Interest Rates

Retirement Planning

Of all the fears that keep retirees up at night, one of the biggest might be the fear of running out of money. Questions like “How long will I live?”, “Will my investments hold up?” and “Will unexpected costs or events erode my savings?” speak to this fear.

Answering these questions is a central challenge of the retirement industry today. At Capital Group, home of American Funds, we encourage retirees and financial professionals to think less about retirement assets as one lump sum that must cover all expenses, as many do, and instead to think more about a ‘building blocks’ approach. This approach means allocating assets to blocks aligned with personal retirement objectives. Four blocks frequently prioritized by retirees are basic living expenses, discretionary expenses, unplanned emergencies and leaving a legacy.

The building blocks of a confident retirement

We believe that thinking about asset allocation in terms of building blocks can help retirees adopt a mental accounting framework for their assets — making it easier to understand, quantify and prioritize their retirement spending and legacy objectives. Our approach has been informed by in-depth qualitative research conducted for Capital Group, including interviews with hundreds of retirees and near-retirees.1

1. Living: Are the essentials covered?

Living expenses typically include day-to-day necessities such as food, housing, transportation and health care. While investors may have some flexibility with meeting these types of expenses over time, many may seek 100% confidence in meeting them at the outset.

2. Lifestyle: What are your optional expenses?

The lifestyle block includes discretionary spending — the spending you can live without if necessary, such as travel, spending on grandchildren, dining out and entertainment. What constitutes a lifestyle expense will vary from retiree to retiree, as will their comfort level with variations in income and spending as their lifestyle evolves over retirement.

3. Emergency: Do you have a cash cushion?

An emergency fund can provide retirees with more confidence in their ability to weather unexpected market, health or household expenses. Investors should plan for the unexpected and have ample cash and/or more readily liquid reserves on hand.

4. Legacy: Do you plan to pass on your wealth?

For some, leaving a legacy is a defining goal of a wealth planning strategy. Many others simply plan to leave behind “whatever is left” after also accounting for living and lifestyle expenses in a single portfolio of assets invested together to balance income, growth and capital preservation objectives.

This hypothetical scenario is shown for illustrative purposes only, is not indicative of any specific investment and does not reflect the impact of fees, expenses or taxes that may be owed.

Putting the building blocks into action

What is the optimal withdrawal rate for a couple’s retirement portfolio? In the above hypothetical example, Harry and June used the four-building-blocks framework when discussing their spending goals and available resources with their financial professional.

- Their annual basic living expenses are $40,800. They would like to set an objective to achieve 100% confidence in meeting these essential living expenses over their lives.

- They desire $27,200 annually for their lifestyle expenses in retirement. Since they have more flexibility in achieving this spending goal, they agree that 75% confidence in reaching it is appropriate, given that the portfolio needs to balance income, growth and asset preservation.

- They have cash savings of $45,000 in their emergency fund for any unforeseen expenses.

- They would like to leave a legacy for their children, which would include the family home valued at $500,000.

Their $1,000,000 portfolio would need to generate $40,000 ($68,000 less $28,000 from Social Security) to cover both their living expenses and desired lifestyle spending — a 4% withdrawal rate.

Testing the income plan against multiple outcomes

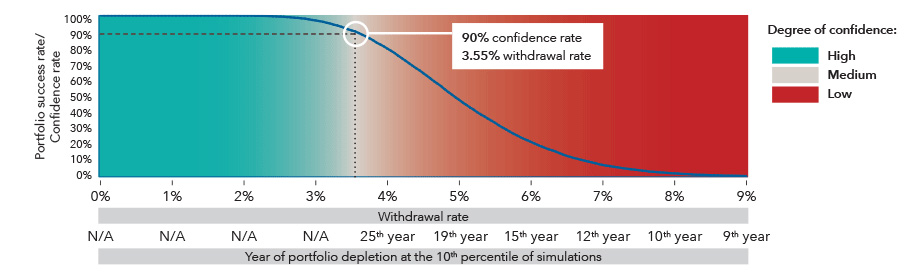

To stress-test this 4% withdrawal rate’s ability to confidently support both living and lifestyle expenses, their financial professional looked at a Monte Carlo simulation, which calculates probabilities based on a number of hypothetical return scenarios. Since Harry and June were most concerned with downside risks, the simulation focused on the lowest 10th percentile of possible outcomes.

According to the simulation, the standard 4% withdrawal rate may be too ambitious in this case. With the proposed split between living and lifestyle expenses, weighted for a combined success rate of 90%, the simulation shows a withdrawal rate of 3.55% or less would provide more confidence in sustaining their spending needs. The analysis suggests that Harry and June’s financial professional may need to discuss with them the trade-offs and implications of decreasing their spending objectives, delaying retirement and adjusting their portfolio, as well as exploring opportunities to increase their level of protected income to improve their overall confidence in retirement.

Retirement income confidence (30-year time horizon)

A Monte Carlo simulation was used to calculate the probable range of outcomes for a hypothetical portfolio composed of 60% global stocks and 40% U.S. bonds supporting the withdrawal rates indicated in the chart for 30 years. Withdrawals are increased by 2% per year. For further information about the assumptions used to create this chart, please see the next page.

Source: Capital Group. Chart is for illustrative purposes only.

Note: Taxes and fees not considered in this hypothetical.

Building retirement confidence — one client at a time

Given the many unknowns of retirement, a building blocks framework may help investors better define their retirement income needs. With insights gleaned from this framework and the benefit of professional advice, investors should be able to invest in portfolios that align with their desired lifestyle and legacy goals and objectives as they navigate through retirement. For financial professionals, that means creating portfolios designed to help clients pursue overall income security, meet their essential living expenses no matter how long they live, and invest for a high degree of confidence.

1 Source: Aeffect (for Capital Group). Retirement Income Product Development Research Findings, 2015. Based on a survey of 800 people who are either current retirees or investors who expect to retire within 1–2 years.

A Monte Carlo simulation was used to calculate the probable range of outcomes and probabilities for hypothetical portfolio reliance. A Monte Carlo simulation is a statistical technique that, through a large number of random scenarios, calculates a range of outcomes that are based on a set of assumptions. This simulation is provided for informational purposes only and is not intended to provide any assurance of actual results.

The following assumptions were used in the Monte Carlo simulation:

The investor withdraws a fixed percentage of the initial portfolio value each year for up to 30 years. The initial withdrawal amount is increased by 2.0% each year.

The hypothetical portfolio is composed of 60% global equities and 40% U.S. fixed income (rebalanced quarterly).

Assumed hypothetical returns for the equities portfolio were 6.4% with a standard deviation of 15.2%; assumed hypothetical returns for U.S. fixed income were 2.6% with a standard deviation of 3.3%.

The portfolio success rate in the hypothetical illustration is the percentage of simulations where the hypothetical portfolio sustained the applicable withdrawal percentage each year for 30 years (inclusive of a 2.0% annual increase). While we believe the calculations to be reliable, we cannot guarantee their accuracy. Simulation results may vary.

All assumptions are for market asset classes only and are reviewed at least annually. These figures represent the views of a small group of investment professionals based on their individual research and are approved by the Capital Market Assumptions Oversight Committee. They should not be interpreted as the view of Capital Group as a whole. As Capital Group employs The Capital SystemTM, the views of other individual analysts and portfolio managers may differ from those presented here. They are provided for informational purposes only and are not intended to provide any assurance or promise of actual returns. They reflect long-term projections of asset class returns and are based on the respective benchmark indices, or other proxies, and therefore do not include any outperformance gain or loss that may result from active portfolio management. Note that the actual results will be affected by any adjustments to the mix of asset classes. All market forecasts are subject to a wide margin of error.

Annualized standard deviation (based on monthly returns) is a common measure of absolute volatility that tells how returns over time have varied from the mean. A lower number signifies lower volatility.

Our latest insights

-

-

-

Municipal Bonds

-

Artificial Intelligence

-

Target Date

This is the headline for the Newsletter promo. Customize the message.

related insights

-

Retirement Income

-

Practice Management

-

Defined Contribution

Never miss an insight

The Capital Ideas newsletter delivers weekly investment insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Kate Beattie

Kate Beattie