Retirement Income

Market Volatility

Use the resources available through this site to help your clients understand that market volatility is normal and can even be an opportunity for gain.

This website includes:

- Guidance grounded in behavioral finance on what to say and show to clients when markets fall.

- Easy-to-digest exhibits you can use to demonstrate that past market downturns were usually infrequent and ended relatively quickly.

- Examples of how missing the rebound from a selloff can impede long-term financial goals.

- Key messages for clients tempted to switch advisors when markets swoon.

On this website you'll find:

- Commentary on the economy, politics, interest rates and other drivers of market volatility.

- Views on the best way to handle market volatility when it erupts.

- Investment perspectives tied to recent headlines.

Visit our market volatility center

Capital Group investment professionals offer their views on the causes of volatility and the implications for investments and economic growth.

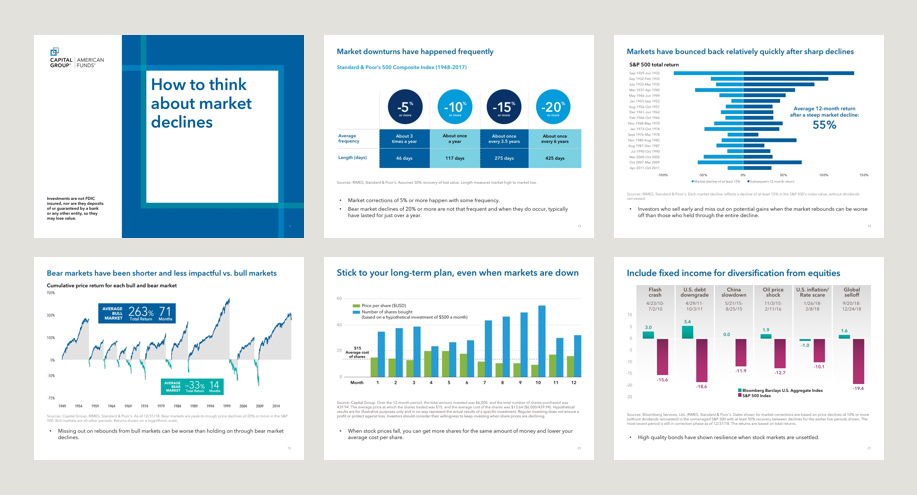

Presentation to share with clients that details the following:

- Recent trends driving market volatility.

- The behavior of historical bull and bear markets.

- How ill-advised investment decisions can erode a nest egg.

- The benefits of a long-term perspective and diversification.

Your clients want to know when the next recession will hit and how it will affect their portfolio. Share our “Guide to recessions” to help them understand and prepare.

Our latest insights

This is the headline for the Newsletter promo. Customize the message.

Related Insights

-

Markets & Economy

Midyear OutlookTHURSDAY, JUNE 20, 2024 -

-

Never miss an insight

The Capital Ideas newsletter delivers weekly investment insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.