Election

MARKET VOLATILITY

Guide to current markets and client concerns

Insights, tools and resources from Capital Group to help you support clients and build your business during unsteady markets

Featured

A BETTER APPROACH

Serving our investors

Capital Group wins for Exemplary Stewardship at the 2023 Morningstar Awards for Investing Excellence.*

WEBINAR SERIES

Deep dive on markets

Join our investment team as we examine the forces roiling markets

WEBINAR SERIES

Retirement Plan Tuesdays: Insights for client conversations

Go in depth with the latest practice management, plan design and investment insight topics

INSIGHTS

How to handle market declines

Investors often flee the market during a decline, and buy back in when stocks are skyrocketing. Both can have negative impacts.

*Source: “U.S. Morningstar Awards for Investing Excellence: The 2023 Winners,” Morningstar.com. In March, Capital Group was announced as the winner of the 2023 U.S. Morningstar Exemplary Stewardship Award, recognizing Capital Group for investment and business cultures that prioritize investors' interests above all else. In order to qualify for the award, which is a part of the 2023 U.S. Morningstar Awards for Investing Excellence, all nominees must have received a Parent pillar rating of “High” and remain investor-focused through 2022. Capital Group did not pay to be considered among the award nominees or pay to use the information in this material.

Market insights and analysis

Timely and actionable insights to help you make sense of the markets and guide your investment decisions

-

3 mistakes investors make during election yearsMarch 7, 2024

-

Election

4 things to watch ahead of the U.S. electionsFebruary 8, 2024 -

Economic Indicators

The U.S. avoided recession last year. What comes next?January 4, 2024

Investment results

See our current results for:

Equities

Fixed Income

Target Date

COMPARISON TOOL

How have your investments held up?

Use our tool to compare your investments to their peers, including during volatile periods

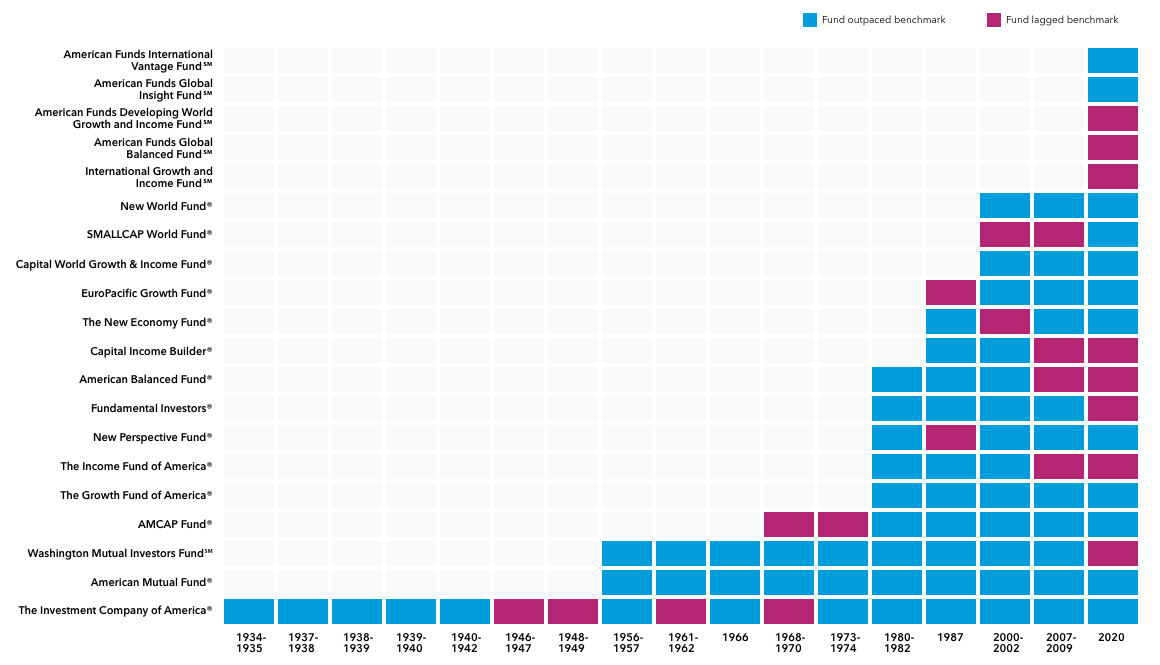

Experience matters

Throughout our history, we've weathered past storms. In fact, our equity-focused funds have outpaced their benchmark indexes during the biggest downturns of the last nine decades.

Across 17 bear markets, the equity-focused American Funds outpaced their benchmarks 77% of the time.

Experience matters

Throughout our history, we've weathered past storms. In fact, our equity-focused funds have outpaced their benchmark indexes during the biggest downturns of the last nine decades.

Across 17 bear markets, the equity-focused American Funds outpaced their benchmarks 77% of the time.

Sources: Capital Group, Morningstar. Class F-2 and R-6 shares with all distributions reinvested. View fund expense ratios and returns.

Dates shown for bear markets are based on price declines of 20% or more (without dividends reinvested) in the unmanaged S&P 500 with at least 50% recovery between declines. Funds shown are the equity-focused American Funds in existence at the time of each decline. Fund and benchmark returns are based on total returns.

Class F-2 shares were first offered on August 1, 2008. Class F-2 share results prior to the date of first sale are hypothetical based on Class A share results without a sales charge, adjusted for estimated annual expenses. The results shown are before taxes on fund distributions and sale of fund shares. Past results are not predictive of results in future periods. Results for other share classes may differ.

Class R-6 shares were first offered on May 1, 2009. Class R-6 share results prior to the date of first sale are hypothetical based on Class A share results without a sales charge, adjusted for typical estimated expenses. Please see the fund’s prospectus for more information on specific expenses.

Benchmark indexes for the funds: S&P 500 (ICA, AMF, WMIF, AMCAP, GFA, FI); MSCI World (NPF, WGI, GIF); 60% S&P 500 / 40% Bloomberg Barclays U.S. Aggregate (AMBAL); 65% S&P 500 / 35% Bloomberg U.S. Aggregate (IFA); 70% MSCI ACWI / 30% Bloomberg Barclays U.S. Aggregate (CIB); S&P 500 prior to the 2020 bear market, MSCI ACWI thereafter (NEF); MSCI EAFE prior to the 2007-09 bear market, MSCI ACWI ex USA thereafter (EUPAC); MSCI ACWI Small Cap (SMALLCAP); MSCI ACWI (NWF); MSCI ACWI ex USA (IGI), 60% MSCI ACWI / 40% Bloomberg Barclays Global Aggregate (GBAL); MSCI Emerging Markets (DWGI); MSCI EAFE (IVE).

Build your practice

Information and resources for client conversations and practice management

Markets and volatility

Move clients from emotion to action

How to have crucial client conversations (article)

Keys to prevailing through market declines

Individual clients (PDF)

The ICA Guide (PDF)

A | F-2 | Quarterly statistical update (PDF)

Retirement plans

Understand market volatility

Plan participants (PDF)

How to handle market declines

Plan participants (PDF)

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Investors should carefully consider investment objectives, risks, charges and expenses. This and other important information is contained in the fund prospectuses and summary prospectuses, which can be obtained from a financial professional and should be read carefully before investing.

All Capital Group trademarks mentioned are owned by The Capital Group Companies, Inc., an affiliated company or fund. All other company and product names mentioned are the property of their respective companies.

Use of this website is intended for U.S. residents only. Use of this website and materials is also subject to approval by your home office.

American Funds Distributors, Inc.

This content, developed by Capital Group, home of American Funds, should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment or fiduciary advice.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.