Retirement Income

Defined Contribution

- Retirement accounts represent the largest source (34.1%) of aggregate wealth for American households.*

- Most workers saving for retirement do so through tax-advantaged employer-sponsored accounts, but 55%† have no access to such plans at their jobs, especially those who work for small businesses.

- Our survey of small-business owners found they face perceived barriers to entry when it comes to offering retirement plans, but financial professionals can help dispel these perceptions.

Defined contribution plans are a critical tool for helping Americans save for retirement, but many workers do not have access to such plans at their jobs, especially those who work for small businesses. This is critically important as small businesses — those with less than 500 workers — make up 99.9%‡ of all businesses in the U.S. and the majority of them (65%) do not offer a plan, according to our research.

The SECURE 2.0 Act of 2022 (“SECURE 2.0 Act”) aims to make it easier for small-business owners to offer plans, but for a variety of reasons, many of them are still holding back. That’s where retirement plan professionals can add value and potentially build business. Capital Group recently completed a survey of small-business owners to better understand their motivations, challenges and what may be keeping them from taking the next step.

Perceived barriers to entry

Many business owners and prospective 401(k) plan sponsors have a reason for why they haven’t started a retirement plan for their employees, and our survey respondents were no different. Some of the perceived barriers to entry included:

Size and stability: The top reason respondents gave (39%) was that they believe their company isn’t big enough, or stable enough, for a retirement plan. Yet there are a range of options available for businesses of all sizes. Using our Small-Business Plan Selector Tool, you can help to determine the type of plan that is most appropriate for the business you’re working with. Some options you can discuss with clients include:

- 401(k) plans are open to all types of businesses and offer the most flexibility (in terms of contributions, loans and vesting, for example).

- Solo 401(k) plans offer many of the advantages of a regular 401(k) for a company that does not have employees.

- 403(b) plans are available to certain nonprofit organizations (for example, public schools and churches).

- Savings Incentive Match Plan for Employees (SIMPLE) IRAs and Simplified Employee Pension (SEP) plans may be best for smaller businesses (those with 100 or fewer employees) that require an easy-to-use plan.

- Payroll Deduction IRAs allow employee contributions only. Many state-sponsored programs are adopting/implementing payroll-deduction IRA-type vehicles.

Limited administrative resources: Just as there are many types of plans, there are many administrative solutions. Many providers offer bundled services that may lower administrative costs and tools that create efficiencies. As a retirement plan professional, you can educate small-business owners on what options exist.

Uncertainty about getting started: This is where financial professional may be able to make the biggest impact. Our survey found that 69% of small-business owners without a plan do not have a financial professional but are currently looking for one. This provides an opportunity for financial professionals to start the conversation by discussing the different types of plans available.

While these perceived barriers to entry may cause small-business owners to think establishing and maintaining retirement plans is difficult, we can help dispel some of these perceptions by assisting you in choosing the appropriate solution for your client.

Offering a plan may be good for business

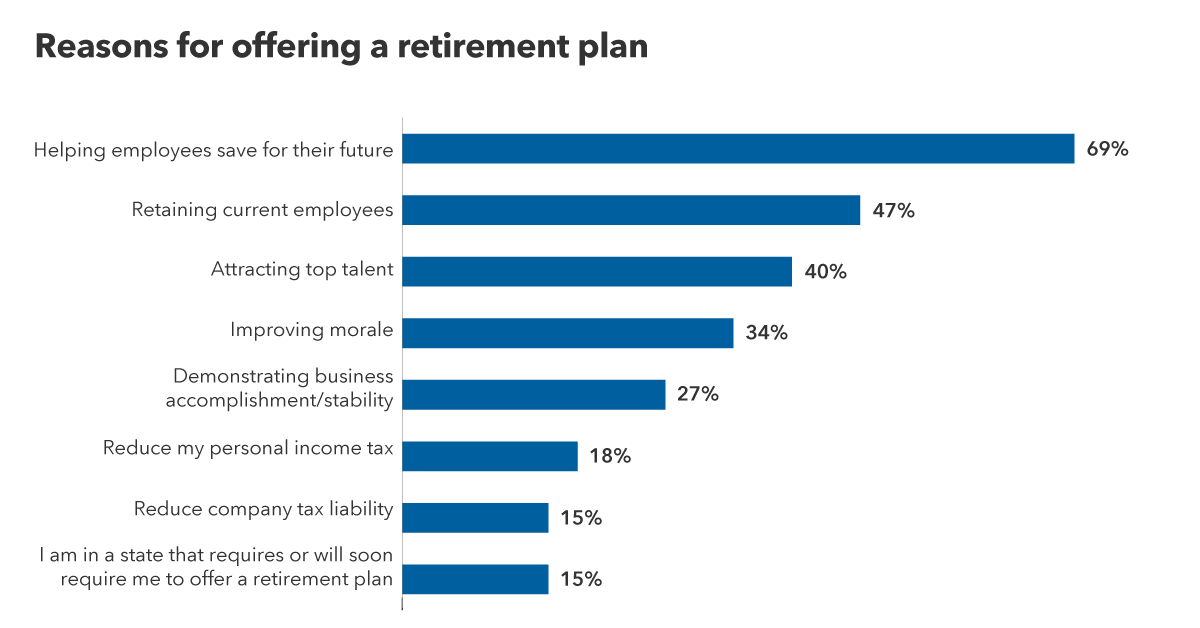

While there are myriad reasons why small businesses don’t offer a plan, our survey found some encouraging reasons why many DO, with 69% citing the desire to help employees save for their future as the top reason.

But beyond helping employees, offering a 401(k)-type plan can also be good for your client’s business in several ways.

For large companies, offering a retirement plan is considered table stakes and a requirement for attracting and retaining employees. Our survey found small-business owners may also be realizing the importance of offering a retirement plan: of survey respondents who do offer retirement plans, 47% said their main reason for doing so was to retain current employees. For 40%, it was to attract top talent, and for another 34%, to improve morale. Offering a retirement savings plan may help your clients’ small businesses stand apart and could contribute to employee satisfaction and retention.

Source: Capital Group/Escalent, 2023.

The survey results also indicate that while reducing taxes may not be the primary reason for offering a retirement plan, it is still a significant factor for small-business owners. A vast majority of respondents (94%) in the survey said they would be very or somewhat likely to offer a plan if they received startup plan taxes or credits.

You can leverage this information to initiate a conversation with prospects about the benefits of offering a retirement plan and the potential tax advantages. You can start by discussing some of the new and enhanced tax credits for smaller employers offered by the SECURE 2.0 Act such as:

- New startup plan tax credit based on contributions the employer makes on behalf of participants

- Expanded existing startup tax credit on employer out-of-pocket plan costs

- Automatic enrollment credit for new plans

By highlighting these tax incentives, you can help small-business owners understand the financial benefits of offering a retirement plan and encourage them to take action. This can be a valuable tool in your efforts to attract and retain clients and grow your business.

Taking the next step

As our survey showed, small-business owners have a variety of motivations and challenges when it comes to offering a retirement plan for their employees. Some feel a sense of duty to helping their workers save for a comfortable retirement or want to attract top talent. Still others may need to overcome some of the common misperceptions that they see as barriers to entry. Whether you are working with an existing client or a prospect, Capital Group can help you find the right plan to suit their needs.

How the survey was conducted:

Capital Group partnered with market research firm Escalent to survey 615 small-business owners and employees from May 17 to June 16, 2023, and 621 small-business owners and employees from September 9 to December 5, 2022. The surveys included a mix of small-business owners and employees aged 21 and up that offer/participate in a workplace retirement plan and owners and employees that don’t offer/participate in a workplace retirement plan.

* Source: Sullivan, B., D. Hays, and N. Bennett, “The Wealth of Households: 2021,” Current Population Reports, P70BR-183, U.S. Census Bureau, Washington, DC, 2023.

† Source: Sandhovel, A., “EIG Applauds Bipartisan Legislation to Help American Workers Save for Retirement,” Economic Innovation Group, accessed December 2023.

‡ Source: “Frequently Asked Questions About Small Business 2023,” Office of Advocacy, U.S. Small Business Administration, March 2023.

Our latest insights

-

-

Retirement Income

-

Target Date

-

Practice Management

-

Participant Engagement

RELATED INSIGHTS

-

Retirement Income

-

Retirement Income

-

Participant Engagement

Never miss an insight

The Capital Ideas newsletter delivers weekly investment insights straight to your inbox.

Renee Grimm

Renee Grimm