Client Conversations

10 MIN READ

Business owners often spend years, if not decades, growing their businesses, but can decide to sell rather abruptly. Financial professionals who work with them too often focus on opportunities that arise after the sale: the investment of the proceeds. Both approaches are short-sighted and are fertile ground for missed opportunities.

Maximizing the client’s goal of a sale requires a robust effort, much like the planning that went into building the business. And an engaged advisor can help those clients prepare to enhance the business’s value, minimize taxes and understand the emotional aspects that come with this next phase of their personal and professional lives.

Serving business owners also presents a growing opportunity. There are currently about 31 million small businesses in the U.S., and many of them will transition to new ownership in the next decade as part of one of the largest waves of wealth transfer in U.S. history, according to the U.S. Small Business Administration. Each of those business owners could benefit from expert advice to help them navigate the journey to an eventual exit, and after.

How you should approach the business transition conversation, of course, depends on where both the client and her business are in their lives. But there are steps you can take at each of those stages. “Start the conversation from the first meeting with a client,” says Jeffrey Brooks, a Capital Group wealth strategist. “You can never do it too soon, but you can wait too long.”

Step 1: Get the client’s finances ready

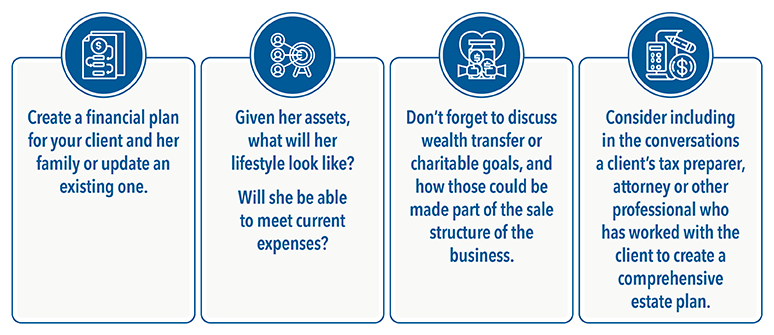

First, address the client’s personal finances. “You can’t create a business succession plan without a clear understanding of your client’s lifestyle costs today, as well as their goals for tomorrow,” Brooks says. “Once you and the client understand the retirement inheritance and charitable goals, you can then assess the business and how its sale or transition can fund those aspects of their lives.”

Once the plan is created, ask clients to share their vision of what retirement looks like. Does she want to completely walk away with the proceeds from a sale? Or does she want to work part time or as a consultant to receive a steady income post-exit, either at her former company or elsewhere? What, if any, are her charitable causes? Does she intend to provide for others in her estate plan?

The answers to those questions can impact a business succession plan. For example, if the business owner plans to continue working part time, it could reduce the total amount she might require in the actual sale of the business from a cash flow standpoint.

Step 2: Get the business ready

Creating an owner’s financial plan is one opportunity for a financial professional to engage presale with business owner clients and, ultimately, participate in the sale process. Another opportunity is to help clients understand how much the business is worth and whether the proceeds are sufficient to meet their retirement, philanthropic and wealth transfer needs.

“We do this upfront,” says Abby Spaulding, founder at Continuum Planner Partners in Nashville. “If a business has sustainable and recurring cash flow, even if it’s a new business, it’s time to do a valuation.”

This informal “valuation,” as she calls it, takes a look at general company metrics — for example, trends in cash flow. Continuum licenses software from BizEquity to run the analysis. “How sticky is the business? Are sales from first-time customers only, or does the business have five-year contracts?” she says. A third-party valuation helps to manage the business owner’s expectations of a realistic sale price.

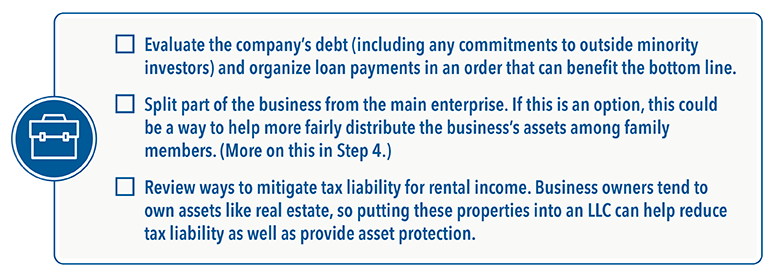

With a valuation in hand, look for ways to maximize the business’s value. Some of these tactics include:

This process can also be beneficial for clients who need to find ways to increase savings while they are still running their business. Consultants, for example, often have practices that aren’t “sellable,” since they themselves are the business. Maximizing income along the way to an exit can enable them to be less reliant on the final sale price to fund their goals.

Lastly, you can also help owners think strategically about another key aspect of the business: employees. Essential employees in the management ranks may start to look for other opportunities if they see an exit is on the horizon. That could negatively impact the business’s performance and its sale value. “Give them an incentive to stay,” Spaulding says. “Write an exit bonus into the operating agreement for the company. If there is a buyout, let them participate with phantom stock.”

Step 3: Get the sale details ready

Don’t wait to begin to work out a client’s preferred deal structure. Begin this process 18 months to a year before a client wants to exit the business.

Find a valuation specialist

Unlike the informal valuation discussed in Step 2, this is the time to recommend a formal, professional, third-party valuation. Large companies especially rely on business valuation firms like consultancies Duff & Phelps or BDO for a deep dive into finances, comparing the company to peers in its industry and geographic market. Small-business owners can do the same through a business appraisal service or experienced accountancy firm. (Spaulding has used NowCFO.) It’s akin to an ostensibly healthy body going to a doctor for a complete physical, where blood, hormones and physical fitness are measured, evaluated and contextualized.

Yes, the company could have what is considered to be good cash flow. But how does that compare to company averages in the industry or area? An underlying operational issue or customer trend that could depress profitability might be undetected. An evaluation by an expert can help know for certain, and offer a strategy to shore up any weaknesses before the business goes on the market.

These reviews are not cheap, and you may get pushback from clients. “There can be some ‘penny-wise and pound-foolish’ reaction, but this is crucial to getting the most value out of a sale,” Spaulding says.

Know the terms

Knowing the business’s value also comes in handy when agreeing to specific deal terms in the sale. Typically, outside buyers want an earnout, a part of the selling agreement that enables a buyer to pay a portion of the sale price through future business proceeds instead of at the time of sale. If the business is worth more than what the client needs for retirement (or what the industry average is), that gives her leverage to refuse or reduce earnouts in a sales contract.

With earnouts, there’s always concern regarding the new owner’s ability to grow the business and make payments, Spaulding says.

Think about tax strategy

Income and estate taxes should both be considered when structuring the terms of a sale, including:

- Stock-for-stock transactions: Consider deferring realized gains and, therefore, taxes.

- Qualified small-business stock treatment: Gains up to $10 million may be exempt from tax.

- Sale to an employee stock ownership plan: Defer capital gains taxes by rolling over proceeds into qualified replacement property.

- Bargain sales to family: See Step 4 for more.

- Qualified opportunity zones: Defer capital gains tax by investing sale proceeds into qualified opportunity zone investments.

- Structured philanthropy: Charitable remainder trusts, donor-advised funds and similar options can be used to defer and/or lower the tax burden post-sale.

(Other tax tips from the SBA can be found here.)

Don’t forget the “fun money”

It’s natural for clients to want to celebrate, and you can help prepare for that, too. “I tell the clients, ‘We know you’re going to do it, so here’s $250,000 in fun money,’” she says. “’Go on a fabulous vacation; buy a boat.’“

Step 4: When the buyer is family

Business owners may prefer to sell a business to children or grandchildren. The challenge can be creating a subsequent estate plan to distribute assets that’s fair to heirs that want to run the business and those that don’t.

“Fair is not equal, and equal is not fair,” Spaulding says. She recalls working with a client who wanted to equalize the inheritance with an insurance policy for the child who would not own the business. But that plan would give one child a million-dollar payment, and the other the responsibility of a business to run but no cash.

You can help business owner clients identify ways to make that transaction fair in practice and not just on paper. Consider providing the latter child an additional asset, such as ownership of real estate that is producing some cash flow. “This is not looking at things on a dollar-for-dollar basis,” she adds.

When the children are buying the business, business owners may also choose to provide favorable terms in the sales agreement, such as stretching any earnout payments over a longer time frame — a potential solution, as long as the client can afford to delay full payment of the sale.

Business owners also should be aware that if they decide to hand over the shares below market value or for nothing, that could be considered a gift and subject to capital gains taxes beyond the lifetime gift exemption under the Tax Cuts and Jobs Act ($11.7 million in 2021), and decrease the amount available to apply to transfers at death. Work with a client’s tax preparers or attorneys to walk clients through these scenarios should they want to go this route.

Apart from family, clients may consider other types of buyers:

Step 5: Get the clients psychologically and emotionally ready

Remember that transition planning is about more than numbers, and part of the value you can add is in helping to create a smooth path for clients in this next stage of their lives — whether it’s retirement or a new endeavor. Talk to them about their personal goals. What do they want to do with this newfound time? Are they interested in pursuing other business opportunities? Volunteering?

You can help clients navigate these decisions by creating a “next stage” advisory board of sorts aimed at helping clients map out this new phase.

Of course, business succession plans are living documents, designed to change as priorities and circumstances do. But starting the planning process well before a business owner wants to sell can help lay the groundwork for a successful transition, both in business and for the client personally.

“Planning involves knowing two points: where you are now, and where you want to end up,” Brooks says. “You don’t plan a vacation by going to the airport and then figure out where you’re going to go. Your vacation spot may be a short drive away.”

1U.S. PE Breakdown Q1 2021, Pitchbook

Advisor Benchmark Study: Pathways to Growth

Related content

-

Marketing & Client Acquisition

-

Tax & Estate Planning