Marketing & Client Acquisition

15 MIN VIDEO

As a financial professional, much of your career is built on people skills. You may be great at networking, well-known in local markets, and at your best when face-to-face with clients and prospective investors. Increasingly, however, it’s just as important to excel at those skills on a digital level. Today, you are expected to service clients in the digital space, and you must meet them there as well.

One easy tool to explore digital branding, referrals and prospecting is LinkedIn. High net worth individuals are more highly engaged than average users of the social media platform — they boast two times the connections, are 102% more likely to share information, and are 84% more reachable via the InMail messaging system. Yet, more than two-thirds of the high net worth individuals on LinkedIn are still not connected to a financial advisor or wealth manager*.

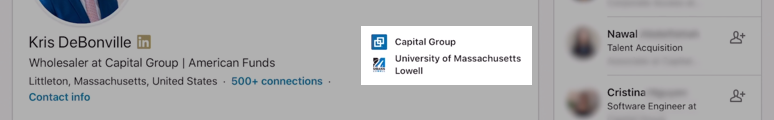

“In an environment where it’s getting harder to acquire new clients and assets, many advisors are attributing business growth to activity on social media,” says Kris DeBonville, a wealth management consultant with Capital Group.

Of course, how you use the platform will depend on your firm’s compliance department and its guidelines on using social media. Before taking any steps, you should verify that these actions fall under the rules of your organization.

Here are three ways to master LinkedIn to maximize your personal profile, identify new prospects and extend your current book of business by connecting to the next generation of clients.

1. Maximize your professional profile

A LinkedIn page may look and feel like other types of social media sites, but its purpose is very different. How you are represented can impact the centers of influence you attract. It helps to think of the platform primarily as a branding tool for yourself and your business. Here are a few ways to put your most professional foot forward:

- Photos. If you are looking to prospect on LinkedIn, you should have a profile photo and a cover photo on your profile page. The cover may be generic — summer at the Cape, the slopes in Aspen — or include specific signage, branding or images of significance. Because this is a professional page, avoid photos of family and friends.

- Profile name. Your user profile name on LinkedIn should be the same name used on all of your professional communications, including your business card, email and website bio. If you go by a nickname or name different from your birth name, use that. “I once ran into an advisor who used the name Seamus, but his legal name was James,” DeBonville says. “He had the name James on his LinkedIn profile, but clients weren’t finding him, because they were looking for Seamus.”

- Title. Advisors use a variety of terms to describe themselves: CFP practitioner, private wealth manager, retirement specialist and so on. The problem is, someone searching for financial advice may not understand what a vice president of financial services does. “Whatever you call yourself,” DeBonville says, “if you are registered as an investment advisor, your profile should include the term ‘financial advisor.’” Note, however, that use of the term must comply with the Securities and Exchange Commission’s Regulation Best Interest.

- Credentials. Licenses, designations, skills and education are crucial elements to include on your profile page. They tell your story, and they also tend to attract the eyes of investors. You can also use the platform’s tools to get specific about personal interests, alumni organizations and affinity groups, which can help you create your own unique centers of influence.

- Bio. If you think of LinkedIn as a digital calling card, it makes sense that your profile would provide as much information as possible. A bio or “about me” is essential, but you don’t need to overthink it. Keep it short and sweet, written in first person. This is also a great spot to include any disclosures required by your firm.

Another important tip: Try to limit connections to other financial advisors. While LinkedIn may seem like a great place to share professional ideas and keep up with peers, it’s also a great place for others in your network to see your connections. In some cases, users may even be able to see full contact information and can treat your connections like their own digital Rolodex. To be sure, this is exactly what the platform is designed for, but it’s a reminder to use discretion when building your own network on the site.

2. Identify new business prospects

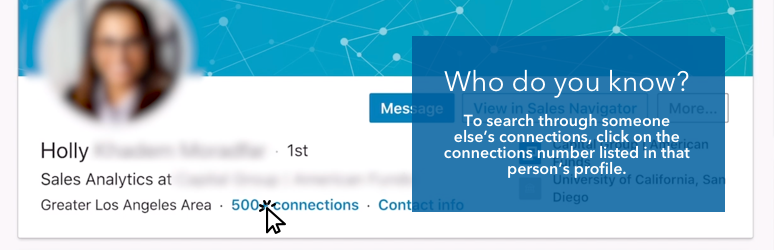

There are a few ways to search for potential client acquisitions on LinkedIn. Connecting with existing clients on the platform and asking for introductions is one of the most powerful strategies, but how you do this is important. More than seven out of 10 high net worth investors say they become uncomfortable when asked for general referrals. On the other hand, a similar percentage of investors say they are more than happy to introduce you to specific people they know if asked**. The distinction may seem minor, but asking “who do you know?” means the investor has to figure out which introductions would be best.

This is where the social network can help. The connections feature allows you to view a client’s connections and use filters to identify the types of candidates you want to find. Once you have a specific person in mind, it’s much easier to ask for an introduction. Here’s how:

- Hone your search. Say you have a favorite client — the kind you wish they all were like. You can search within that client’s network for similar characteristics. For example, you can search for the client’s company to see coworkers who may have similar profiles. You can then filter by location and only see people in your geographic area. This will give you a smaller number of potential profiles to view and consider.

- Export and save potential client profiles. If you select “More” to the right of a person’s profile photo, you can click “Save to PDF.” This extracts all of the information from that person’s profile, which you can download and save. This creates a resource you can pull from the next time you meet with your client. You can say: “I saw a few people I’d like to meet. How do you know this person, and can you connect me? Can I mention that you and I have worked together in the past?” With a few simple searches, you are now hand-picking referrals rather than asking.

- Generate targeted lists. Once you become familiar with using filters, you can create lists according to the criteria that you choose. For example, if you believe targeting business owners in this environment may be a great opportunity, you can search by the term “owner.” But that type of term may give you too many results. To drill down further, the “All Filters” screen will allow you to customize in many different ways:

- Focus on second-degree connections — people you don’t know but who are connected to your first-degree connections.

- Pay attention to location. You can search for people in your greater region or local neighborhood.

- Find your niche. If you have experience working in a certain industry or a certain type of profession, you can search using those filters as well. You can even search within this search to find further affinities, like an alma mater or common interest, within a group. The best part is, once you set these filters, you can get LinkedIn to send you an email when it finds new people that meet your criteria.

Build a better client list

A variety of filters let searchers on LinkedIn get very specific.

For those who use LinkedIn regularly, the Sales Navigator tool can be a powerful addition. Users pay a fee for access, but it can allow you to filter even further and see information on third-degree connections.

“You can utilize sales navigator doing the same things as the free version, but it will give you much more information and may open the door to other connections,” DeBonville says.

3. Make next-generation connections

Many financial professionals will respond to this tutorial with a shrug, saying, “My best clients are too old for social media. They aren’t on LinkedIn.” While that may be true, the people most important to that client — a spouse and children — could be very active on the network. You can use LinkedIn to create or deepen relationships with those people as well.

“It’s very natural to connect to a client’s friends and family members as a way to expand your network,” DeBonville says. But you can also use those connections to expand centers of influence within your current book of business.

Here is language you can use: “I’d like to connect with X on LinkedIn, if you don’t mind. LinkedIn is like Facebook for business networking, and I want to connect so they recognize me. If something happens to you, I want them to be aware of our relationship. I will let them know we work together but won’t disclose any details. They can utilize me as a resource, even if they aren’t a client.” This helps you build a network of the next generation in a noninvasive way.

To get results, perhaps the most important tip is to make LinkedIn a habit. “Some advisors say, ‘This sounds great, maybe I’ll try it.’ Then they try it a little and give up, because it doesn’t yield results,” DeBonville says. Think of it like a diet: If you don’t do it consistently, it won’t work. To get the desired results, try to block a half hour to an hour every week to commit to your LinkedIn prospecting.

Related content

-

Client Acquisition

-

Marketing & Client Acquisition

Advisor Benchmark Study: Pathways to Growth

* LinkedIn 2020. High net worth individuals are defined as Chief Executive/Partner/Owner level in companies with 200+ employees, and VP+ level in companies with 1,000+ employees, except in the finance industry, where VP titles are excluded. They are compared to the average LinkedIn U.S. user.

**Oechsli Institute, “Best Practices of Today’s Elite Advisors,” 2019