Many 401(k)s are set up to have participants pay plan costs from plan assets. Plan sponsors may instead elect to pay plan costs out of company funds. This can benefit employers and employees:

Additional tax deduction

Lower participant fees

Reduced litigation risk

One way to tell if a 401(k) plan is successful is to set measurable objectives for participant outcomes. The following hypothetical example shows how plan expenses can be part of that mix.

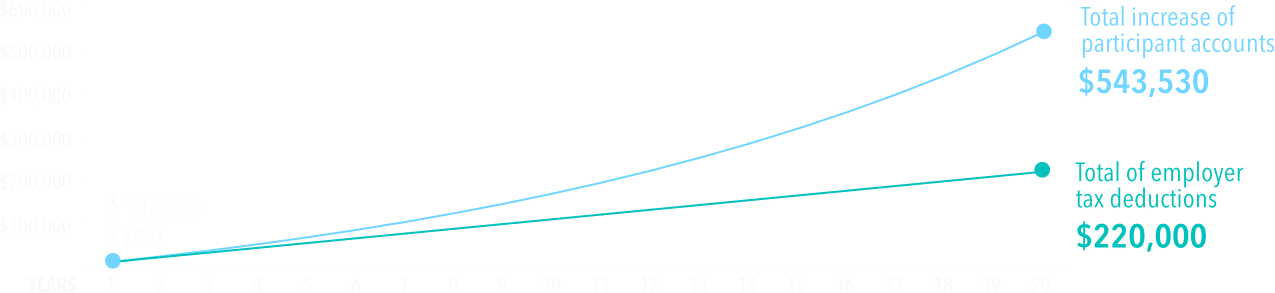

Tax savings for employer, increased assets for employees

Assumes $1 million in plan assets, 30 participants, $11,000 in annual plan costs and an 8% annual investment growth rate over 20 years

This hypothetical example was developed by third-party retirement plan consultant Patrick Shelton, GBA and managing member of Benefits Plans Plus, LLC and is not intended to represent or predict actual results. The example assumes annual recordkeeping costs of $4,000, annual advisor costs of $5,000 and annual TPA costs of $2,000. To estimate the increase of participant balances, one-fourth of $11,000 ($2,750) is invested quarterly with an annual growth rate of 8% compunded quarterly over 20 years.

In this example, the employer receives an $11,000 annual tax deduction and participants receive a cumulative addition of $543,530 to their account balances over 20 years. This additional accumulation may really make a difference in the quality of retirement for participants. Sponsors, of course, can elect to pay or not pay plan expenses each year, depending on business conditions.

The potential benefits of paying 401(k) expenses with company assets:

Plan sponsor benefits:

• Tax savings — Out-of-pocket plan fees are a tax-deductible expense.

• Reduced litigation risk — Exposure to excessive fee claims may be lower.

• More plan assets — May help the plan qualify for lower pricing.

Participant benefits:

• Better fee transparency — Participants have fewer embedded costs.

• Lower share of costs — Employers pay a greater portion of plan expenses.

• Potential higher account balances — Could help improve retirement outcomes.

Small businesses may find substantial benefits from expanded startup tax credits

The SECURE 2.0 Act of 2022 created a new startup plan tax credit based on contributions the employer makes on behalf of participants, and expanded the existing startup tax credit on employer out-of-pocket plan costs. These tax credits may provide a significant cost savings for small businesses that are starting a plan.

Learn more about the SECURE 2.0 tax credits.

Resources

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Investors should carefully consider investment objectives, risks, charges and expenses. This and other important information is contained in the fund prospectuses and summary prospectuses, which can be obtained from a financial professional and should be read carefully before investing.

This material does not constitute legal or tax advice. Investors should consult with their legal or tax advisors.

All Capital Group trademarks mentioned are owned by The Capital Group Companies, Inc., an affiliated company or fund. All other company and product names mentioned are the property of their respective companies.

Use of this website is intended for U.S. residents only. Use of this website and materials is also subject to approval by your home office.

American Funds Distributors, Inc.

This content, developed by Capital Group, home of American Funds, should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment or fiduciary advice.