Retirement Income

Retirement Income

- For investors seeking to accumulate assets, variable annuities can provide a powerful platform for investments to grow and compound over time.

- Variable annuities can serve as a practical tool for legacy planning, allowing for the designation of beneficiaries and the ability to pass on assets efficiently.

- Professional asset management within variable annuities can enhance the accumulation process through active management designed to maximize returns.

While variable annuities are commonly associated with generating protected lifetime income, they can also prove valuable to investors seeking to accumulate assets by offering tax advantages, growth potential with professional management, and legacy planning benefits.

Now, let’s delve into these key points to understand how variable annuities can be a valuable tool for asset accumulation.

Long-term, tax deferred investment growth has its advantages: Investments that combine the compound growth of earnings with the benefits of tax deferral can substantially add to a person’s wealth over time. Many investors experience this in their IRAs and/or employer sponsored retirement plans, where compounding can gradually make an impactful difference to an investor’s overall retirement portfolio. Variable annuities are also tax-deferred – delaying the recognition of investment earnings for income tax purposes and providing the potential for substantial tax-deferred growth over time; even after the extra costs of these vehicles are considered.

With variable annuities, investors can also have more control over the timing of their withdrawals. This can benefit those with higher current tax liabilities and/or higher returns. Typically, the longer a person’s money can be invested, the greater the benefit can be from tax deferral and compounding.

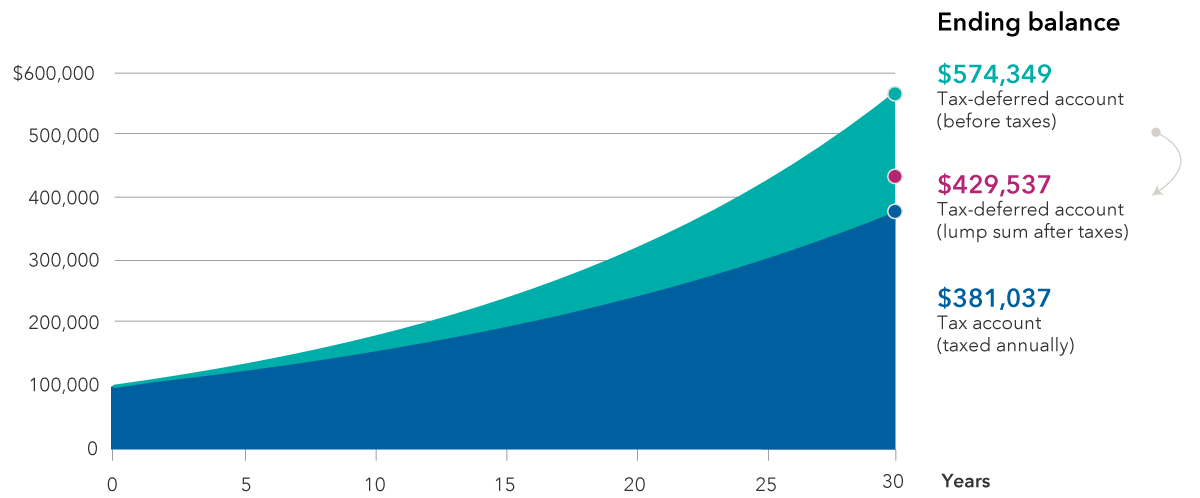

Taxable vs. tax-deferred investing over a 30-year time frame

Hypothetical growth of $100,000 for a household in the 24% tax bracket

Sources: Capital Group, Dinkytown.net financial calculators, 11/2/23. Hypothetical results are for illustrative purposes only and in no way represent the actual results of a specific investment.

This hypothetical assumes both accounts have an initial investment of $100,000 over a 30-year time frame and a 6% annual rate of return. The taxable account is assumed to be a non-qualified account with tax applied annually to realized short-term gains (that is, on investments held for less than a year) at a 24% marginal income tax rate. Tax-deferred accounts such as annuities do not have tax applied until distribution, even to realized gains. Tax is assumed to apply to the tax-deferred lump sum distribution at a roughly 25% effective tax rate, based on the 2023 IRS tax brackets.

An investor’s personal investment horizon and income tax bracket, both current and anticipated, may further impact the comparison. Withdrawals prior to age 59-1/2 on qualified accounts may be subject to a 10% federal penalty. This material does not constitute legal or tax advice. Investors should consult with their legal or tax advisors.

The power of legacy protection: The combination of growth and tax deferral can be a beneficial strategy for the gradual accumulation of a substantial legacy. But how do you protect that legacy? Many variable annuities offer a variety of death benefit options, some for an additional cost. These options not only allow for investors to remain invested for growth opportunities but can also provide an additional layer of legacy protection. Annuity death benefits can often bypass the probate process, allowing proceeds to pass directly to designated beneficiaries. This streamlined transfer of wealth can help investors avoid delays and potential estate expenses.

The power of professional management: Many variable annuities offer professional asset management that provides investors with access to a team of experienced portfolio managers who can craft well-informed strategies and help optimize asset allocation. This experience can potentially boost returns and bolster risk management. Additionally, many variable annuities offer diversification across a spectrum of asset classes to allow portfolio customization that aligns with their risk tolerance and financial goals.

Unlike many other investment vehicles, variable annuities permit switching between investment options within the annuity without triggering immediate tax consequences. This access and flexibility can be a powerful tool for many investors seeking wealth accumulation and preservation.

Consider the American Funds Insurance Series® as a part of your accumulation strategy

Since 1984, the American Funds Insurance Series (AFIS) has remained dedicated to enhancing investor outcomes and achieving their objectives. Our AFIS funds offer a proven track record for investments with a variety of objectives and are available at an insurer near you.

For over 90 years, Capital Group, home of American Funds, has applied a consistent philosophy and consistent approach to generate consistent outcomes. With $2.5 trillion in assets under management,1 it is one of the asset managers most trusted by financial professionals.2

Our funds employ The Capital SystemTM, combining independent, high-conviction decision-making with the diversity that comes from multiple perspectives. In combination with our consistent approach, the system pursues superior outcomes. It seeks to deliver long-term results that help clients pursue their goals.

In summary, while variable annuities are commonly associated with generating protected lifetime income, they can also prove valuable while an investor is seeking to accumulate assets, especially when other retirement accounts are maxed out. Variable annuities can enhance an investor’s ability to accumulate wealth by offering tax advantages, growth potential, legacy planning benefits and professional asset management.

Who might benefit from the compounded advantages of tax-deferred earnings:

- Individuals with higher marginal income tax rates

- Investors with a longer time frame to retirement (10+ years)

- Investors who have maxed out their employer plans and IRAs.

- Those who expect lower marginal tax rates in retirement.

1As of 12/31/23.

2Cogent Syndicated: Advisor Brandscape, June 2023. Represents data from 1,541 registered financial advisors who provided feedback between January and March 2023. Survey participants were required to have an active book of business of at least $5 million and offer investment advice or planning services to individual investors on a fee or transactional basis. Respondents were asked to select the firms they associated with 14 distinct brand image attributes. Capital Group led in eight categories, including in the category of: “Is a company I trust.”

Our latest insights

-

-

Target Date

-

Practice Management

-

Participant Engagement

-

Practice Management

RELATED INSIGHTS

-

Retirement Income

-

Municipal Bonds

-

Practice Management

Never miss an insight

The Capital Ideas newsletter delivers weekly investment insights straight to your inbox.

Variable annuities are long-term investment products designed for retirement purposes and are subject to market fluctuation, investment risk and possible loss of principal. Variable annuities contain both investment and insurance components and have fees and charges, including mortality and expense, administrative and advisory fees. Optional features are available for an additional charge. The annuity’s value fluctuates with the market value of the underlying investment options, and all assets accumulate tax deferred. Withdrawals of earnings are taxable as ordinary income and, if taken prior to age 59½, may be subject to an additional 10% federal tax. Withdrawals will reduce the death benefit and cash surrender value.

Kate Beattie

Kate Beattie