NEWEST INSIGHT

3 ways annuities can help accumulate assets

Annuities as an accumulation strategy

Latest insights

Focus on retirement

Shareable thoughts from our Senior Retirement Income Strategist Kate Beattie

Tools

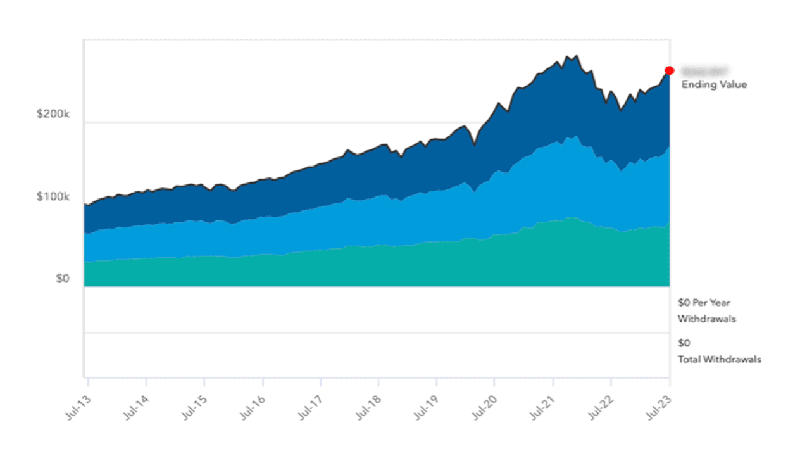

Visualize outcomes

Hypothetical calculators for impactful conversations

INSURANCE SERIES FUNDS

Build portfolios to scale

As one of America's largest variable annuity asset managers,* we offer a core 18 insurance-dedicated funds — 11 of which are aligned with their retail American Funds mutual fund counterparts.

*Source: ISS Market Intelligence Simfund, as of 12/31/23. Variable annuities not including fixed accounts.

†Our aligned funds share identical investment objectives, portfolio manager teams and management expenses to their retail counterparts.

INSURANCE PARTNERS

One of the first

Capital Group was one of the first in the industry to offer funds exclusively to insurance companies. Contact us through the over 40 firms we work for:

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Investors should carefully consider investment objectives, risks, charges and expenses. This and other important information is contained in the fund prospectuses and summary prospectuses, which can be obtained from a financial professional and should be read carefully before investing.

All Capital Group trademarks mentioned are owned by The Capital Group Companies, Inc., an affiliated company or fund. All other company and product names mentioned are the property of their respective companies.

Use of this website is intended for U.S. residents only. Use of this website and materials is also subject to approval by your home office.

American Funds Insurance Series serves as an underlying investment option for multiple insurance products, including variable annuity contracts and variable life insurance policies. Availability of funds will vary based on the insurance contract offered.

American Funds Distributors, Inc.

This content, developed by Capital Group, home of American Funds, should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment or fiduciary advice.

Variable annuities may impose a variety of fees that may affect the growth of your client's portfolio. Variable annuities have investment and/or withdrawal limitation requirements. Early withdrawals may incur a fee. Guarantees are subject to the claims-paying ability of the issuing insurance company.

American Funds Insurance Series serves as an underlying investment option for multiple insurance products, including variable annuity contracts and variable life insurance policies. Availability of funds will vary based on the insurance contract offered.