EQUITIES

Ideas for using active ETFs to pursue key investment themes

Select a category to go directly to that implementation idea:

Large value

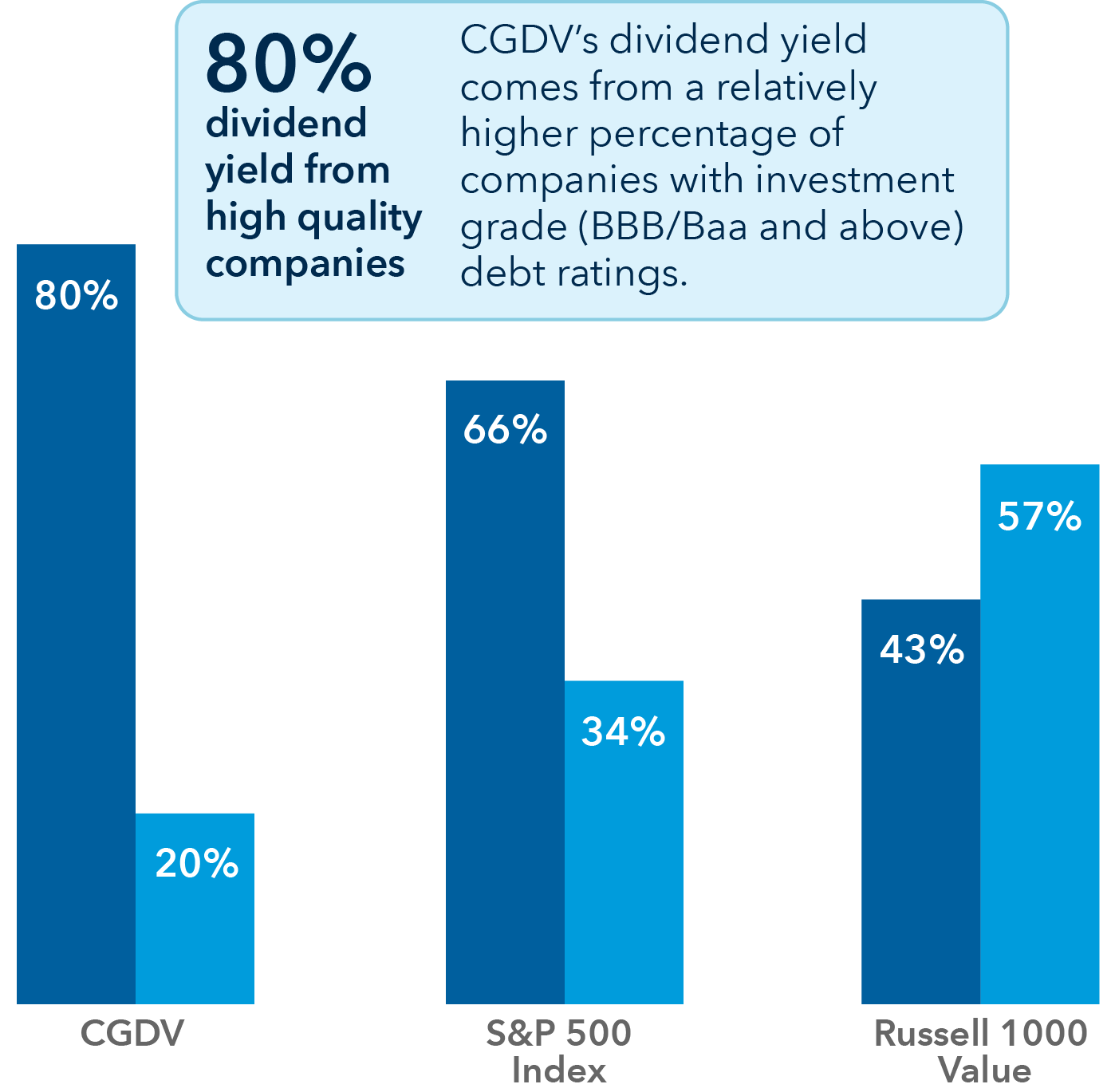

Pursue consistent income by focusing on companies that pay dividends

▉ High quality

▉ Low quality/no rating

Data as of March 31, 2023. See disclosure1

See disclosure 1

Well-established U.S. companies with a history of financial strength and regular dividend payments may not be exciting but their potential payouts could be. Consider Capital Group Dividend Value ETF (CGDV), which aims to invest in companies that are capable of paying dividends across a variety of market and economic environments.

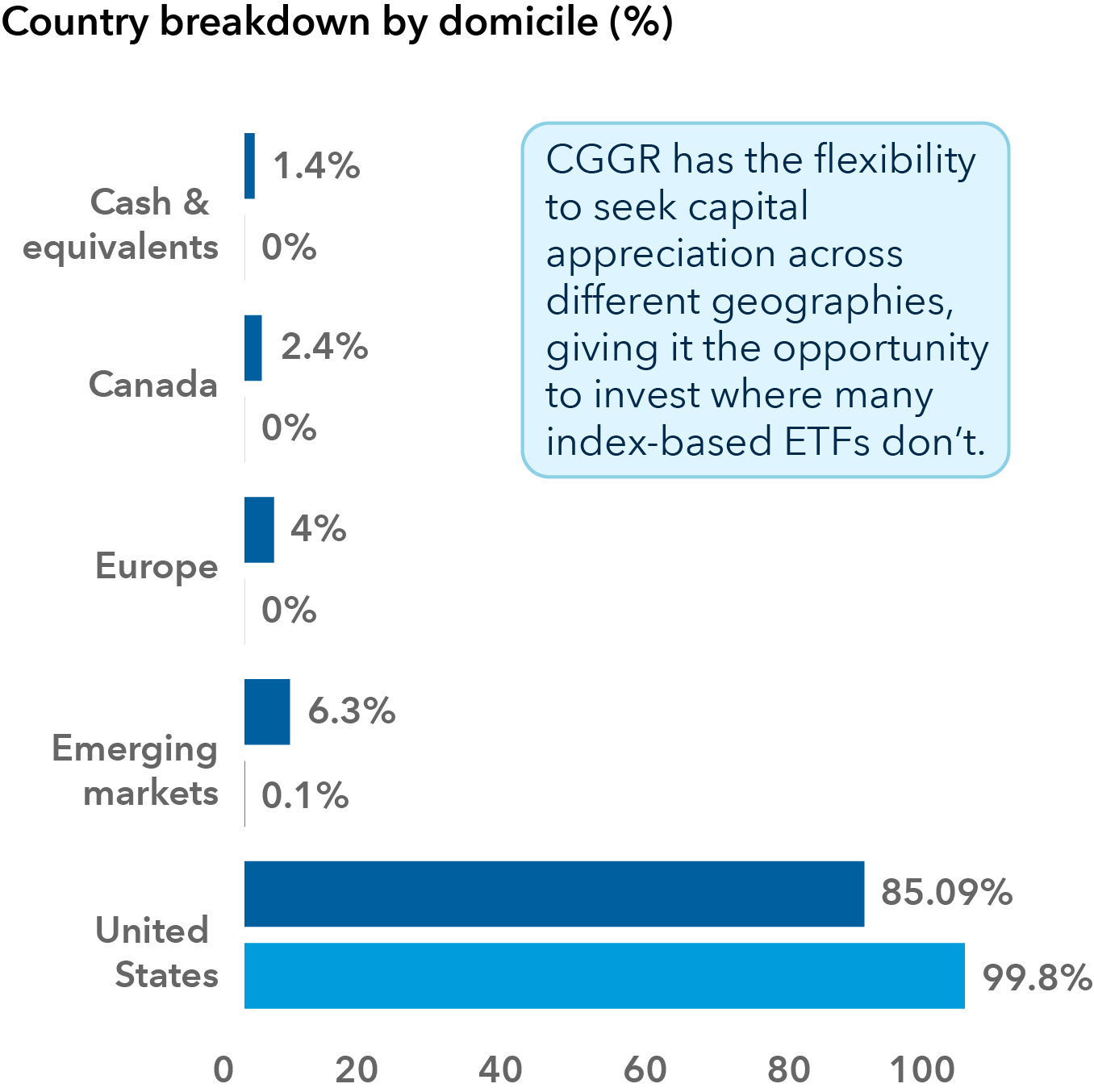

Large growth

Expand your definition of growth to avoid limiting your opportunity set

▉ CGGR

▉ Russell 1000 Growth Index

Data as of March 31, 2023. See disclosure2

See disclosure 2

Growth can take many forms, which is why Capital Group Growth ETF (CGGR) has the flexibility to invest in a variety of opportunities, including developing industries, cyclical companies in a slow period or non-U.S. domiciled companies that are industry leaders.

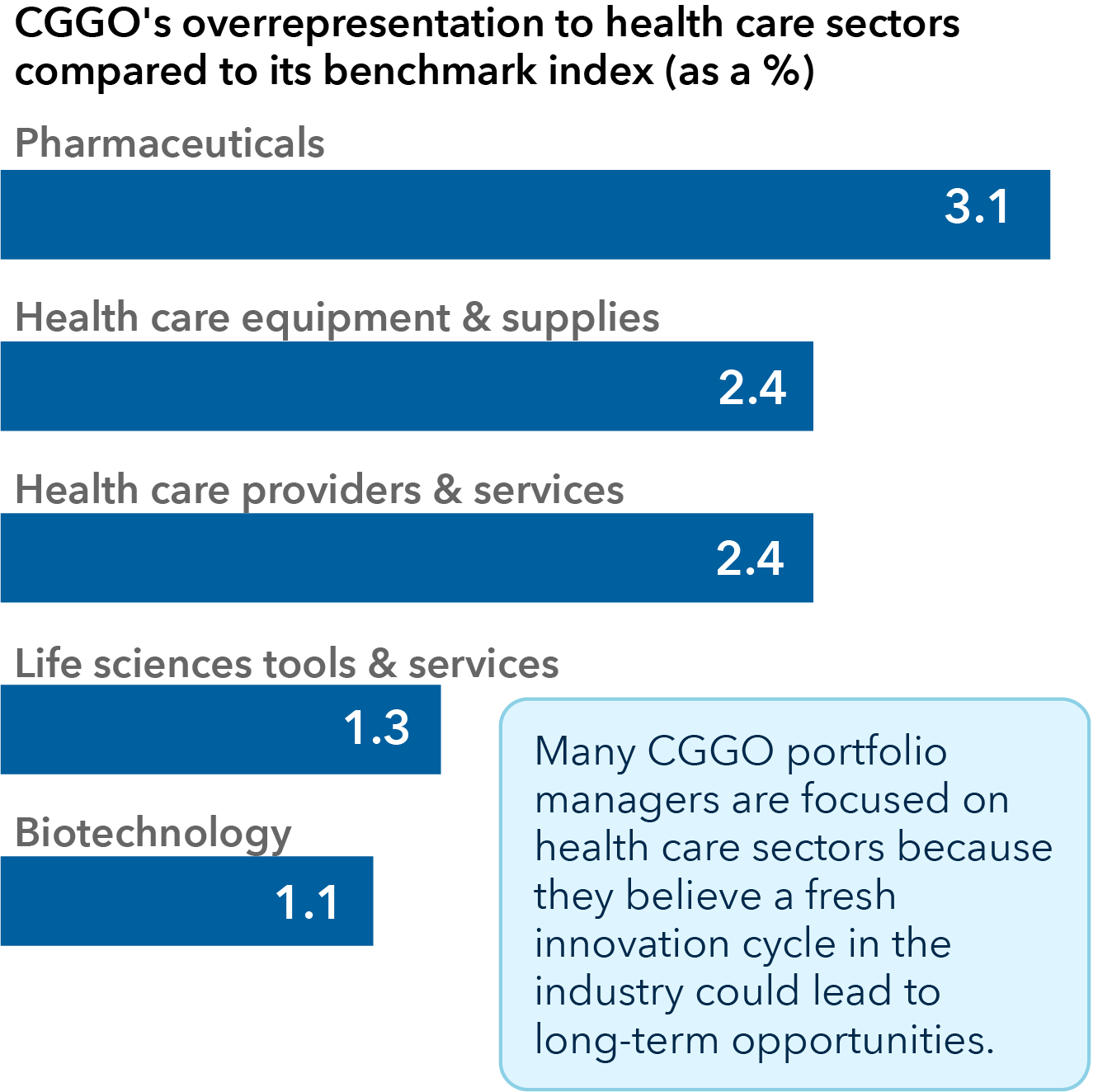

Global large-stock growth

Pursue growth wherever it’s found — because innovation isn’t limited to one sector or region

Data as of March 31, 2023. See disclosure3

See disclosure 3

Within Capital Group Global Growth ETF (CGGO), innovation isn't limited to a specific industry, region or company size. Its geographic flexibility allows portfolio managers to identify attractive opportunities, no matter where they’re located, what industry they’re in or the size of the company.

Disclosure 1

Source: Factset as of March 31, 2023. The indexes used in this comparison represent the fund’s primary benchmark, the S&P 500 Index (a market capitalization-weighted index based on the results of approximately 500 widely held common stocks) and the fund’s secondary benchmark, the Russell 1000 Value Index (a market capitalization-weighted index that represents the large-cap value segment of the U.S. equity market and includes stocks from the Russell 1000 Index that have lower price-to-book ratios and lower expected growth rates). High quality percentage prefers to the number of holdings as a percent of the total holdings whose debt rating is investment grade (BBB/Baa and above). Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch, as an indication of an issuer’s creditworthiness. Low quality/no rating reflects the percentage of companies with below investment grade debt (BB/Ba and below) or whose debt is not rated by ratings agencies.

Disclosure 2

As of March 31, 2023. Source: Capital Group, FTSE/Russell indexes. The index used in this comparison represent the fund’s secondary benchmark, the Russell 1000 Value Index. Cash and equivalents includes short-term securities, accrued income and other assets less liabilities. It may also include investments in money market or similar funds managed by the investment adviser or its affiliates that are not offered to the public.

Disclosure 3

As of March 31, 2023. Source: Capital Group, MSCI. The index used in this comparison represent the fund’s primary benchmark, the MSCI All Country World Index (a free float-adjusted market capitalization-weighted index that is designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indexes). Data reflects only equity holdings within the portfolio and excludes cash and equivalents (short-term securities).

FIXED INCOME

Active fixed income ETFs built for times like these

Select a category to go directly to that implementation idea:

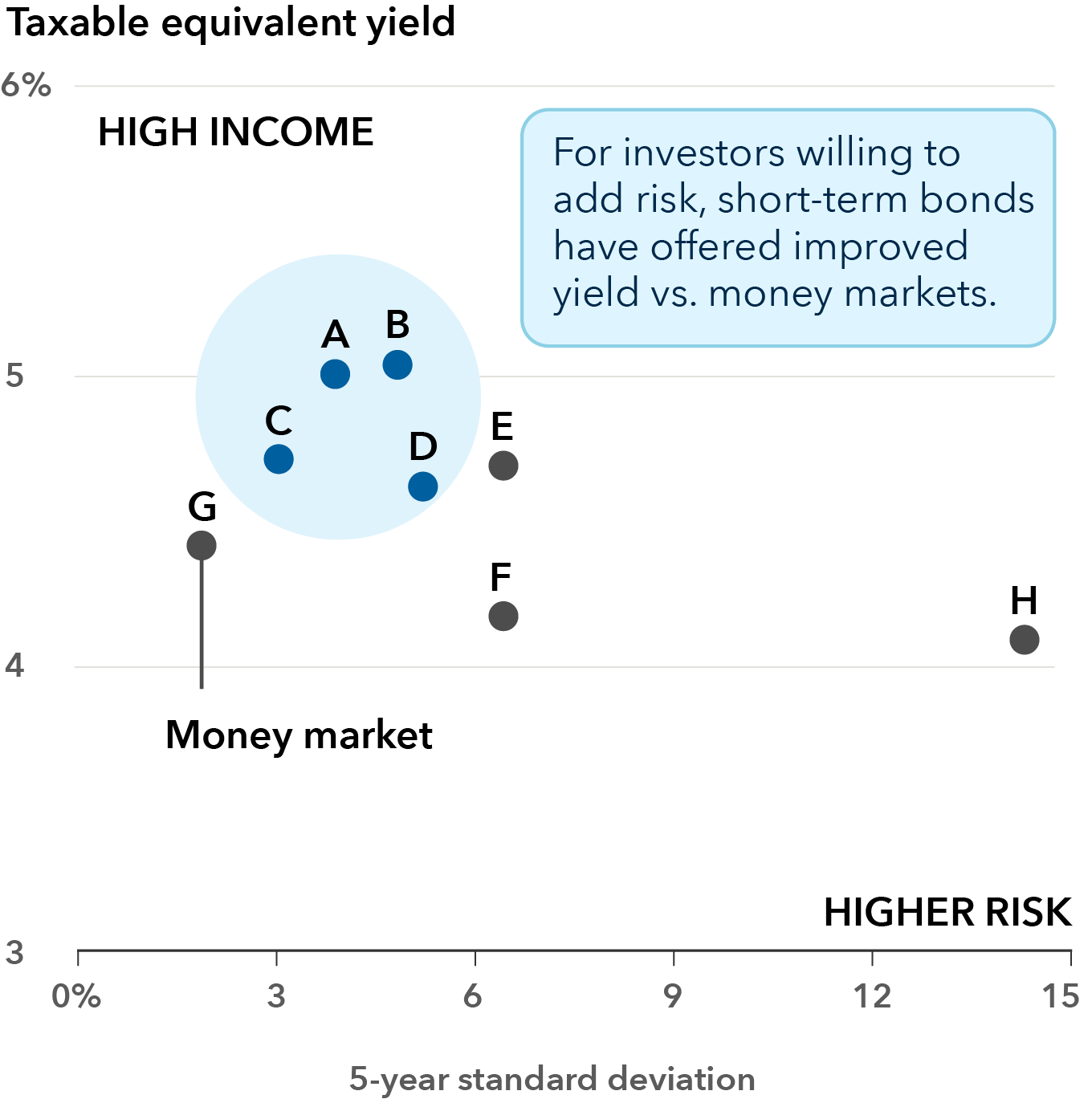

Short duration

Pursue short-term bond income with low interest rate sensitivity

A. 1-5 year municipal |

E. Core |

B. 1-10 year municipal |

F. Treasury |

C. 1-3 year taxable |

G. Money market |

D. Intermediate taxable |

H. Long Treasury |

Data as of December, 31, 2022. See disclosure4

See disclosure 4

Consider moving excess cash and money market holdings into Capital Group Short Duration Income ETF (CGSD), a short-duration fixed income ETF that aims to pursue income with low interest rate exposure.

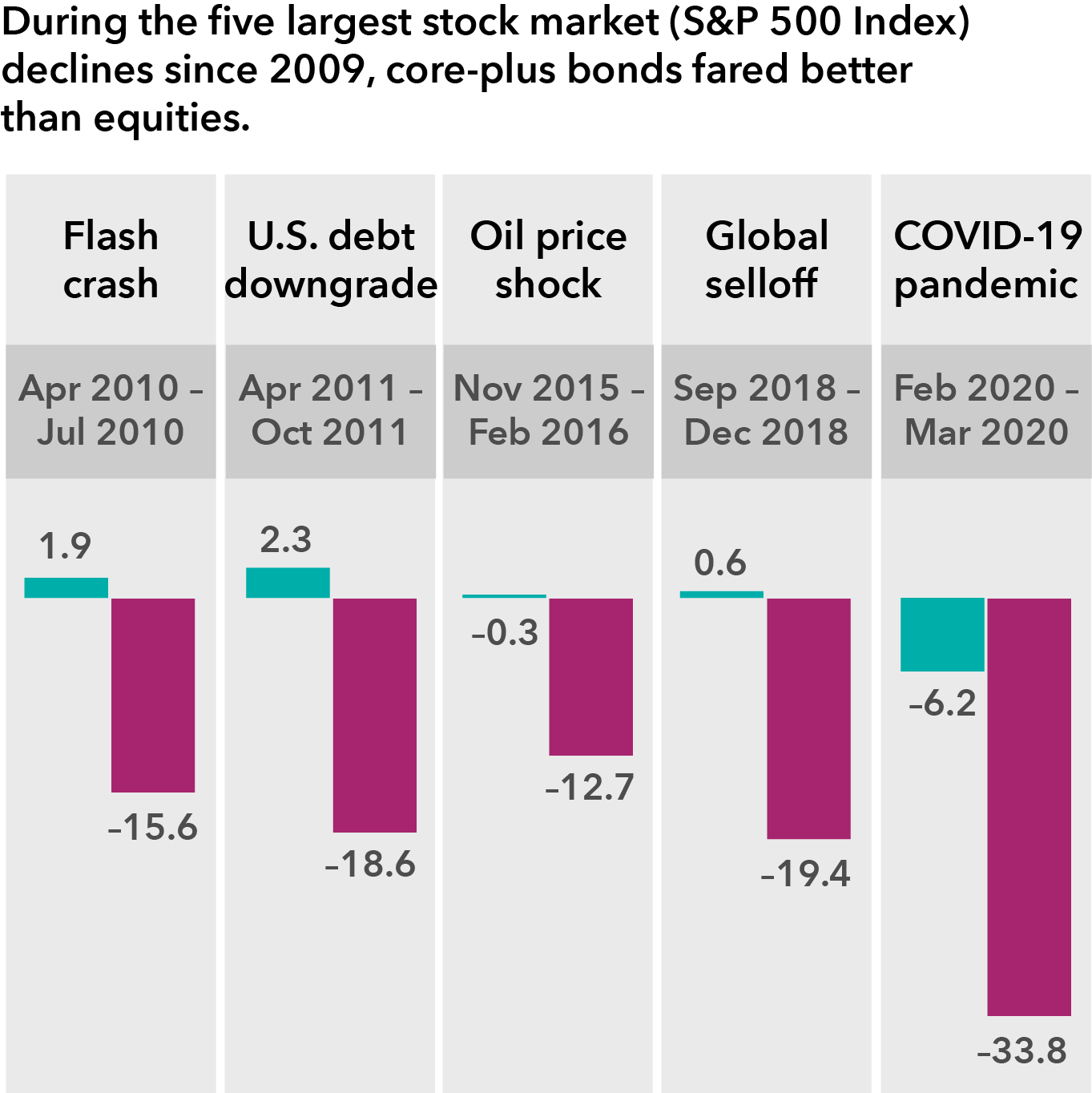

Core plus

Consider core-plus bond funds to mitigate equity volatility

▉ Morningstar U.S. Intermediate Core-Plus Bond Category Average

▉ S&P 500 Index

Data as of December, 31, 2022. See disclosure5

See disclosure 5

Don't overlook the importance of diversification, particularly when uncertainty abounds. Consider Capital Group Core Plus Income ETF (CGCP), which invests across the fixed income spectrum for the potential to mitigate the downside while pursuing a resilient income stream.

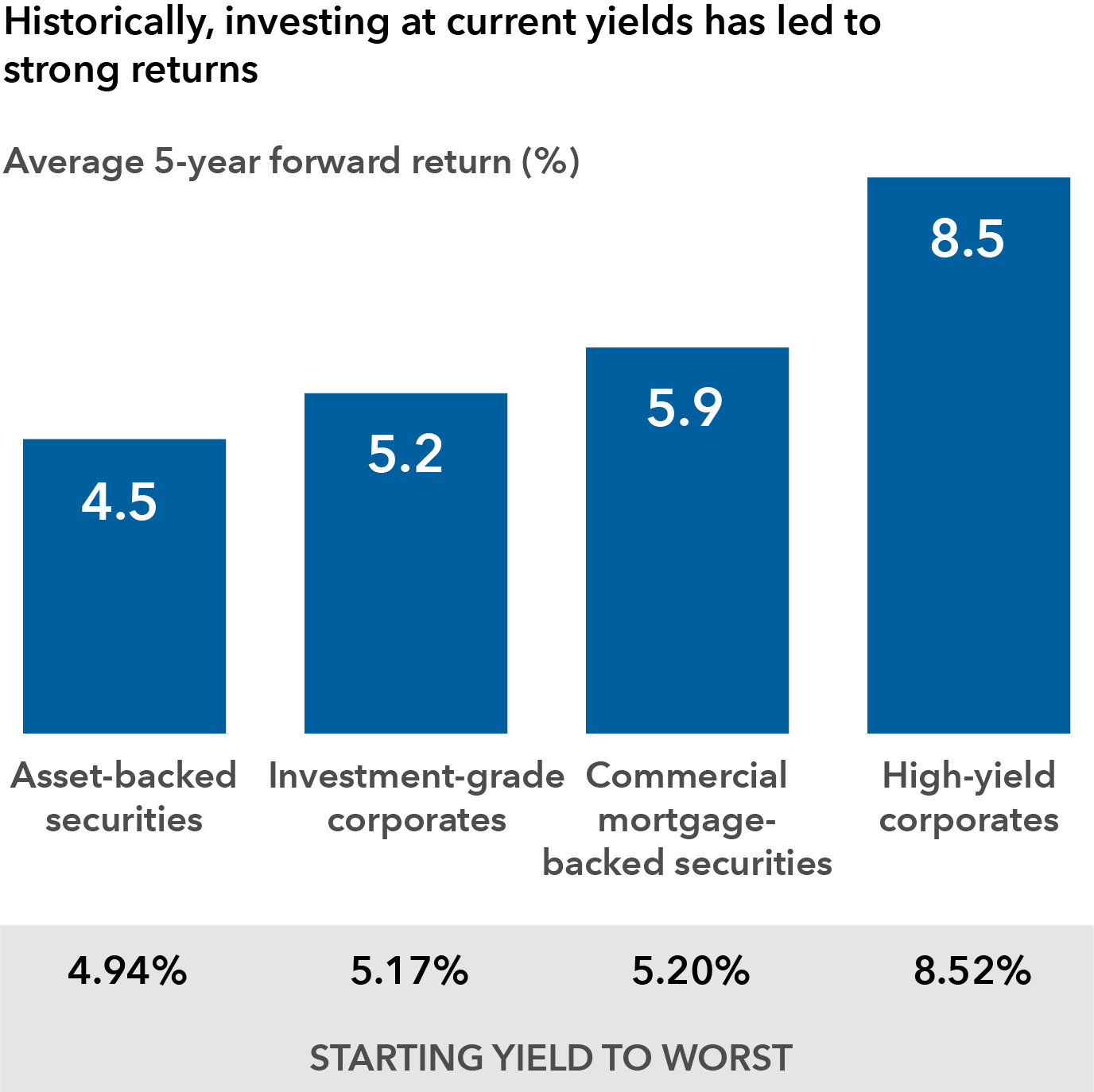

Multisector

Seek a high level of current income

Data as of March 31, 2023. See disclosure6

See disclosure 6

With the ability to flexibly allocate across a broad swath of U.S. bond sectors to pursue income opportunities, Capital Group U.S. Multi-Sector Income ETF (CGMS) seeks multiple sources of income and total return while managing credit risk and volatility.

Munis

Consider munis, which have weathered recessions well

▉ Savings and loan recession (July 1990 – March 1991)

▉ Early 2000s recession (March 2001 – November 2001)

▉ Great Recession (December 2007 – June 2009)

▉ COVID-19 recession (February 2020 – March 2020)

Data as of January 31, 2022. See disclosure7

See disclosure 7

Interested in pursuing a tax-exempt income stream while preserving capital? Consider Capital Group Municipal Income ETF (CGMU), which invests in multiple potential sources of returns with a broadly diversified municipal bond portfolio.

Disclosure 4

As of December 31, 2022. Source: Bloomberg Index Services, Ltd., Morningstar. Money market: Morningstar Prime Money Market Category (These portfolios invest in short-term money market securities in order to provide a level of current income that is consistent with the preservation of capital) average. While money market funds seek to maintain a net asset value of $1 per share, they are not guaranteed by the U.S. Federal government or any government agency. You could lose money by investing in money market funds. Unlike mutual fund shares, investments in U.S. Treasuries are guaranteed by the U.S. government as to the payment of principal and interest. In addition, certificates of deposit (CDs) are FDIC-insured and, if held to maturity, offer a guaranteed return of principal. 1-3-year taxable: Bloomberg U.S. Aggregate 1-3 Year Index (represents securities in the one to three year maturity range of the U.S. investment-grade fixed-rate bond market), Intermediate taxable: Bloomberg U.S. Aggregate Intermediate Index (represents securities in the two to 10 year maturity range of the U.S. investment-grade fixed-rate bond market), 1-5 year municipal: Bloomberg Municipal Short 1-5 year Index (a market-value-weighted index that includes investment-grade tax-exempt bonds with maturities of one to five years), 1-10 year municipal: Bloomberg Municipal Short Intermediate 1-10 year Index (a market-value-weighted index that includes investment-grade tax-exempt bonds with maturities of one to 10 years), Core: Bloomberg U.S. Aggregate Index (represents the U.S. investment-grade fixed-rate bond market), Treasury: Bloomberg U.S. Treasury Index (represents U.S. dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury), Long Treasury: Bloomberg U.S. Long Treasury Index (represents U.S. dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury with maturities of ten years or more). The indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. Yields for indexes are yield to worst. Money market yield is 7-day SEC yield. Taxable-equivalent yield assumptions are based on a federal marginal tax rate of 37%, the top 2022 rate. In addition, we have applied the 3.8% Medicare tax. The fixed-year standard deviation measures the variability of returns over the preceding 60-month period.

Disclosure 5

Source: Capital Group, Morningstar. As of 6/30/21. Dates shown are representative of the five largest equity market declines (without dividends reinvested) in the S&P 500 Index with at least 50% recovery persisting for more than one business day between declines. The returns are based on total returns. The index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Funds within the Morningstar U.S. Intermediate Core-Plus Bond Category invest primarily in investment-grade U.S. fixed income issues including government, corporate and securitized debt, but generally have greater flexibility than core offerings to hold non-core sectors such as corporate high yield, bank loan, emerging markets debt and non-U.S. currency exposures.

Disclosure 6

Sources: Capital Group, Bloomberg. Yields and monthly return data as of March 31, 2023, going back to January 2000 sectors shown. Based on average monthly returns for each sector when in a +/- 0.30% range of yield to worst (the lowest yield that can be realized by either calling or putting on one of the available call/put dates, or holding a bond to maturity) shown. Sector yields above include Bloomberg Asset Backed Securities Index (represents the universe of U.S. asset-backed securities), Bloomberg U.S. Investment Grade Corporates Index (representing the universe of investment-grade publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity and quality requirements), Bloomberg Commercial Mortgage Backed Securities Index (representing the universe of U.S. commercial mortgage-backed securities) and Bloomberg U.S. Corporate High Yield Index (representing the universe of fixed-rate, non-investment-grade corporate bond market). The indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. Sectors were selected to reflect the broad investment universe of CGMS with the ABS and CMBS indexes representing the typical issuers that make up the securitized sector of the U.S. fixed income market. Past results are not predictive of results in future periods.

Disclosure 7

Sources: Capital Group, Bloomberg, National Bureau of Economic Research. Data as of 1/31/22. Growth represented by Bloomberg Municipal Bond Index (a market-value-weighted index designed to represent the long-term investment-grade tax-exempt bond market). The index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Past results are not predictive of results in future periods.

Stay informed

Sign up to make sure you don't miss upcoming Capital Group ETFs insights like these.

This content is intended for financial professionals only and is subject to your home office restrictions.

ETFs for the core (& more)

Learn about our equity and fixed income ETFs and access ETF insights

Consider active fixed income ETFs

Explore these ideas in-depth and learn why active bond ETFs may be compelling now

Fixed income at Capital Group

Anchored in 50 years of active fixed income investing