Turn plan sponsors into takeover prospects

Winning a takeover plan can be one of the fastest ways to grow your business. To prompt plan sponsors to consider a change, try asking these simple questions and see how we can help you evaluate Form 5500 data.

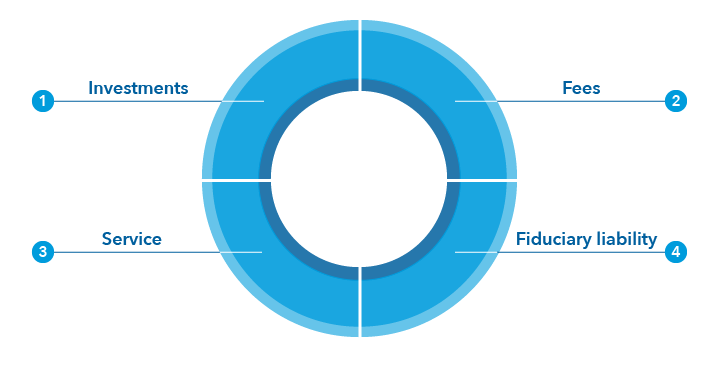

Four common reasons sponsors change plans

1. Ask investments question:

“Does your plan have a quality target date series that focuses on participant outcomes?”

Use our target date brochure to show sponsors the benefits of our series, including quality underlying funds and a distinctive glide path approach. You can also use Target Date ProView® to compare up to four series with Morningstar® data in a client-ready report aligned with DOL guidelines.

2. Ask fees question:

“Do you and your employees fully understand all of your plan fees?”

If the answer is no, we can help you benchmark plan fees with the Retirement Plan Cost Comparison Tool, which generates a report that can help sponsors see if the fees are reasonable and if an American Funds plan might have lower costs.

3. Ask service question:

“On a scale from 1 to 10, how would you rate the level of service that your plan receives?”

If anything but a 10, ask, “What would it take for a 10?” The answer may help you learn what’s most important to the sponsor. Review our employer-sponsored plans to learn about the features and services we can provide sponsors and participants, as well as you, the plan's financial professional.

4. Ask fiduciary liability question:

“Are you concerned about your fiduciary liability as a plan sponsor?”

Many sponsors don’t fully understand what they’re responsible for as a plan fiduciary. Learn what Fiduciary Services Tools and Resources American Funds offers you and sponsors to help satisfy fiduciary obligations.

5. Identify prospects and analyze plans with Form 5500 data

You can use Form 5500 plan data (available at sites such as efast.dol.gov and BrightScope.com) both to identify prospects and to find out more about any you’ve found.

Learn about Leveraging Plan Data From Form 5500 or call your retirement plan counselor or (800) 421-9900 to have us utilize our expanded BrightScope access to interpret and analyze plan data for you. For example, we may be able to point out plan weaknesses that you can address, such as excessive fees, poor participation rates and inadequate investment menus.

Supporting products & solutions

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Investors should carefully consider investment objectives, risks, charges and expenses. This and other important information is contained in the fund prospectuses and summary prospectuses, which can be obtained from a financial professional and should be read carefully before investing.

All Capital Group trademarks mentioned are owned by The Capital Group Companies, Inc., an affiliated company or fund. All other company and product names mentioned are the property of their respective companies.

Use of this website is intended for U.S. residents only. Use of this website and materials is also subject to approval by your home office.

American Funds Distributors, Inc.

This content, developed by Capital Group, home of American Funds, should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment or fiduciary advice.