Retirement Income

Retirement Planning

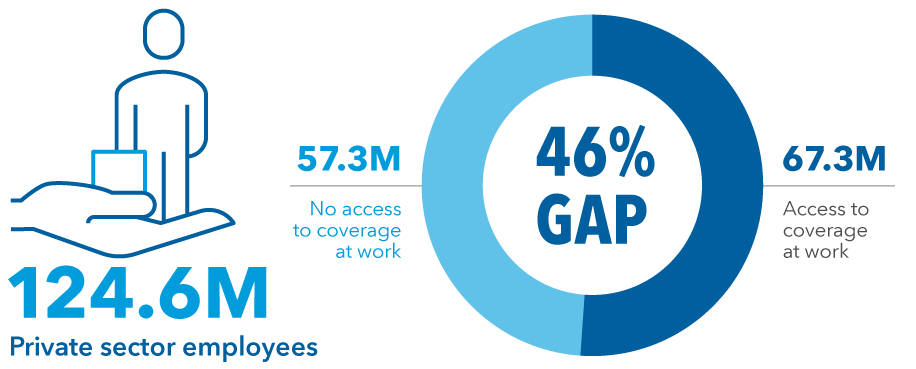

Despite years of legislative efforts to increase retirement savings and plan participation, the latest numbers show that we still have a long way to go to close the gap in retirement plan coverage. Indeed, 46% of private sector employees say they have no access to a plan through their employer.

Source: Georgetown University Center for Retirement Initiatives in conjunction with Econsult Solutions, Inc., 2020. ESI analysis of Census Bureau Current Population Survey and BLS National Compensation Survey Data.

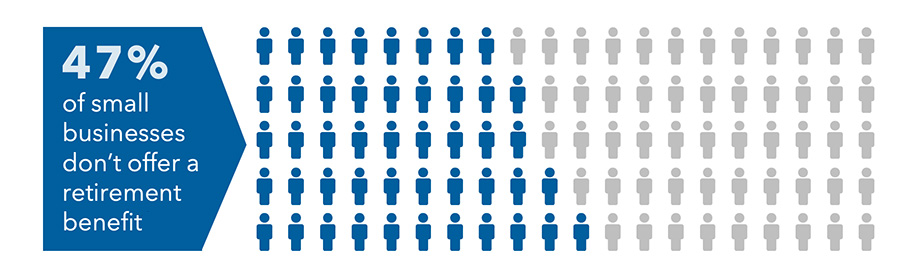

While expanded access to workplace retirement plans is needed across the United States, the need seems to be especially great for small businesses. Firms with fewer than 100 employees comprise the majority of all businesses, accounting for nearly 98% of them and employing more than 35% of private sector workers. As a result, it could be said that the retirement savings crisis is overwhelmingly a small-business problem. While Congress has tried to make it easier for small businesses to offer retirement plans, the retirement gap among this cohort persists, as 47% of them do not offer a retirement benefit.

Source: U.S. Bureau of Labor Statistics, National Compensation Survey: Employee Benefits in the United States, March 2021 ("private industry" businesses with fewer than 100 employees).

Still, ongoing legislative efforts at the federal and state levels are leading to increased awareness. As a result, retirement plan professionals have an opportunity to help these business owners establish plans that have the potential to close the retirement coverage gap for their employees.

Why no plan?

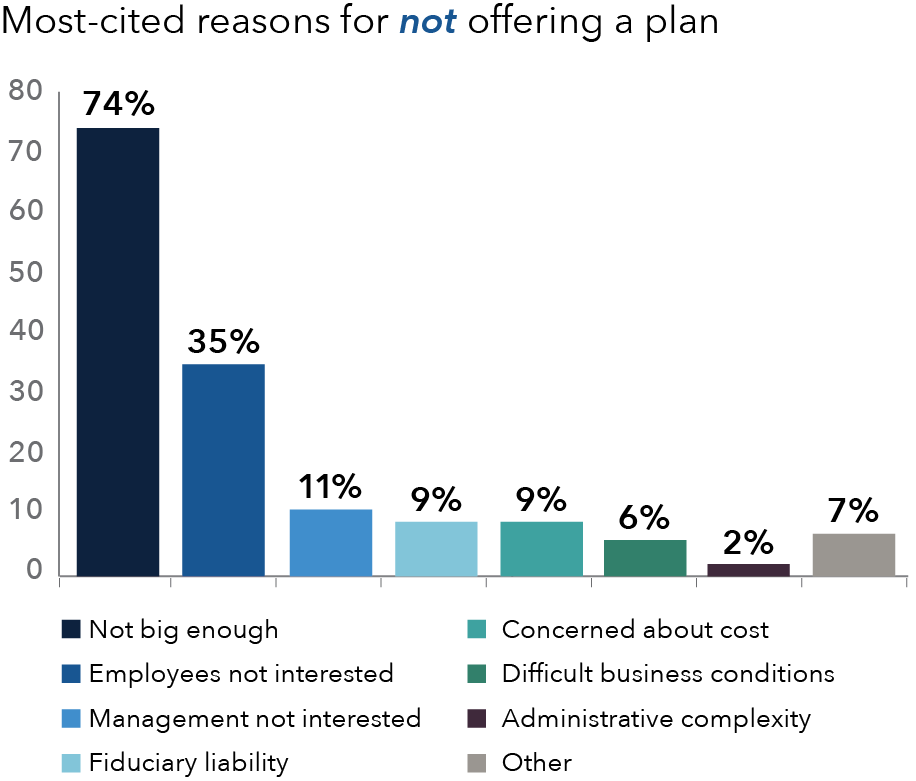

Studies show that most employers (65%) feel very or somewhat responsible for helping their employees achieve a financially secure retirement.* But it’s clear that many employers may have reservations about setting up a plan and could use some help. The majority think they are simply not big enough to offer a plan (74%) and more than one-third (35%) say they are too costly.

Source: Transamerica Institute, "Navigate the Pandemic: A Survey of U.S. Employers." June 2021. Responses to the question, "Why is your company not likely to offer a plan in the next two years? Select all."

But there are options for plan sponsors of all sizes, including low-cost SEP IRAs and SIMPLE IRAs. The fact that more than 60% of employers report they are not at all familiar with SEP or SIMPLE IRAs† shows that the problem may be even larger than one simply of access.

Legislative efforts on the federal level

The SECURE Act, short for Setting Every Community Up for Retirement Enhancement Act, was signed into law in 2019 and represented the first major piece of retirement legislation since the Pension Protection Act (PPA) of 2006.

Among the many provisions within SECURE are two key incentives meant to boost the number of employer-sponsored plans and get more employees enrolled:

o Significant increase to the startup tax credit

o New tax credit for automatic enrollment

An employer could receive up to $16,500 in tax credits for the first three years, which is an attractive selling point for those that have yet to establish a retirement plan due to cost concerns. By now, many financial professionals are familiar with SECURE’s provisions, but for a brief refresher, refer to this in-depth article that discusses key takeaways.

Building on the SECURE Act’s momentum, both the U.S. House of Representatives and the U.S. Senate have bills in 2022 that are currently winding their way through the legislative process. In April, the House overwhelmingly passed its retirement legislation, the Securing a Strong Retirement Act, also referred to as the SECURE Act 2.0. For more information about SECURE 2.0, refer to our recent article.

In June, the Senate Finance Committee unanimously approved its legislation known as the EARN Act, short for Enhancing American Retirement Now. The two pieces of legislation include some similar provisions related to expanding coverage, including enhancements to an employer’s tax credits to cover startup costs and modifications to participation requirements for part-time workers.

Notably, the House bill includes a new startup plan credit for small employer retirement contributions. As a result, small employers would not only receive a credit in relation to startup costs but also a credit for any employer contributions, not to exceed $1,000 per employee.

One area that differs is with regard to auto enrollment. Congress is wrestling with whether to mandate auto enrollment and auto escalation or incentivize those features through tax credits. The House bill, SECURE 2.0, includes a provision requiring employers to automatically enroll employees in any new plan (but not existing plans) once they become eligible and then auto increase their deferrals. The Senate bill, EARN, has a provision that would offer a tax credit to small employers who adopt an auto enrollment feature.

There is a chance that a retirement bill will make its way to President Biden for enactment this year and we will be closely watching how any final bill handles the coverage gap and auto enrollment.

States step in to close the coverage gap

In the absence of any federally mandated retirement program, states across the country have begun considering or actually enacting their own state-sponsored retirement program mandates to help individuals save for retirement.

As of April 1, 2022, 10 states and two cities have enacted mandates. Four are already active and some will take effect at a future date. To satisfy the mandates, employers must either enroll their employees in state-run payroll deduction IRAs or offer a tax-favored retirement plan (like a SIMPLE IRA or 401(k) plan) to their workers.

Each of the state-run IRAs is unique, but they share some common features:

- Investments through Roth IRA accounts

- Default investment in a passive target date retirement fund, subject in certain states to an initial holding period in a capital preservation fund

- All employees must be covered (as opposed to private sector retirement plans, which allow certain exclusions).

While the state programs are a step in the right direction and may get people into the habit of saving, they don’t necessarily provide the retirement security that an employer-sponsored retirement program can.

‘The Great Resignation’ may help drive plan formation

In addition to all of this legislation, there’s another phenomenon taking place in 2022. It’s colloquially referred to as "The Great Resignation," which has seen employees leaving jobs in record numbers.

According to data from MetLife and the latest U.S. Chamber of Commerce Small Business Index, the labor shortage may be especially painful to small-business owners, as almost half (46%) indicate they are facing a worker shortage.

One of the top ways companies attract and retain talent is by increasing wages. But in a tight labor market, a decent salary might not be enough. With many Americans concerned about retirement security and their ability to save enough on their own, 401(k)s are taking on increased importance to employees and candidates. As a result, a 401(k) plan or other retirement plan may be an attractive recruitment and retention tool. This provides an opening for financial professionals to talk to small-business clients about adding or enhancing a retirement plan to better compete in the race for talent.

Opportunity for retirement plan professionals

The combination of the legislative landscape and the coverage gap provides an opportunity for financial professionals to expand their existing retirement plan business or gain an entry into this rapidly growing space.

* Source: Transamerica Institute, "Navigating the Pandemic: A Survey of U.S. Employers," June 2021.

† Source: The Pew Charitable Trusts, "Employer Barriers to and Motivations for Offering Retirement Benefits," June 2017.

Our latest insights

-

-

Retirement Income

-

Target Date

-

Practice Management

-

Participant Engagement

RELATED INSIGHTS

-

Retirement Income

-

Retirement Income

-

Practice Management

Never miss an insight

The Capital Ideas newsletter delivers weekly investment insights straight to your inbox.

Sue Walton

Sue Walton