Retirement Planning

9 MIN ARTICLE

The bucket strategy for retirement income is simple, flexible and easy to implement. Most importantly, it resonates with clients and helps them stick to the plan.

Income for life. It sounds like one of those lotto daydreams you might indulge in after a particularly hard day at the office. It’s also one of the toughest aspects of retirement for investors to wrap their heads around: How do you use the investment portfolio you’ve accumulated to create a steady paycheck for life?

Even for financial professionals working with investors at or near retirement, creating a sustainable portfolio distribution strategy is no minor feat under the best conditions. And it’s all the more challenging when you factor in risks such as low interest rates, market volatility, sequence of returns (experiencing low or negative returns early in retirement), inflation, longevity and health.

Perhaps the greatest risk to a sustainable retirement income strategy, however, is the client’s own behavior. Whether by spending too freely or cashing out of investments in reaction to short-term market worries, humans can be difficult to predict and manage. So while there are many approaches to retirement income distribution, success may rely on the strategy that takes into account investors’ fears, expectations and worst impulses.

Managing retirement fears with the bucket strategy

“Investors who think of their assets as discrete buckets or building blocks to serve specific needs — such as living expenses, discretionary spending, unplanned emergencies and legacy — arguably have a better framework to manage retirement planning without fear,” says Kate Beattie, CFP, RICP, senior retirement income strategist at Capital Group. “Using a bucket retirement strategy, can have the positive effect of helping retirees adopt a mental accounting framework for their assets, making it easier for them to understand, quantify and prioritize their retirement spending and legacy objectives.”

There are many ways to build a bucket strategy, but consistency and maintenance are key. Here’s how to implement the bucket approach to retirement income, along with tips for financial professionals who want to recommend it to clients.

What is the retirement bucket strategy?

The bucket approach to retirement income is based on separating assets according to when they are going to be spent, creating a cash cushion for the early years of retirement, while maximizing the rest over a longer period of time. The easy-to-understand concept taps into what behavioral finance expert Richard Thaler calls a mental accounting bias, where investors think of money differently depending on its intended use. Buckets and their variations help clients compartmentalize their savings according to when they will need to spend it, which creates confidence that needs will be met in the early years and lessens the worry about what’s happening with the market.

First developed in 1985 by wealth manager Harold Evensky, the bucket strategy began as a simple “now versus later” approach to dividing investors’ retirement savings into two segments: a cash bucket to meet five years of living expenses, and an investment bucket for longer term growth.

Over time, many advisors adopted the idea of bucketing multiple savings pools to meet different needs or time periods during retirement, although the number of buckets, what they represent, and even what they are called (e.g., buckets, pyramids, building blocks) may differ from one investment firm to the next. Some advisors prefer three buckets, others four or five. Some buckets signify blocks of time, while others are to fund specific goals such as living expenses, savings, health care and legacy gifting.

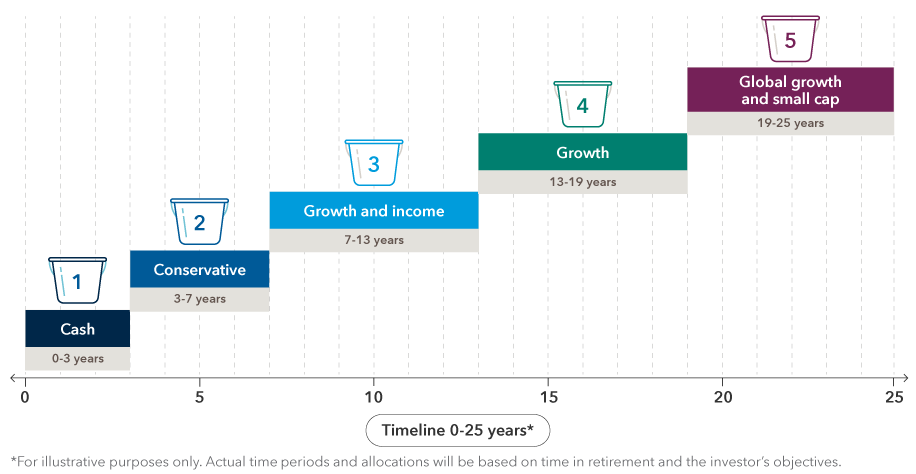

Time-release funding in five buckets

Advisor Joe Schoenhardt built his Chicago-area practice, Infinity Financial Concepts, helping investors with a five-bucket method to time-release funding.

The first bucket is predicated on expenses for the first three years of retirement and contains cash. The second bucket contains very conservative assets, “because they're up next,” Schoenhardt says. Bucket three is in growth and income investments, and four is more focused on domestic growth. Bucket five contains global growth as well as small-cap investments, which may be relatively riskier. The firm uses a software program to help with the allocations and investments.

Clients can distinguish today’s funds from those that will be used later. “They understand that the money that's going to fluctuate the most is money they're not going to spend for 15 or 20 years,” which makes it easier to withstand downturns. “If they think everything’s in one big pot, they panic. With the buckets, they may not like when the market’s down, but they understand why they don’t need to worry,” Schoenhardt says.

One well-drawn retirement

An example drawdown strategy using five buckets over a period of 25 years.

Source: Capital Group, Infinity Financial Advisors

There are different ways to manage the bucket strategy over time to maintain liquidity and growth goals throughout retirement. “We always spend clients' money out of a cash bucket, to meet lifestyle needs or required minimum distribution needs,” Schoenhardt says. “When that cash bucket is empty, we then relinquish money that's in the investments down into that cash bucket.” Rebalancing is key, particularly in those buckets with higher equity exposure. It also offers an opportunity to harvest outsize gains and extend the life of the cash bucket. He and his team finesse the strategy, guided by the software and the client’s specific investments.

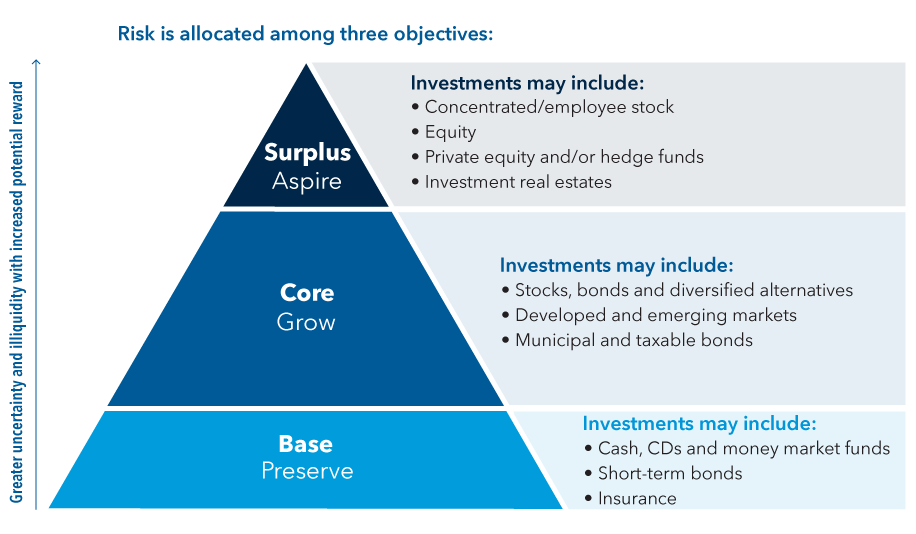

The HNW pyramid

Even very wealthy investors who are unlikely to run out of funds respond to mental accounting and the retirement bucket strategy. “A lot of distribution strategies are designed to help manage the emotional concerns of clients, not necessarily maximize wealth,” says Aaron Petersen, CFP and senior wealth advisory manager with Capital Group’s Private Client Services. “The emotional fear of markets declining impacts everyone.”

Petersen and his team have developed an objective-based approach that’s similar to bucketing but tailored to the needs of high net worth (HNW) clients. The team uses a slightly different metaphor: the pyramid. Assets are separated into three segments, including a base, core and surplus:

The base – Designed for preservation, the base may contain cash, short-term bonds or insurance — assets pulled out of the market that don’t have a lot of volatility risk. “Based on our research, we typically suggest considering one to two years of living expenses in the base,” Petersen says. But for some clients, that feels like too much to have sitting on the sidelines, especially when markets are going up. “Portfolio declines have lasted less than a year for some investors, with the average recovery period being about 12 months,” says Petersen. “It’s not until investors get into the depths of a down market that they really need that emergency cash reserve. For that reason, many of our clients feel pretty comfortable with one year of living expenses set outside the market,” he says.

The core – The core is the amount of money you need to meet all of your living expenses for the rest of your life with a high level of certainty that it will last, says Petersen. This varies from client to client, but it represents the bulk of the portfolio and has the potential to generate long-term growth. Investments may include stocks, bonds (munis and taxable) and diversified alternatives, in both developed and emerging markets.

The surplus – The aspirational portion of the pyramid, also known as the surplus, holds everything else, says Petersen. “Some clients have it, some don’t. This can be more of an HNW problem. For those who have more than they will need, you can open up a discussion about what to do with it,” he says. The alternative could be more spending, or not taking as much risk in the rest of the portfolio, because you don’t need to. Maybe it could be used for philanthropic giving or gifted to the family.

Petersen says his clients often have options outside of the portfolio that can be used to generate cash if necessary. “HNW clients tend to own real estate with plenty of equity. And if they needed to, they could use it to generate some short-term cash flow. Others have credit lines backed by their portfolios they can look to for their short-term cash needs,” he says.

Still, the pyramid seems to resonate with them. “They understand why we are setting aside this cash.” Sometimes, he says, the structure provides a helpful way to consider riskier investment allocations with clients. “If you don’t have a core that’s fully funded, you probably don’t want to be investing in things that are more speculative. Consider reserving that for when you have a surplus,” he says.

Stacking retirement priorities

The pyramid is similar to a three-bucket strategy, but with an objective-based approach.

Source: Capital Group Private Client Services. For illustrative purposes only.

Managing retirement income buckets

With Petersen’s pyramid strategy, some clients spend from the core and leave the base almost as an emergency reserve. “As the markets move, they use their portfolio withdrawals to rebalance the portfolio,” he says. “When markets are starting to drop and clients become antsy, that’s when we’ll say to a client, ‘This may be a good time to spend from your base portfolio so you aren’t selling when markets are down.’” It’s back to this emotional fortitude, he says. “You don’t want them to overreact to what the markets are doing in the short run.”

For time-pressed advisors, that perspective can be priceless. In fact, Schoenhardt’s clients are so comfortable with the strategy that he and his colleagues never have to discuss short-term fund returns. “It never gets brought up,” he says, “because we aren’t focused on that.” His clients understand, he says, that success is not entirely performance-driven — it’s time-driven.

The bucket list

Ready to build some buckets? This simple checklist can help.

Related content

-

Retirement Planning

-

-

Client Relationship & Service