Marketing & Client Acquisition

Demographics & Culture

- 60-year-old white males typify high net worth clients now, but that’s changing.

- Rapid economic and demographic shifts are creating fast-growing pockets of female, multicultural and Generation X high net worth clients.

- Advisors who evolve their practices can position to address these important opportunities in the near future.

When you think “high net worth,” a prototypical client probably comes to mind. Forget this image, though, because data show the high net worth population is about to change. Preparing now for the shift could leave your practice well positioned for the coming wave of wealth transfer to this new type of client.

We’ve analyzed data and studies on high net worth investors and the results are startling. While this important market is largely homogeneous today, data point to a change coming in the not-too-distant future. Our data hold profound meaning no matter if you have a large roster of high net worth clients already, or hope to add them to your practice.

Adjusting now — perhaps considering suggestions we present below — could position your firm for an enormous growth opportunity in three areas.

Opportunity 1: Dawn of the new woman

Women in their 40s, 50s and 60s are taking control of all aspects of their lives. That not only includes their relationships and careers, but also their money. This should put husbands — and financial advisors — on notice.

Women control considerable funds

Source: McKinsey, Money in Motion Study, 2016.

Statistics are telling. According to the Pew Research Center, men aged 45 to 54 used to be twice as likely as women to remarry. Now remarriage rates are the same across genders. Meanwhile, more than half (54%) of divorced women aged 50 and older want to remain single.

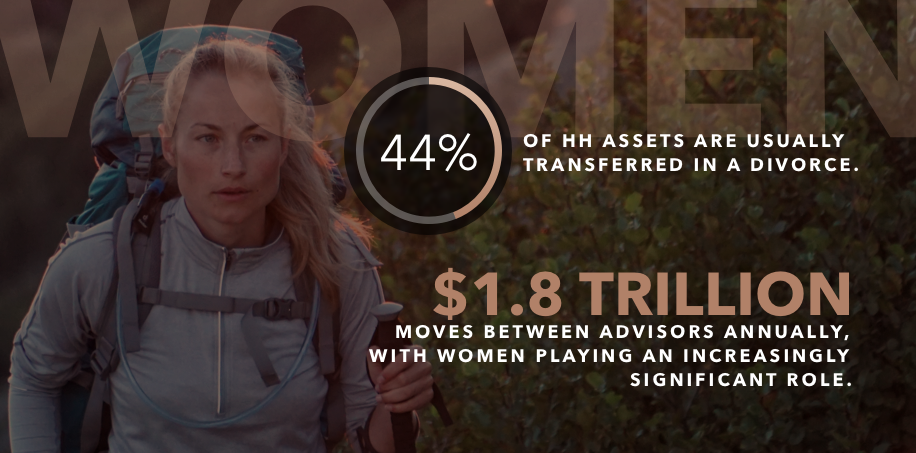

Empowered women are also shaking up asset management. We know that $1.8 trillion moves between advisors each year, according to McKinsey’s “Affluent Money in Motion” survey. Women play a pivotal role, as 44% of assets are usually transferred in a divorce, says the Kaufman Institute. Women aren’t just inheriting wealth, they are creating it.

How to tap into this market

Diversify your staff. Look around your office. If you don’t see any female financial advisors, it’s time to change this as you grow. Female advisors can connect with female clients at a fundamental level.

Female financial advisors are also positioned to prospect new clients from microcommunities, or small groups of people who gather around a common interest. One female financial advisor told me when she was in her early 30s, she’d regularly meet with other moms for social reasons. At first the conversation was about balancing work commitments with parenting, but over time, these moms would ask for financial advice. Before she knew it, she’d built a business and stream of potential clients. The advisor faced little competition from other advisors who were all jockeying for the same clients in the same places.

Even if you bring on female advisors, it is important for you to develop gender-smart skills yourself because understanding this market segment takes research, empathy and time. There are unlimited sources to help you better understand the unique financial needs of women, but in talking to clients, I might offer up two places to at least get started. Make sure you read blogs that matter to midlife women. Sixty + Me is a virtual watercooler for women in their 60s and discusses what’s important to them. Then there’s Midlife Rambler, where women discuss life once the kids leave the house.

Opportunity 2: Multiculturalism

Get ready for big changes in the cultural diversity of high net worth individuals. The data are telling.

Just 56% of millennials are white in the U.S., says Brookings Institute. And diversity is even wider in some parts of the country. In California, where I live, for instance, 68% of millennials are nonwhite. Every time I walk my dog in the neighborhood, I marvel at the diversity around me.

Asians are the future of wealth

Source: Prudential, Asian-American Financial Experience, 2016.

The data point to further change, especially with the Asian population. Already, Asian Americans earn 39% more average income. Yet, they are less likely to work with financial advisors. If you’re interested in tapping into the biggest source of growth in high net worth, this is an area of interest for you.

How to tap into this market

It’s important to customize your products and services for different markets.

You need to understand demographic pockets in your area. If you’re not directly exposed to areas of diversity in your community, data can help you. U.S. Census Bureau data isn’t fine-tuned enough for this kind of work. Many towns have small business development centers or economic development councils that can provide very specific demographic information. These can give you a good place to start. You need to understand where the growth is coming from so you can position to serve these groups.

Know that clients typically have a comfort level working with advisors that look like them. It’s important, as you’re growing and hiring, to add advisors who represent the important diversity in your community, as unearthed by the data.

Opportunity 3: Generation X

If you’re like most advisors, you have a plan for clients who are baby boomers or millennials. What’s less common is a strategy for Generation X, which is a massive potential opportunity.

Gen X: ‘The neglected generation’

Source: Pew Research Center, 2016.

This group, generally born the the mid-1960s to early 1980s, fall through the cracks for many advisors. These people are also perfect candidates for financial services. Many are in their peak-earning years and currently at the age individuals often seek out advisors. What’s more, nearly half, 44%, of these investors feel insecure about their retirement savings, says Pew Research Center. Gen Xers have seven times the investable assets versus millennials.

How to tap into this market

This demographic may not trust financial advisors, but their parents do. That’s your entry point. One of the best ways to prospect for these investors is through their parents, who are probably your best current clients.

Members of Generation X are suspect of you because they enjoy investing on their own, want to maintain control, don’t want to pay fees and generally don’t trust advisors. When you meet with Gen Xers, keep these things in mind and take them on directly.

Here’s an approach. Rather than focusing on investment selection, which might be an area Gen Xers think they can do themselves, you might discuss taxes or estate planning with them. Many Gen Xers might be looking at inheriting wealth from their parents, but feel insecure about ways to manage risks in the transfer.

Above all, just know that the definition of high net worth investors is changing. Your practice — if you want to capture these shifts — will need to change, too.

Use of this website is intended for U.S. residents only.

Mike Van Wyk

Mike Van Wyk