WHY CHOOSE US?

Model portfolios offer multiple approaches to help clients pursue their investment objectives while freeing you to spend more time cultivating those relationships.

31 years average investment industry experience1

American Funds Model Portfolios received "Gold" Medalist Ratings from Morningstar2

underlying funds were recognized among the Morningstar "Thrilling 30"3

Among the most recognized for third-party models and multi-asset4

Morningstar affirmed the Medalist Ratings in 2023 based on qualitative and quantitative factors which are monitored and reevaluated at least every 14 months. Capital Group paid a licensing fee to publish the ratings data. Capital Group also commissioned A Material Company to conduct a survey of registered financial advisors during Q2 2023, in which respondents were asked to identify leaders in portfolio construction, models, and multi-asset investing.

OUR MODELS

Choose from a diverse suite of models

American Funds active models

Multi-asset solutions that use Capital Group's active mutual funds and ETFs.

Capital Group active-passive models

Multi-manager solutions that combine Capital Group's active funds with passive ETFs from providers such as Vanguard, Blackrock and Schwab.

Quarterly commentary

- Market recaps

- Model strengths and weaknesses

- Quarterly results

Model fact sheets

- Asset mix information

- Fund breakdowns

- Expense ratio comparisons

OUR PROCESS

Model portfolios align with investment objectives

We take client objectives, such as time horizon, risk tolerance, savings or withdrawal expectations, liquidity needs, unexpected expenses and longevity risks, and compare them to our success metrics in an ongoing analysis to determine whether our model portfolios are helping to meet client needs.

-

-

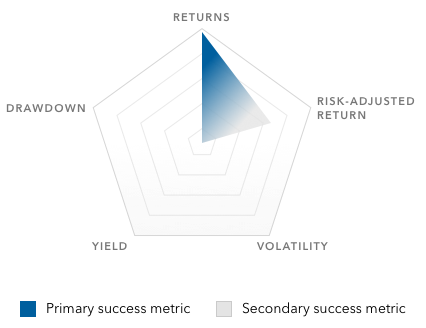

Growth

OBJECTIVE

Long-term growth of capital

PRIMARY SUCCESS METRIC

Returns

Maximum drawdown is a measure of downside risk over a given time period; it is the maximum loss from the highest point to lowest point of (fund/portfolio) returns before a new high point is reached.

Annualized standard deviation (based on monthly returns) is a common measure of absolute volatility that tells how returns over time have varied from the mean. A lower number signifies lower volatility.

-

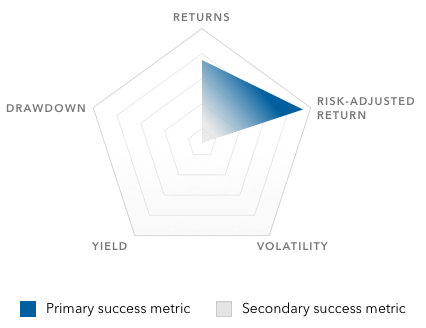

Growth and income

OBJECTIVE

Long-term growth of capital and income

PRIMARY SUCCESS METRIC

Return and risk-adjusted return

Maximum drawdown is a measure of downside risk over a given time period; it is the maximum loss from the highest point to lowest point of (fund/portfolio) returns before a new high point is reached.

Annualized standard deviation (based on monthly returns) is a common measure of absolute volatility that tells how returns over time have varied from the mean. A lower number signifies lower volatility.

-

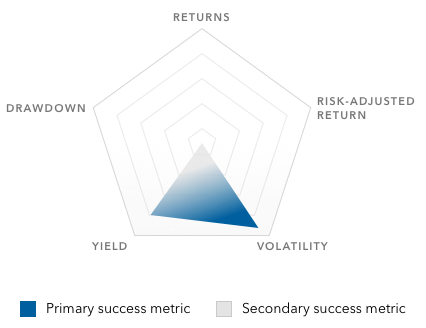

Income

OBJECTIVE

Current income, long-term growth of capital and conservation of capital

PRIMARY SUCCESS METRIC

Volatility and yield

Maximum drawdown is a measure of downside risk over a given time period; it is the maximum loss from the highest point to lowest point of (fund/portfolio) returns before a new high point is reached.

Annualized standard deviation (based on monthly returns) is a common measure of absolute volatility that tells how returns over time have varied from the mean. A lower number signifies lower volatility.

-

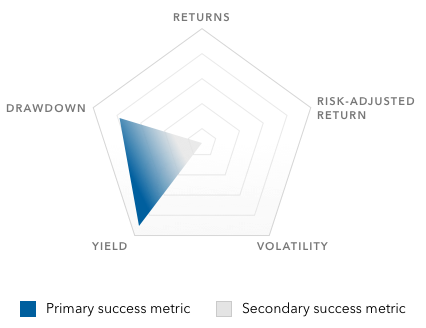

Preservation and income

OBJECTIVE

Current income and capital preservation

PRIMARY SUCCESS METRIC

Yield and drawdown

Maximum drawdown is a measure of downside risk over a given time period; it is the maximum loss from the highest point to lowest point of (fund/portfolio) returns before a new high point is reached.

Annualized standard deviation (based on monthly returns) is a common measure of absolute volatility that tells how returns over time have varied from the mean. A lower number signifies lower volatility.

-

-

-

Key objectives

For each strategy under consideration, we consider several different factors that blend both quantitative and qualitative factors:

Asset class and objective exposure

We seek to identify the key objectives and appropriate asset classes for each model to ensure they align with its designated success metrics.

Diversification

Combining funds which may have different objectives and asset classes to create a diversified approach designed to align with investor risk and return profiles.

Flexibility

Flexibility is key to successful outcomes. We maintain a flexible approach in our models and adjust as necessary.

-

Constant monitoring

We constantly monitor the portfolios

Continuous monitoring

- Returns, risks, asset classes and market capitalization exposures are monitored daily.

- Portfolios have defined asset allocation thresholds and are rebalanced if those thresholds are crossed.

Strategic management

- Flexible strategies in portfolios are a key differentiator and important design component.

- Use of flexible strategies gives portfolio managers the ability to observe investment opportunities in real time coming from underlying portfolio holdings.

Rebalancing

- The Capital Solutions Group (CSG) and its committees monitor individual fund weights daily and at quarter end.

- If an individual underlying fund has crossed a proscribed threshold, the CSG will assess whether to rebalance the portfolio.

-

Resources and quarterly updates

Get the latest information on our model portfolios

Review quarterly commentaries and updates on every American Funds Model Portfolio and easily sign up for regular updates.

Making portfolios personal

Explore insights around portfolio construction and request a consultation with Capital Group's analytics team.

Why Models?

Some of the highest growth advisors in the country are 24% more likely to utilize model portfolios in their practice and spend less time monitoring the markets.†

Stronger client relationships

Financial professionals who have outsourced investment management say it helps deliver stronger client relationships (83%), higher new client acquisition (74%) and increased client retention (82%).

Save time

Advisors who outsourced the majority of their investment management (50% or more) saved an average of 7.9 hours per week — time that can be spent on developing stronger client relationships.

Growth in total AUM

The benefits of outsourcing can be seen with the 91% of advisors who experienced growth in total assets under management.

Source: The Impact of Outsourcing, AssetMark, Inc. 2021

†Source: Pathways to Growth — 2023 Advisor Benchmark Study. Capital Group, partnering with behavior and analytics firm Escalent, conducted a multi-year advisor benchmarking study among a representative total of nearly 3,000 advisors.

Model portfolios are only available through registered investment advisers. This content is intended for registered investment advisers and their clients..

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

1The Capital Group Portfolio Solutions Committee (PSC) are the people who build and oversee the model portfolios. As of December 31, 2022, this group of seven portfolio managers has an average of 31 years of investment industry experience.

2Capital Group has paid Morningstar a licensing fee to access and publish its ratings data. ©2024 Morningstar, Inc. All rights reserved.

The model ratings mentioned above are based on forward-looking qualitative assessments as well as select quantitative data through June 30, 2023 for the core models and September 30, 2023 for the Retirement Income models, respectively. No share classes were directly cited for the ratings upgrades, but Morningstar's reports include mentions of the F-2 share class as examples. Gold medalist ratings (100% analyst-rated) were reaffirmed as of 08/14/2023 for the following model portfolios: American Funds Global Growth Model Portfolio, American Funds Growth Model Portfolio, American Funds Moderate Growth Model Portfolio, American Funds Growth and Income Model Portfolio, American Funds Moderate Growth and Income Model Portfolio, American Funds Conservative Growth and Income Model Portfolio, American Funds Conservative Income Model Portfolio. Gold medalist ratings (100% analyst-rated) were reaffirmed as of 07/25/2023 for the following model portfolios: American Funds Tax Aware Growth and Income Model Portfolio, American Funds Tax Aware Moderate Growth and Income Model Portfolio, American Funds Tax Aware Conservative Growth and Income Model Portfolio. Gold medalist ratings (100% analyst-rated) were reaffirmed as of 07/24/2023 for the following model portfolios: American Funds Tax Aware Moderate Income Model Portfolio, American Funds Tax Aware Conservative Income Model Portfolio. Gold medalist ratings (100% analyst-rated) were upgraded as of 1/16/2024 for the following model portfolios: American Funds Retirement Income Model Portfolio - Enhanced, American Funds Retirement Income Model Portfolio – Moderate, American Funds Retirement Income Model Portfolio – Conservative.

The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. The Morningstar Medalist Rating™ is the summary expression of Morningstar’s forward-looking analysis of investment strategies as offered via specific vehicles using a rating scale of Gold, Silver, Bronze, Neutral, and Negative. The Medalist Ratings indicate which investments Morningstar believes are likely to outperform a relevant index or peer group average on a risk-adjusted basis over time. Investment products are evaluated on three key pillars (People, Parent, and Process) which, when coupled with a fee assessment, forms the basis for Morningstar’s conviction in those products’ investment merits and determines the Medalist Rating they’re assigned. Pillar ratings take the form of Low, Below Average, Average, Above Average, and High. Pillars may be evaluated via an analyst’s qualitative assessment (either directly to a vehicle the analyst covers or indirectly when the pillar ratings of a covered vehicle are mapped to a related uncovered vehicle) or using algorithmic techniques. Vehicles are sorted by their expected performance into rating groups defined by their Morningstar Category and their active or passive status. When analysts directly cover a vehicle, they assign the three pillar ratings based on their qualitative assessment, subject to the oversight of the Analyst Rating Committee, and monitor and reevaluate them at least every 14 months. When the vehicles are covered either indirectly by analysts or by algorithm, the ratings are assigned monthly. For more detailed information about these ratings, including their methodology, please go to global.morningstar.com/managerdisclosures/. The Morningstar Medalist Ratings are not statements of fact, nor are they credit or risk ratings. The Morningstar Medalist Rating (i) should not be used as the sole basis in evaluating an investment product, (ii) involves unknown risks and uncertainties which may cause expectations not to occur or to differ significantly from what was expected, (iii) are not guaranteed to be based on complete or accurate assumptions or models when determined algorithmically, (iv) involve the risk that the return target will not be met due to such things as unforeseen changes in management, technology, economic development, interest rate development, operating and/or material costs, competitive pressure, supervisory law, exchange rate, tax rates, exchange rate changes, and/or changes in political and social conditions, and (v) should not be considered an offer or solicitation to buy or sell the investment product. A change in the fundamental factors underlying the Morningstar Medalist Rating can mean that the rating is subsequently no longer accurate.

3Source: Morningstar, "The Thrilling 30" by Russel Kinnel, September 2023. Morningstar`s screening took into consideration expense ratios, manager ownership, returns over manager`s tenure, and Morningstar Risk, Medallist and Parent ratings. The universe was limited to share classes accessible to individual investors with a minimum investment no greater than $50,000 and did not include funds of funds. Class A shares were evaluated for American Funds. Visit morningstar.com for more details. The funds named to the list were American Balanced Fund, American Mutual Fund, Capital Income Builder, The Growth Fund of America, The Income Fund of America, The New Economy Fund and New Perspective Fund. Not all funds are in all models or portfolio strategies.

4Source: Capital Group/American Funds Brand health data source: Brand Health Survey, LRW | A Material Company (2Q, 2023). 714 registered financial advisors, with an active book of business of at least $10 million, participated in a web survey conducted from April 2023 to June 2023. The respondents included a group of Capital Group clients as well as prospects; in this second-quarter survey, the respondents who use models and portfolio construction consultation services were asked to identify leaders in portfolio construction consultation services, third-party model portfolios and multi-asset investing. The survey base for these questions included 429 model users and 203 financial professionals who used portfolio construction consultation services. Capital Group commissioned research vendor Material to conduct this anonymous study.

Model portfolios are provided to financial intermediaries who may or may not recommend them to clients. The portfolios consist of an allocation of funds for investors to consider and are not intended to be investment recommendations. The portfolios are asset allocations designed for individuals with different time horizons, investment objectives and risk profiles. Allocations may change and may not achieve investment objectives. If a cash allocation is not reflected in a model, the intermediary may choose to add one. Capital Group does not have investment discretion or authority over investment allocations in client accounts. Rebalancing approaches may differ depending on where the account is held. Investors should talk to their financial professional for information on other investment alternatives that may be available. In making investment decisions, investors should consider their other assets, income and investments. Visit capitalgroup.com for current allocations.

Figures shown are past results and are not predictive of results in future periods.

Model portfolios are subject to the risks associated with the underlying funds in the model portfolio. Investors should carefully consider investment objectives, risks, fees and expenses of the funds in the model portfolio, which are contained in the fund prospectuses. Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility. These risks may be heightened in connection with investments in developing countries. Small-company stocks entail additional risks, and they can fluctuate in price more than larger company stocks. The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds. The use of derivatives involves a variety of risks, which may be different from, or greater than, the risks associated with investing in traditional securities, such as stocks and bonds. A nondiversified fund has the ability to invest a larger percentage of assets in securities of individual issuers than a diversified fund. As a result, a single issuer could adversely affect a nondiversified fund’s results more than if the fund invested a smaller percentage of assets in securities of that issuer. See the applicable prospectus for details.

All Capital Group trademarks mentioned are owned by The Capital Group Companies, Inc., an affiliated company or fund. All other company and product names mentioned are the property of their respective companies.

©2023 Morningstar, Inc. All Rights Reserved. Except for Lipper rating information, the information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar, its content providers nor Capital Group are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. Information is calculated by Morningstar. Due to differing calculation methods, the figures shown here may differ from those calculated by Capital Group.

Use of this website is intended for U.S. residents only.

This content, developed by Capital Group, home of American Funds, should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment or fiduciary advice.