Client Relationship & Service

5 MIN ARTICLE

Women are increasing their financial power. In fact, a third of the world’s wealth — about $70 trillion as of 2019 — is controlled by women, according to research from Boston Consulting Group. It’s increasingly common for women to be the primary breadwinners in their households. Moreover, women are amassing wealth more quickly than men and outpacing the growth of the overall global wealth market. And yet, many women find themselves unprepared for important financial decisions later in life.

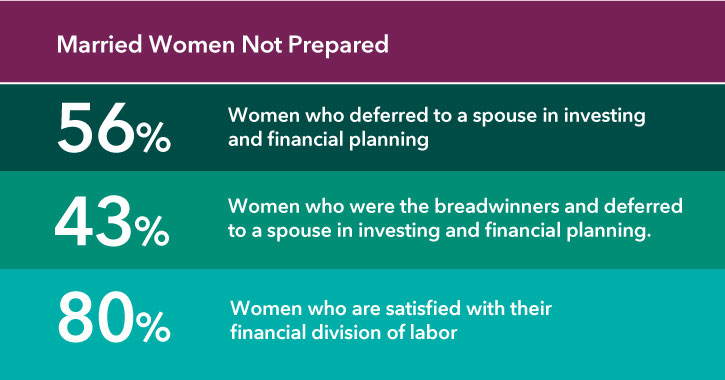

That’s because when it comes to household finances, more than half of married women (56%) defer to a spouse when it comes to investing and financial planning, according to a study from UBS. Even in cases where women are the primary breadwinners, 43% say they still leave major financial decisions to a spouse.

“Certain divisions of labor are typical in any household,” says Leslie Geller, a wealth strategist at Capital Group. “But when women are not part of the financial planning, they run the risk of jeopardizing their futures if they go through a divorce or outlive the spouse.” In those cases, they can find themselves suddenly in the financial driver’s seat. In addition to potential cash flow challenges, they may find themselves facing unexpected legal and tax bills, or losing out on their fair share of a business.

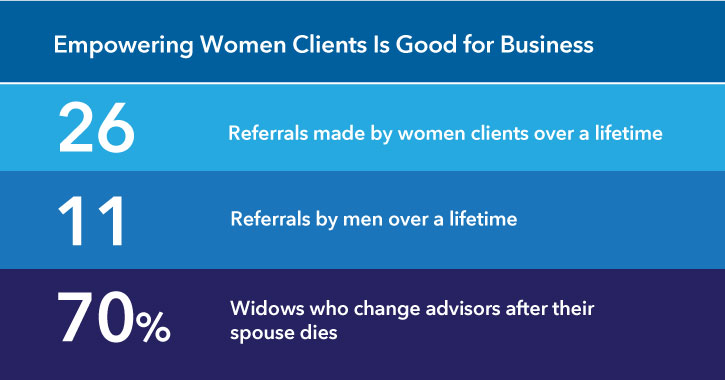

The good news is that you can help women clients close the gap between earning and amassing wealth and actively controlling it. And what’s more, there is a strong business case for it. Women are more likely to show their appreciation for your good work by making referrals — 26 over a lifetime, as opposed to 11 by the typical male client, according to an article from Investment News. Just as important, women are more likely to vote with their feet if they’re not happy. Seventy percent of widows change advisors after their spouse dies, according to a study from Family Wealth Advisors Council.

3 steps toward greater financial empowerment for women

Source: Investment News, “Female clients more likely than men to make referrals,” April 2012; and Family Wealth Advisors, “What do breadwinner women want” report, 2015

Simply put, it’s important for any individual — not just women — to take control of their wealth and financial resources. Here are some suggestions you can use to help your clients prepare for long-term success:

1. Establish the necessary relationships. One reason many women may not feel fully engaged in the management of their finances is the origin of the relationship with their financial professionals. “When it comes to married women, relationships with the financial advisor, the attorney and the CPA are often initiated by the spouse,” Geller says. “Women are often outsiders to these already-formed relationships. This can cause them to feel that they aren’t the top priority, or worse yet, that they aren’t even part of the team.”

It is critical that all clients get to know you and engage with you and other financial professionals involved in the management of their wealth. Invite and encourage them to join meetings and calls that the spouse may have normally attended alone. “Ideally, an advisor will build a relationship with both spouses from the beginning,” Geller says.

For your part, make an effort to set up individual times with each spouse for a one-on-one conversation without their partners present. Present the meeting as a safe environment and opportunity to discuss things from their individual perspectives — a time to allow questions on their own terms and a chance to get to know you.

2. Help them tackle the right questions. Before they can feel fully engaged about future decisions, clients need to understand the fundamentals of their financial plans and investment strategies. This is important for anyone in a professional financial relationship, but especially for those who are looking for a way to get up to speed.

“Unfortunately, some women find themselves in situations where they need to take action to ensure that their financial rights are protected and their obligations and risks are limited appropriately,” Geller says. “But they need the right information before they can take action, and that requires asking the right questions.”

As a starting point, check out our list of questions you can share with your clients. Written from the perspective of a married woman, the questions can be easily adapted to fit other situations as well.

3. Normalize financial conversations. Many people may feel a stigma about discussing financial topics. Unfortunately, staying away from the topic may contribute to a woman’s hesitation to take initiative with financial matters.

One way to overcome this stigma is by talking about these issues more regularly. Encourage her to share her experiences with people she trusts to help her feel more empowered and ready to engage. Friends and family members will likely benefit from the conversation too.

Source: UBS, “On Your Own” report, 2018

Bottom line

The consequences for clients of not being fully engaged in their financial futures can be significant, particularly if they find themselves in situations where they must make major financial decisions that they didn’t before.

But by focusing on helping them build relationships, ask the right questions, and normalize the financial conversation, you can help then take greater control of their financial futures. And along the way, you’ll be cultivating important client relationships with the stewards of a growing portion of the world’s wealth.

Related content

-

Practice Management

-

-

Tax & Estate Planning