Save

If you start now, setting aside $152 per month in a 529 education savings account, you’ll have invested about $18,000 over 10 years. If you could achieve a 6% average annual return on that investment, you could wind up with $25,000.

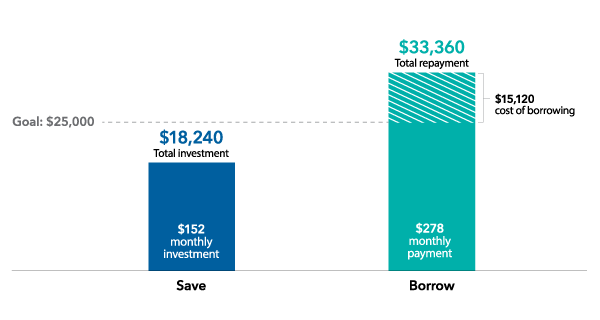

The cost of college is daunting, and it's easy to put off saving for it. After all, you could always get a loan, right? Here's an example of two ways to arrive at the same destination. In both cases, your hypothetical goal is to have $25,000 to pay toward college costs.

If you start now, setting aside $152 per month in a 529 education savings account, you’ll have invested about $18,000 over 10 years. If you could achieve a 6% average annual return on that investment, you could wind up with $25,000.

If you borrow that $25,000, you’ll be paying interest, not earning it. Assuming you have 10 years to repay at a 6% interest rate, the student loan payments after graduation would be about $280 per month. You’d wind up spending more than $33,000 to repay the $25,000 loan. That's going to cost you $15,000 more than if you had put money aside earlier.

Assuming you’ll need more than $25,000 for college, think about how much more your monthly loan payment could be.

The chart below shows a comparison between saving now and borrowing later.

Source: Capital Group. Investment results are hypothetical.

For your child, starting life free of college debt can be a real boost. For you, having more money to put toward your own retirement — instead of paying interest on college loans — can help keep you on track for that important goal. A financial professional can help you prioritize your education and retirement goals.

If you choose to open a 529 savings plan, your money grows free from federal and state taxes while in the account. Those tax-free earnings can really add up and provide you with more cash available to pay college costs. Your 529 savings plan withdrawals will also be free from federal and state tax as long as you use them for qualified education expenses.

If withdrawals are used for purposes other than qualified education expenses, the earnings will be subject to a 10% federal tax penalty in addition to federal and, if applicable, state income tax. States take different approaches to the income tax treatment of withdrawals. For example, withdrawals for K-12 expenses may not be exempt from state tax in certain states.

Parents, grandparents, other family members and friends can contribute to your child’s 529 savings plan, so you don’t have to go it alone when saving for his education.

Clearly, it’s a better deal to save small amounts now rather than pay larger amounts later. As a new parent, saving now for your child’s college education may not feel like a top financial priority. But there are many benefits to starting sooner that can make college planning easier when the time comes.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Investors should carefully consider investment objectives, risks, charges and expenses. This and other important information is contained in the fund prospectuses and summary prospectuses, which can be obtained from a financial professional and should be read carefully before investing.

This material does not constitute legal or tax advice. Investors should consult with their legal or tax advisors.

All Capital Group trademarks mentioned are owned by The Capital Group Companies, Inc., an affiliated company or fund. All other company and product names mentioned are the property of their respective companies.

Use of this website is intended for U.S. residents only.

American Funds Distributors, Inc.

This content, developed by Capital Group, home of American Funds, should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment or fiduciary advice.