

For example, 2018 tax reform dramatically increased wealth transfer exemptions. This presents a whole host of planning opportunities, especially for ultra high net worth clients, Stackpool says.

When clients ask about politics, “you use it as a segue,” he says. “You segue to the things they should be thinking about such as long-term tax planning and long-term estate planning.”

Remind clients, too, that the firm hires professional money managers with experience evaluating political and economic events to keep portfolios properly positioned, Stackpool says. That allows clients and advisors to focus on goals, not react to daily events outside your control.

- Stay neutral. Some clients might ask leading questions to see where you are politically. It’s best to keep your personal political opinions to yourself and stay focused on the client’s goals, Smith says. “You want to rephrase (clients’) questions to around the current news coming out of D.C., especially how it affects capital markets and how it might affect their portfolio,” he says. “You don’t have to show your politics.”

Taking sides brings with it a “great risk with a high percentage of clients,” Joslin says. That’s true especially with high net worth clients who “probe far more frequently to see if you are well-read and informed about issues (political or otherwise), and that you can clearly articulate the opinions and positions you hold.”

Personal opinions on political drama might be fine outside the office, Stackpool says. “But when we’re talking professionally, that doesn’t quite factor in,” he says. “We’re talking about things and events that are going to affect them in 40 years’ time.”

All three advisors stressed how long-term portfolios are rarely, if ever, affected by political posturing. Both Smith and Joslin often show clients historical data revealing how rash moves based on politics could have derailed a plan.

Joslin says clients understand this. “With our business owner clients in particular, we’ll ask them how much time they spend managing their businesses based on the federal or local political landscape. With some exceptions, the answer is usually ‘not much,’ for the same reasons that they are managing their businesses for the long haul,” he says.

Smith urged one advisor to keep a diary of the politically motivated decisions one client wanted to make over the years: selling or buying based on news. After showing the client how such emotional trading would have backfired, the client said, “You’ve saved us.”

RELATED INSIGHTS

-

-

Marketing & Client Acquisition

-

Annualized standard deviation (based on monthly returns) is a common measure of absolute volatility that tells how returns over time have varied from the mean. A lower number signifies lower volatility.

Use of this website is intended for U.S. residents only.