Life Events

7 MIN ARTICLE

Clients with elderly parents are usually aware they should be doing something to protect their parents and themselves; they’re just not sure what. As an advisor, you can help them identify the right questions to ask to help secure a parent’s finances and legacy.

KEY TAKEAWAYS

- Help clients understand different types of capacity and how to plan for incapacity

- Learn the essential questions to ask about an elderly parent’s estate plan

- Find out about measures that can be taken to help the parents qualify for federal or state benefits

With people living longer, adult children are often asked to act as coordinators and managers of an elderly parent’s care. If you work with clients who are caring for elderly parents or loved ones, you may be able to help. Although physical care should be the primary concern, managing and protecting finances is a close second. An outdated estate plan, a financial agent with improper motives, a successor trustee verging on incapacity — these are just a few of the potential missteps when it comes to elder financial care. And any one of them could lead to family strife.

One common issue involves children doing all they can to arrange 24-hour nursing care for an ailing parent, yet failing to secure their own financial well-being in the same way. Then there are the scenarios in which the hired caregiver becomes a confidant, and the parent amends an estate plan to name the caregiver as agent, fiduciary and beneficiary in the estate plan documents. After the parent dies, the caregiver and child become locked in an expensive dispute over the validity of the documents.

A well-constructed estate plan can help prevent these types of surprises. If you have clients caring for elderly parents, helping those clients think through the components of their parents’ estate plans can focus their attention on the relevant decisions and spur them into action by raising important and time sensitive considerations to discuss with an estate planning attorney or tax professional. What’s more, these questions can help clients plan for their own needs in the future.

Does the elderly parent have capacity?

There are two main types of capacity:

- Testamentary capacity: the ability to make a will or trust.

- Contractual capacity: the ability to enter into contracts.

Each state has its own interpretation of capacity and the distinction between the two. In general, the mental capacity required to enter into contracts is higher than the mental capacity required to make a will or trust.

The practical consequence of testamentary incapacity is that an individual can no longer make or modify a will or trust. For contractual incapacity, the consequence is the inability to enter into contracts. In other words, if an individual enters into a contract while she is incapacitated, her rights and obligations under the contract may not be enforceable.

Most individuals do not recognize when they themselves reach the point of incapacity. This can lead to a whole host of financial problems, ranging from not paying bills on time to becoming a target for bad actors or undue influence. Accordingly, it’s up to an individual’s family members to recognize the signs of incapacity, and to take the appropriate actions to have the declaration of incapacity made official and a conservator or guardian appointed by the court. A client who thinks a parent could be incapacitated should contact an estate planning or elder law attorney in the state where the parent resides.

Is there a plan for incapacity?

There are several steps that can be taken to help ensure the safety of the parents and the security of their financial affairs through incapacity.

- Have a durable financial power of attorney and health care directive in place and up to date. In these documents, an individual appoints an agent to make decisions on her behalf if she is incapacitated. Under a financial power of attorney, the agent has the authority to make certain financial decisions on behalf of the individual; under the health care directive, the agent has the authority to make health care decisions on behalf of the individual. For the financial power of attorney to remain effective through incapacity, it must be a “durable” power of attorney. In addition to naming an agent for health care matters, the health care directive should include a living will, in which the individual makes known her end-of-life wishes.

- Integrate a revocable trust into the estate plan. The beauty of a properly funded and structured revocable trust is that it can accomplish the transition of control upon incapacity without any judicial proceeding, change of ownership or even the use of a financial power of attorney. Upon the incapacity of a grantor of a revocable trust (assuming the grantor is also serving as trustee), the person named as successor trustee will automatically assume control of the trust and all of the assets held within the trust.

- Review successor fiduciary/agent appointments in all estate planning documents. This is essential if the client’s parents are close in age, and if they have named each other as fiduciaries/agents in their wills, living trusts and powers of attorney. There may be a circumstance where both parents die or become incapacitated around the same time, so it is important for the continuity of control that successor fiduciaries and agents are appointed in the estate planning documents. It may even make sense for the parent to resign now, while he still has capacity, and have the successor trustee take over the administration and management of the trust.

Does the estate plan reflect the elderly parent’s current wishes?

If a significant amount of time has passed since the client’s parents last reviewed their estate planning documents, a lot may have changed from a family and financial perspective. Take the time to review the parents’ beneficiaries, fiduciary succession and the terms of any continuing trusts. Furthermore, in certain circumstances, it may also make sense for the parents to consider certain gifting strategies, with the intent of depleting the parents’ taxable estate.

Any gift planning requires the advice of an estate planning attorney or other professional advisor, but if time is of the essence (as it can be when dealing with elderly individuals), there are some easy gifting strategies to implement:

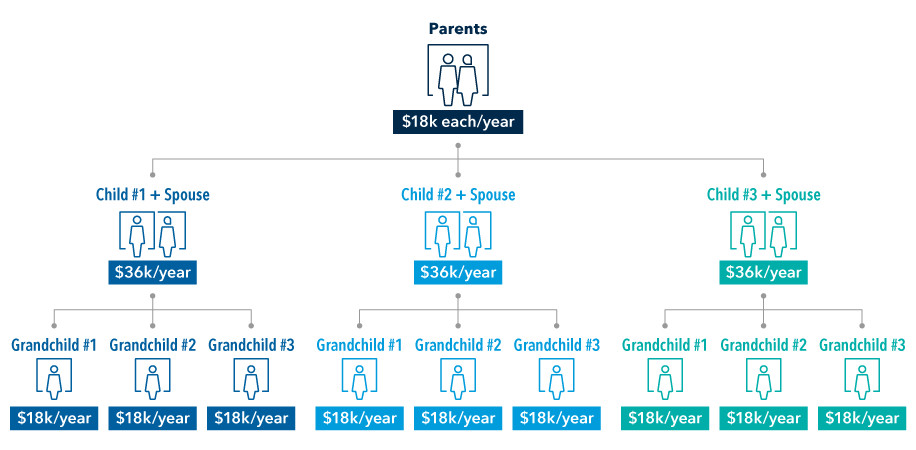

- Annual exclusion gifts. Depending on how many children, grandchildren and other potential beneficiaries the parents may have, this technique can have a serious impact. Each year, an individual can give $18,000 each to as many people as he likes, without cutting into his lifetime exemption (this means married couples can give $36,000 each year). If the parents have three children (including the client), and each of these children has a spouse and three children, two years of annual exclusion gifts to all of these individuals will remove more than $900,000 from the parents’ taxable estate.

The gift of annual exclusion gifts

Source: IRS.gov as of 9/30/2023, representing 2024 limits.

- Paying tuition and medical expenses directly. The payment of tuition and medical expenses directly to a school or medical provider — as long as certain very strict requirements are met — is not considered a taxable gift. With the cost of private school education and college today, this can be an impactful way to benefit younger generations. One way to supercharge this technique is to prepay future tuition to certain institutions where beneficiaries will be attending school for several years. To qualify, these prepayments cannot be refundable under any circumstances.

Should the parents be replaced as current trustees?

Even if the parents are still firmly in the realm of capacity, it may make sense for the client (or another family member) to replace her parents as trustee of their revocable trust at the current time. As described earlier, the trustee has authority over all of the assets held in the trust, so even if the client’s parents become incapacitated, the trustee’s authority over the assets will not be affected.

Does the client’s estate plan need to account for the parents?

If the client has been paying for any portion of her parents’ care or living expenses, or envisions a circumstance where that may become the case, the client should review her estate planning documents to ensure that these arrangements will continue if the client ends up predeceasing her parents.

Can measures be taken to help the parents qualify for federal or state benefits?

Depending on the financial situation of the client’s parents, they may qualify for state or federal benefits like Medicaid. If your client is supporting parents, the support should be structured so as not to disqualify her parents from these benefits. This is often achieved through the use of special needs trusts or Medicaid-qualifying trusts. It may also make sense to restructure the parents’ assets (through gifting or trust structures) to strike a balance between continuing qualification for benefits and preserving lifestyle and legacy. An attorney that specializes in elder law is the expert of choice for these types of inquiries.

The reversal of the caregiver dynamic between parent and child is a significant transition, and it can be a difficult one for your clients to navigate. As a result, although you are a trusted confidant to your clients, they may not always share when this transition has begun in their own lives. Reaching out to remind your clients how to protect themselves and the loved ones that depend on them is always a welcome gesture and a great way to start the conversation.

Caregiver checklist

Having conversations with clients who are caring for an elderly parent? This checklist can help you cover the estate planning essentials or download our Aging parents: Discussion checklist to use with clients.

STEP 1: Capacity

STEP 2: Estate plan review

STEP 3: Transition of care planning

STEP 4: Other considerations